With mainstream exchanges becoming progressively cumbersome due to privacy invasive policy and regulation, some crypto traders are switching to more private, face-to-face trading. While this route isn’t for everyone, and comes with unique risks, it does offer a very real solution to many of the problems plaguing mainstream exchanges currently. The goal of this breakdown is to provide a few best practices for safety and success when trading crypto in person.

Also Read: Bitcoin Cash Roundup: Adoption Stories and New Developments

Why Face to Face?

For anyone that’s ever had their money frozen on an exchange, this question is a no-brainer. Since most exchange wallets are custodial, meaning the service itself holds and manages user funds centrally, one bug in the code, hack, or audit from a governmental regulatory agency could mean that you and your money are parted indefinitely. Stomach sinkers of this nature have occurred often enough that many, understandably, don’t want to run these risks anymore. Others are concerned about privacy and the security of their personal data and information. Trading in person via a non-custodial platform or otherwise lets traders hold funds until the very last second, and guarantees more control. Still, there are important things to be mindful of in order to trade safely and successfully.

Best Practices

To avoid getting scammed, set up, or potentially endangered, there are some time-tested best practices for trading face to face. The overarching one is simple, though: just use common sense.

Choose a trustworthy platform / trader

Maybe you know someone in your community who also uses cryptocurrencies. Perhaps a friend of a friend, or an acquaintance interested in getting into crypto, but they don’t know how. Online, reliable peer-to-peer platforms such as that currently offered at local.bitcoin.com are great places to start. Platforms that offer blind escrow, and end-to-end chat encryption are the safest bets. Whatever one’s approach, testing first and vetting for reliability is critical.

Using shoddy, unproven platforms or trading with strangers who’ve no reputation for being honest probably won’t end well. There are scammers as well as government agents on some p2p networks, and in real life, more than happy to ensnare even innocent, legal users of crypto for their own benefit.

Well-managed platforms will have a reputation system in place so users can verify which traders have completed the most trades successfully, and feedback features for rating their quality of service. Be sure to work out all the specifics of the trading process and procedure in clear detail on an encrypted chat application prior to meeting for the trade.

Meet in an open, highly visible public space

After working out the specifics of your deal, and providing only necessary information to the contact, meet in an open, highly visible space that is frequented by people but also provides enough serenity to conduct business. A well-lit coffee shop or popular meeting spot in view of the public can be a great place to conduct crypto trades. Trust your gut in meeting someone for the first time, and if anything “feels off,” don’t hesitate to politely back out.

Show me the money, discreetly

A great way to get scammed face to face is to send your bitcoins to the guy across the table and watch him run off without paying you. In this situation you could give chase (risky), yell, flail about, or call the cops, but you’re more than likely just SOL. Be sure the other person lets you see the money, gift cards, etc., first, before sending any coins.

Most respectable traders will place money on the table discreetly (in an envelope or book) so that it is within reach of both parties, and sudden moves to bolt are not likely to succeed. Once the tx has enough confirmations for the buyer’s liking, they should slide the money over and invite the other party to count it. If you are the one buying crypto be sure to make the seller feel at ease by setting up the trade similarly. Crypto-to-crypto deals require a bit more creativity perhaps, but having both devices in reach and openly in view can help.

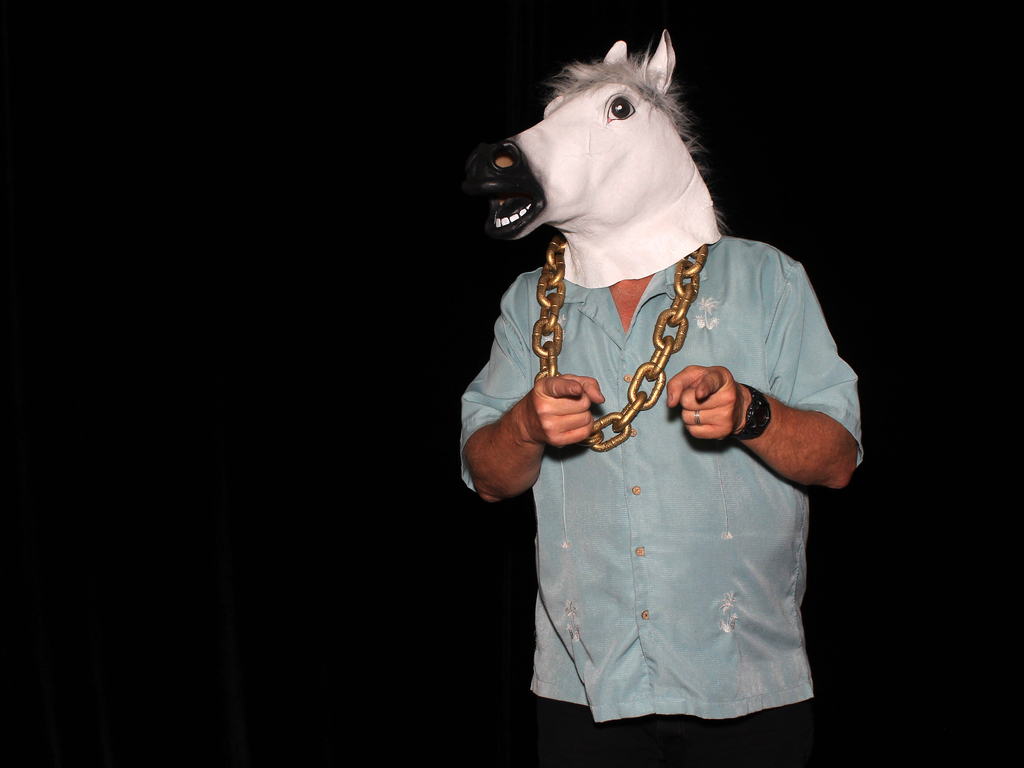

Horse Sense Is Number One

There are limitless options for working out trustworthy trade arrangements, including step-by-step, fractional trades to test the waters on first meeting, PGP contracts making it difficult for a party to lie about the agreement after the fact, and verification via other contacts of a trader’s reputation. However, as mentioned earlier, the main thing is to trust your reason, and gut instinct. If some aspect of a crypto trade arrangement feels spooky or inconsistent, it’s more than okay to kick the deal and get out. More often than not, however, in person trades are fun, friendly experiences that can be a good way to get out of the typically isolated, smugly self-referential hell that is crypto Twitter, catching a breath of fresh air while stacking sats and building the bitcoin economy.

What are your recommended best practices for trading in person? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of vidalgo, Shutterstock, local.Bitcoin.com.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post How to Trade Crypto in Person Safely appeared first on Bitcoin News.