10101.art, a ground-breaking art-tech platform, celebrated its official launch in Dubai’s Monada Art gallery this week.

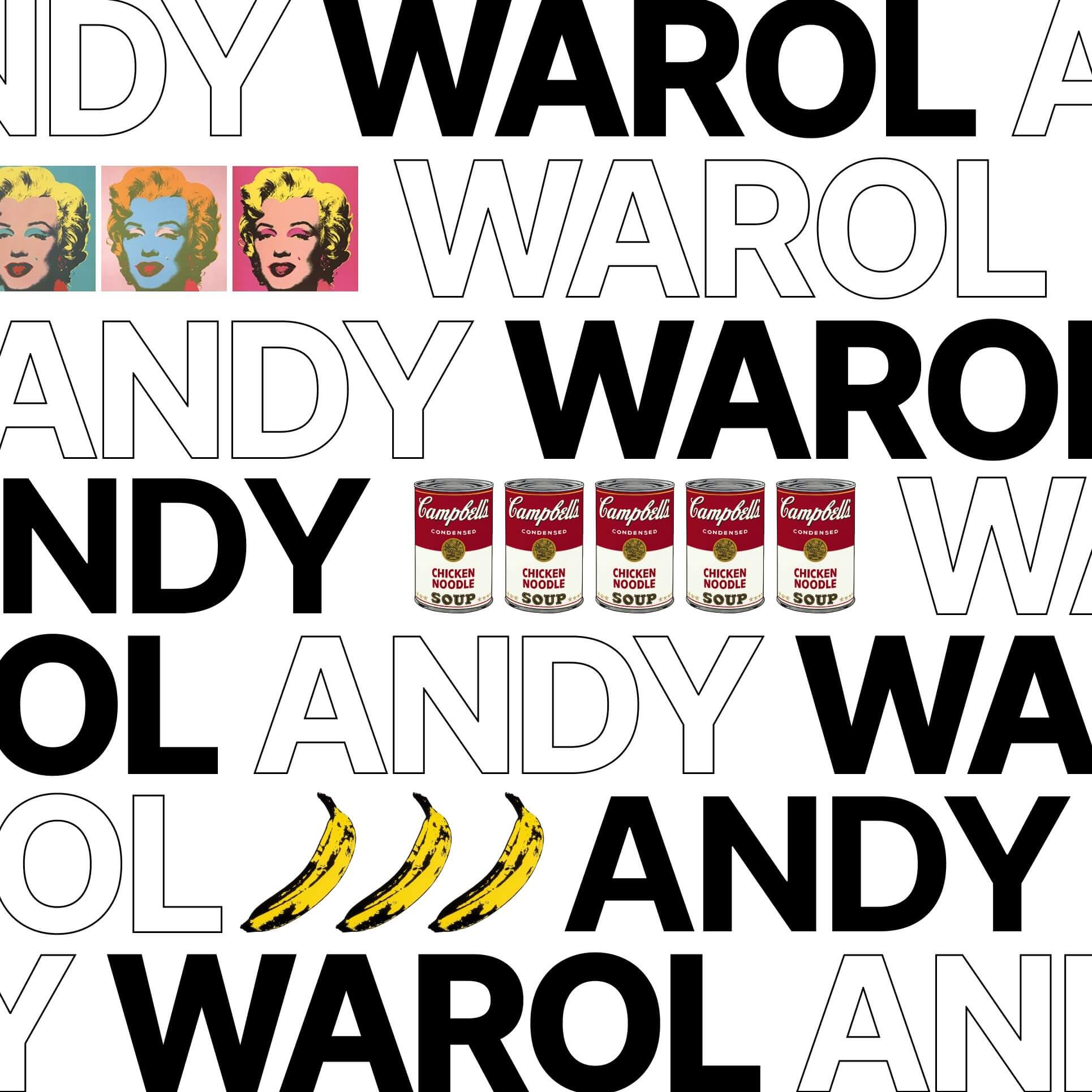

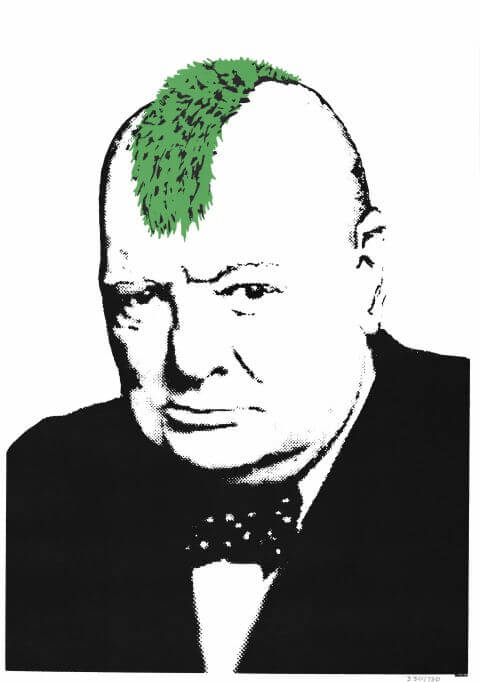

Bringing the power of the distributed ledger to the global art market, 10101.art leverages blockchain technology to make iconic works by Banksy, Warhol, Picasso, Dali, and others available for collective ownership.

