Unlike restricted proof-of-work (PoW) blockchains like Bitcoin, the Polkadot blockchain allows cross-blockchain transfers of any asset or data, facilitates more transactions per second and needs less infrastructure.

Polkadot uses a nominated proof-of-stake (NPoS) blockchain centered on interoperability of parachains that connect to and are secured by the Relay Chain. Validators can validate both the Relay Chain and the parachains, making it a flexible and scalable blockchain solution.

The native token on the Polkadot blockchain is named DOT (DOT). It can be used on the Polkadot network for trading, staking, bonding, paying transaction fees and voting in network governance.

This article highlights what Polkadot staking is, how it works, how to stake DOT, its requirements and rewards, and why tokenholders should stake DOT.

What is Polkadot staking and how it works

Founded in 2016 as a layer-0 protocol and multichain network, Polkadot is a blockchain project introduced by Ethereum co-founder Gavin Wood.

The project aims to create a decentralized, secure and fair internet known as Web 3.0, or Web3, by facilitating communication across previously incompatible and independent blockchain networks.

Polkadot staking involves using DOT tokens to nominate validators in exchange for earning rewards. Polkadot is an NPoS blockchain that relies on nodes to verify transactions and secure its network. The NPoS mechanism is a sophisticated process in which nominators select the validators who are allowed to participate in its consensus protocol. Generally, more participants and more distributed nodes mean a more decentralized network, reducing the likelihood of successful blockchain attacks by hackers.

Depending on their availability, level of expertise and budget, DOT holders can engage with the Polkadot staking system natively in four main ways. Stakers unable to produce the minimum required amount to nominate individually (this is a fluctuating amount) can join a nomination pool and share all benefits and penalties proportionally.

Alternatively, stakers can nominate validators. Stakers often choose a validator based on their reliability in verifying the legitimacy of network transactions. On the other hand, stakers can open and run a nomination pool, if they are confident in their abilities to identify competent and trustworthy validators, and ask for a commission. Others can join and stake their cryptocurrency.

At the top end are the validators, better suited to people with significant time commitment and technical expertise. These people run the nodes, which are servers running specialized software that may submit a block of transactions and either validate or disapprove it.

Note that there’s a stringent set of staking requirements before Polkadot allows anyone to become a validator since validators need specialized expertise and validators will be in charge of a master node.

Stakers who stake with a validator get more Polkadot tokens as a reward if the validator correctly verifies a transaction. If validators approve a fraudulent transaction or try to defraud the system, they and their nominators will get slashed by losing a percentage of their staked DOT. Any slashed DOT will be added to the Polkadot Treasury.

Additionally, there are specialized positions that require more technical expertise than a nominator but less commitment than a validator. These include collators, who are responsible for keeping track of valid parachain transactions and submitting them to validators on the Relay Chain, and members of the Polkadot Alliance.

DOT staking requirements

Users will need a fluctuating minimum amount of DOT to stake and nominate directly. This rule does not apply when joining a nomination pool, using a liquid staking method or using an exchange since users delegate their power to validators who meet minimum requirements.

An exchange platform may impose additional requirements, such as Know Your Customer/Anti-Money Laundering, minimum staking amounts, minimum lockup periods or fees.

Why stake Polkadot

Staking DOT is a way to provide security and decentralization to the network and earn staking rewards. People who stake DOT help maintain the network’s stability, development and security in exchange for DOT.

Stakers can even use the staked tokens to generate a passive revenue stream with the potential for growth in the ecosystem. Stakers in the Polkadot ecosystem get to participate in the network’s governance while benefiting from the token’s appreciation.

How to stake Polkadot (DOT)?

DOT holders may participate in the network’s governance by staking their tokens and earning DOT token rewards.

The common ways to stake DOT are through a cryptocurrency exchange, a hardware wallet, the network’s Polkadot.js user interface (UI) or the Polkadot app.

1. Using Polkadot.js UI

Stakers may use the Polkadot.js UI to either stake as a validator or a nominator. Nominators can propose up to 16 validator prospects on the Polkadot platform. The Polkadot network relies on validators to operate nodes and ensure the network’s safety and reliability.

There are rewards for the validators and nominators, and the validators’ behavior determines the amount of rewards the nominators will receive. In short, the higher the performance of the validator, the higher the rewards for validators and nominators.

Here are the steps to nominate a validator on the Polkadot.js UI or the Polkadot app:

- Create a Polkadot account.

- Navigate and select the “Network > Staking > Accounts page” tab.

- Click “+ Nominator.”

- Choose a stash and controller account.

- Enter the amount to bond.

- Choose a desired validator.

2. Stake natively or join a nomination pool

Native staking is one of the easiest ways to stake DOT, and users have the option to stake directly as a nominator or join a nomination pool. The Polkadot website has a dedicated page explaining this process in detail.

3. Using a cryptocurrency exchange

This method has gained popularity since it is relatively easy to stake in a staking pool on a cryptocurrency exchange. It involves users purchasing DOT tokens on their chosen exchange, adding them to their Polkadot wallet and then clicking the stake button to begin staking.

Stakers can acquire DOT tokens using fiat or crypto. After that, they deposit the tokens into the exchange account or directly to the Polkadot wallet if they already hold one. When deposited into the Polkadot platform, DOT tokens have the potential to earn substantial rewards with minimal effort from stakers.

Examples of staking platforms include Kraken, Binance, Coinbase, KuCoin and Crypto.com.

Staking with an exchange can be a convenient option, but it comes with its own set of challenges:

- Lack of control over private keys: When staking with an exchange, users are not in control of their private keys. This means that they have to rely on the exchange’s practices and security measures.

- Reduced staking rewards: Exchanges usually take a percentage of the staking rewards as a fee for their services. This means that users will earn less than they would if they were staking independently.

