Australian-born Michael Dunworth, CEO of Silicon Valley-based blockchain Wyre, has said that financial advisors should invest in Bitcoin to understand the currency better in the decentralized economy.

In a report from the Financial Standard, Dunworth said:

“You don’t have to break the bank. You could invest $10, $100 or $1,000 worth of bitcoin.”

What better way, after all, to fully understand the inner workings of a decentralized economy than by investing in it?

Of course, such a task for the average person on the street may be easier said than done. Many people may be put off by the idea of investing their hard-earned money, let alone what they should invest in. Add to the confusion digital currencies such as Bitcoin and Ethereum and countless people may consider it too much of a task to undertake.

Yet, it doesn’t have to be that way. As digital currencies and the use of the blockchain technology continues its upward trajectory, new opportunities are coming on the market for people to invest. But, with past and current initial coin offerings (ICOs) delivering over 500 digital currencies, which are being traded daily, how can someone searching for a way to diversify their investment portfolio, with the right tokens and digital currencies, enter the crypto space? And when is it the right time to do so?

According to Sydney-based billionaire Mike Cannon-Brookes, who is the co-founder and co-CEO of software firm Atlassian, who has invested in Bitcoin, he tweeted data that indicated $10,000 worth of bitcoins in July 2010 would be worth nearly $150 million with today’s exchange rate.

Unfortunately, unless one is gifted with the sight to see into the future, knowing what to invest in and when can be an uphill struggle for some.

However, whether someone is turning to the decentralized economy for the first time or they are a seasoned investor who wants to acquire and invest in assets without any hassle, The Token Fund provides an avenue for potential investors to break into the crypto space.

What is the Token Fund?

The Token Fund – also be known as a Coin Traded Fund (CTF), which is analogous to exchange traded-funds (ETFs) where you buy shares of a portfolio that tracks the yield and return of its native index – aims to achieve a straightforward process for an investor to invest in the decentralized economy. By doing so, it enables even those with little digital currency knowledge to jump on board and invest in digital assets.

With cryptocurrencies such as Bitcoin and Ether having a correlation close to zero with the real economy, they present a viable alternative hedge against financial crises. However, while ETFs hold over $2.6 trillion of assets globally, are being utilized by a growing number of investors in various markets, and is expected to account for $5 trillion of assets by 2020, according to PricewaterhouseCoopers (PwC), digital currencies still remain outside of ETFs.

At present, there is no digital currency market index in existence. The Securities and Exchange Commissions (SEC) rejection of the Winklevoss twins Bitcoin exchange traded-fund (ETF) in March dashed those hopes. However, while the SEC reconsiders its previous rejection decision, investors require another source of direction to turn to where they can gain optimal exposure in the cryptocurrency space.

As such, The Token Fund’s CTF has been developed that will act as an index with fund managers Viktor Shpakovsky and Vladimir Smerkis responsible for making investment decisions, providing efficient, transparent and provable operations, and ensuring security and taking contingency measures.

Once users sign up, they can deposit Bitcoin or Ether into the project wallet, upon which they will receive a specific number of TKN tokens, depending on the deposit amount and the fund’s capital each day. Investors also have the option of selling their TKN tokens back to The Token Fund before cashing out. TKNs are based on the Ethereum blockchain, which ensures the development of a complex system with low costs compared to Bitcoin.

In practice, though, the use of an index is only applicable depending on the market capitalization of known currencies. The Token Fund is structured primarily on market capitalization; however, it also focuses on trading volume too. Therefore, digital currencies with an average daily turnover of less than $100,000 for the past six months are automatically excluded from the portfolio. Bitcoin and Ethereum make up just under 60 percent of the portfolio. However, in order to represent a constantly adjusted cross-section of the decentralized economy with the most potential, The Token Fund also focuses on other tokens such as Ethereum Classic, Monero, Storjcoin X, Zcash and Dash to name a few.

In order to account for any changes in the market, The Token Fund portfolio will rebalance based on set rules to ensure the continued growth of the fund.

Strong Performance from The Token Fund

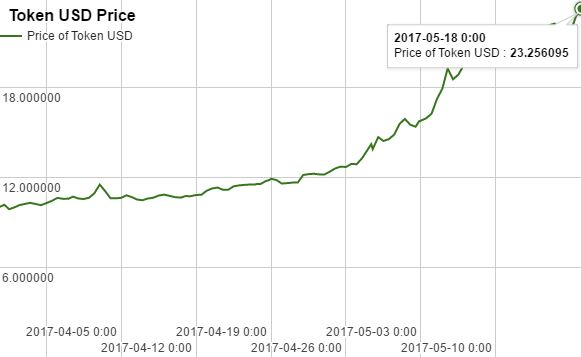

Since the arrival of the fund on 24 March, the TKN price has risen from $10 to just over $23 on 18 May. As can be seen from this graph, which is available to anyone and updated daily, the funds portfolio volume in TKN tokens rose from 131 at the end of April to 394 on 17 May. This data is available to view here, which is updated every 12 hours.

The Rise of Digital Currencies

The year 2017 has, so far, been a great year for digital assets. While Bitcoin has continued to reach new all-time highs, achieving $2100+ this May, other currencies too have attained new heights.

For the first time in May, Ethereum scaled to above $100. For a digital currency that was trading around $8 in January, Ether has progressed in leaps and bounds, illustrating that it has what it takes to push barriers. Litecoin has also pushed ahead to reach new heights after remaining stagnant within the $3-5 price range for a few years to now trade around $26. The news of San Francisco-based Bitcoin exchange Coinbase announcing that it was adding support to the currency on its wallet platform also helped bump Litecoin’s price up. Whereas, Ripple, which recently overtook Ethereum to claim the number two spot before Bitcoin, saw its market cap value soar to over $14.5 billion after the XRP token climbed to as much as $0.33, representing a roughly 40 percent increase in 24 hours, according to CoinMarketCap.

The world of cryptocurrencies and the blockchain is helping to reshape the global economy with more money flowing into digital assets. As such, this is proving a good time to invest and diversify into digital assets, giving an ideal avenue for people interested in removing themselves away from the traditional financial system.

As The Token Funds whitepaper states:

“Growing interest in such assets may be promising something big, perhaps a revolution similar to the one the Internet provided in the early 90s.”

Featured image from Shutterstock. Story image from The Token Fund.