With 2021 winding down and 2022 hopefully being the year of the Merge, I wanted to do a deeper dive into five of the top things to expect with Ethereum’s impending transition to proof-of-stake. The Merge itself will not be as initially glamorous as many market participants and outsiders may believe. However, the underlying improvements and the foundation it sets will allow Ethereum to onboard millions of users without sacrificing decentralization.

- Lower energy consumption – Changing Ethereum’s consensus layer to proof-of-stake rids the network of miners and replaces them with validators. Under proof-of-work, Ethereum requires miners to compete for hash power by consuming electricity. By using randomness to assign block production, proof-of-stake is able to run with significantly lower energy consumption. The Ethereum Foundation predicts that after the Merge the network will use at least 99.95% less energy than it does in its current state.

- Deflationary ether – An Ethereum research report modeled the impact the combination of EIP 1559 and proof-of-stake will have on ether’s circulating supply. The transaction fee burn combined with lower rewards and ether locked for validating will drive the circulating supply equilibrium down to between 27.3 and 49.5 million ETH. For comparison, the current supply is sitting at 118 million ETH and is still slightly inflationary after the addition of EIP 1559.

- Same execution layer – Ethereum’s current execution layer will be ported over to the incoming proof-of-stake consensus layer and supported by the clients that are currently in charge of Eth1. For existing users and application developers, this means that interacting with Ethereum will remain incredibly similar post-Merge.

- Increased/similar transaction fees – While impossible to predict, it is entirely possible that transaction fees will initially increase or remain the same post-Merge. Once Ethereum sheds the narrative that it consumes more energy than a moderately sized country, new users and entities may come onboard to use the technology and increase the current demand for blockspace. However, impending upgrades (such as sharding, rollups and calldata improvements) to the network after the Merge will focus on increasing scalability without sacrificing decentralization.

- A road to decentralization and scalability – Running a validator on the Beacon Chain requires 32 ETH, an upfront investment of over $120,000 at current prices. While this is not a low barrier to entry, it still removes the economy of scale that exists in mining proof-of-work chains. By replacing hash power with randomness/statistics and keeping block size low, Ethereum enables any user with average hardware to profitably run an Ethereum validator. Additionally, under proof-of-stake, the Ethereum network will have the capability to implement sharding and other scalability focused upgrades that will lower transaction costs down the road.

Pulse check

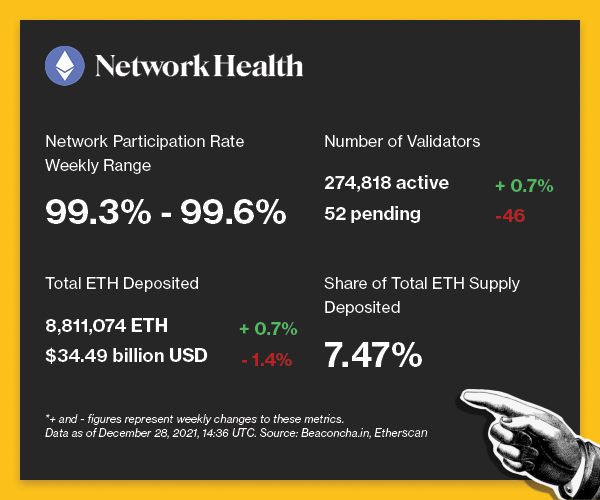

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

- Teenage suspect wanted in Canada after hacking DeFi protocol Indexed Finance earlier in the year. BACKGROUND: The hacker known as “Andy” exploited $16 million using a flash loan in October. After his identity was discovered by the team at Indexed Finance, Andy vowed to fight with the argument “code is law” in court, but failed to appear this Tuesday. The trial will likely set a precedent for future DeFi exploits, which are currently semi-ungoverned.

- B.Protocol raised $22 million to bring further efficiency to DeFi lending protocols by democratizing liquidations. BACKGROUND: B.Protocol allows users to provide “backstop” liquidity to decentralized lending services, in the event that loans become undercollateralized. The protocol further shows the potential for removing middlemen from finance, including centralized exchanges and market makers.

- Gnosis created a beacon chain (GBC) to act as an Ethereum frontrunner before important updates on Eth2. BACKGROUND: The Gnosis Beacon Chain will allow Ethereum developers to see how future updates will affect the network in a “real-world value environment” as well as Ethereum’s test networks. The current Gnosis Chain was formerly known as xDAI and will be merged into the GBC in the coming months.

- Blockbuster DAO is currently looking to raise capital to purchase Blockbuster from Dish Network and turn it into a decentralized streaming service. BACKGROUND: While Constitution DAO failed to win the bid for a copy of the U.S. Constitution, it likely paved the way for further crowdfunding and governance-backed acquisitions. Blockbuster DAO could be an interesting experiment in integrating aspects of decentralization into traditional finance, in what is essentially a form of a “people-owned” SPAC.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.