- Increased risk of hacks and exploits: As more people stake with a particular exchange, the exchange’s wallet grows, giving it more voting power and potentially centralizing the blockchain network. This also makes it a more attractive target for hackers and other bad actors who may try to exploit vulnerabilities in the exchange’s security.

4. Using a wallet

Staking DOT through a wallet is more complicated than staking on a cryptocurrency exchange. When using a wallet, the chosen validator is the only intermediary between a staker and the rewards.

Users must first choose up to 16 validators before they can begin staking. Therefore, stakers should carefully evaluate their validators before committing to the wallet method. Also, they should be mindful of the provider’s security, dependability and track record before selecting a validator or staking service.

To start staking using a wallet, a staker must first get some DOT from an exchange and deposit it into a DOT wallet. There are several wallets available to stake DOT, with options including:

- Ledger

- Polkadot.js

- Talisman

- Fearless

- Subwallet

- Nova

- Polkawallet

Users should choose their wallet based on how much DOT they want to stake and the purpose for which they intend to use their DOT wallet.

Hardware wallets, also known as cold wallets, are the safest alternative, since they store and back up private keys offline. However, there is often a more complex learning curve and higher costs associated with hardware wallets. Ledger is the only DOT-compatible hardware wallet.

Alternatively, users may choose a software wallet, which is convenient and free. Although easy to use, software wallets aren’t as safe as hardware wallets. Thus, they are probably better for storing fewer DOT or for inexperienced users.

DOT staking rewards

Once every 24 hours, delegators and stakers get Polkadot staking rewards depending on how many blocks their stake contributed to creating. Compared to other proof-of-stake blockchains and exchange staking, Polkadot is likely to provide higher returns.

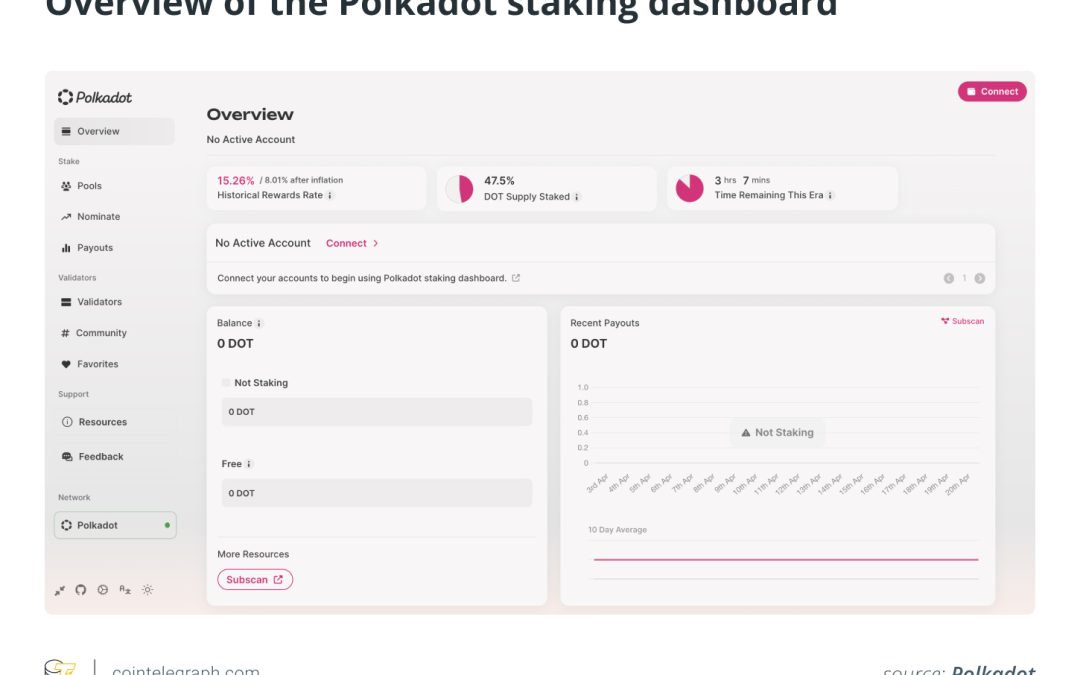

According to crypto-staking data aggregator Staking Rewards, the annual percentage yield (APY) Polkadot holders may receive varies based on the wallet, the crypto-trading platform and the validators. The maximum APY that holders can earn is 14.34%. Polkadot’s staking dashboard provides on-chain data to indicate current rewards.

Similarly, staking DOT tokens can give different rewards based on the type of staking method. Nominators who do not run the nodes themselves but instead assign the stakes to validators may earn a maximum APY of 14.1%. Due to the added responsibility of maintaining the network, validator node operators might make as much as 14.8%.

What are the risks of staking Polkadot?

Like any other investment, staking in Polkadot has its own set of risks. Although it currently offers a healthy APY, that can change due to prevailing market conditions. Most staking platforms review their interest rewards periodically.

Although the Polkadot staking system design is highly secure, there are a few risks associated with nominating the validators. For instance, if validators breach the terms and conditions, Polkadot may punish (slash) their stake, which means stakers may lose some of their staked DOT.

Because of slashing, nominators must be extremely vigilant in their selection of validators. They should only settle on validators with a proven track record of reliability. Also, DOT has an unbonding period of 28 days, which means stakers must wait at least 28 days before receiving their tokens. That can be a disadvantage in a highly volatile market.

If a chosen validator is unresponsive during an entire session, the validator’s bond will undergo involuntary chilling and may not be up for selection in the next session. Moreover, the validator will not earn rewards during the chilling session.

When users stake DOT on a software wallet, its safety is only as good as the wallet provider’s safety protocols. That is beyond the safety reach of Polkadot and is vulnerable to hacking beyond its control.