Alina Krot, CEO of 10101.art, sat down to discuss the platform’s launch with Philip Hoey, Director of CoinJournal.

Philip Hoey: Thanks so much for taking the time to speak with CoinJournal, Alina. Let’s kick off with a quick overview of your platform – can you describe the journey that led you and your team to launch 10101.art?

Alina Krot: My journey to the art world was quite long. Even though art has always been my passion, my first career choice was finance. I used to work with high-risk assets and large investment lending projects in a bank before getting into the startup scene. 5 years later I realized that the big corporate world is not for me. In 2019, I got involved in WEB 3. This choice allowed me to dive into the blockchain field and work on several projects, gaining valuable experience.

Eventually, I’d grown to take a product management role. All that experience made me realize that basically any traditional sphere can be made more accessible with blockchain.

The puzzle of financial expertise and art appreciation came together when I met Iryna, founder of 10101.art. I realized that the art market can actually become more inclusive with the power of blockchain. Moreover, I knew I could really contribute to that.

PH: What first sparked your interest in combining physical art with blockchain technology?

AK: I guess it was the realization of the absolute benefits blockchain is able to bring to the art industry. And by that I mean collective ownership and democratization of the art market itself. For a long time art ownership was a privilege of the richer people. Blockchain and collective ownership is making this market accessible for everyone.

Every year more and more industries, such as real estate, healthcare, finance, etc. have already realized the benefits of blockchain implementation, so I’m pretty sure that a more widespread adoption will bring new disruptive innovations in numerous fields.

PH: NFT enthusiasts will be very familiar with investing in digital assets, but 10101.art is pioneering the use of NFTs for physical artworks. Given that many of these artworks are considered masterpieces and will almost certainly appreciate in value, it seems like this might offer collectors a less risky approach to engaging with art. Would you agree with that?

AK: Absolutely, owning a piece of art on 10101.art is definitely less risky, especially for those familiar with the NFT space.

First, there are liquidity issues. Traditionally, art can be tough to sell quickly, especially for collectors with little to no experience. With collective ownership through NFTs, individuals are able to trade them on a secondary market.

Another huge advantage is affordability. 10101.art allows people to buy a smaller piece of a valuable artwork. This makes masterpiece ownership much more reachable compared to needing to buy the whole thing at auctions.

There’s also the transparency factor. Blockchain technology provides a clear record of ownership and the artwork’s history, which can be reassuring.

PH: In the past there have been other platforms that have used special purpose vehicles to enable fractional ownership of famous artworks, but leveraging the power of the blockchain seems like a more efficient process than forming a new SPV every time a new artwork is offered for sale. Would you say physical NFTs are the future of fractional ownership in the art world?

AK: There’s no doubt that traditional collective ownership models, reliant on special purpose vehicles (SPVs), can be inefficient. The need to establish a new SPV for each artwork creates significant administrative burdens. In this regard, physical NFTs, leveraging the power of blockchain technology, offer a compelling alternative.

The efficiency gains associated with NFTs are undeniable. By eliminating the requirement for bespoke SPVs, co-ownership becomes streamlined. Additionally, the inherent transparency and security of blockchain facilitates seamless transactions and clear ownership tracking.

Furthermore, physical NFTs democratize access to the art world. By tokenizing high-value artworks, individuals who might not possess the resources to acquire a masterpiece outright can still participate in the art market.

PH: Which blockchain does 10101.art use?

AK: Currently our platform operates on Ethereum blockchain. But we also plan to launch some collections using other new EVM-compatible blockchains in the near future.

PH: Can you explain the tokenization process?

AK: Of course. The tokenization process on 10101.art is divided into four major stages.

The process begins with a dedicated team scouring valuable collections, auction houses, and galleries. Authenticity is paramount, so each piece undergoes careful examination before being considered.

Once an artwork is selected, our development team scans and uploads it for safekeeping on a secure, decentralized system. This ensures the digital record remains tamper-proof and readily accessible. Here’s where the magic of blockchain comes in: using smart contracts, we split ownership of an artwork into tokens. These contracts clearly define the total number of tokens available and their initial value, providing complete transparency. All ownership rights over a particular painting are specified in the documents defining co-ownership, published on our website.

Eventually, individuals become co-owners of a renowned artwork. By purchasing a token, they don’t just acquire a digital image. They gain a verifiable stake in the physical piece itself, stored at our partner gallery, Monada Art.

PH: How many fragments is each individual artwork divided into, and is there a limit to how many tokens an individual art collector can buy for that artwork?

AK: The amount of fragments depends on the artwork itself. For example, so far there are 1500 pieces of Banksy’s “Turf War” and 1200 of Warhol’s “Campbell’s Soup Cans” in total available on 10101.art. However, there’s no actual limit.

PH: Do 10101.art users use crypto to buy these artworks, or can they also use fiat?

AK: Our team is currently working on that matter. So, the only thing I can say is stay tuned for the updates on our social media! We’ll announce the start of fiat payments soon.

PH: If an enthusiast wants to buy a whole artwork on 10101.art is that possible?

AK: It is possible, although it’s an individual procedure. If you’re interested in buying a whole artwork, feel free to contact us and we’ll figure it out.

PH: What happens if all of the tokens for a particular artwork aren’t sold?

AK: If a painting is not completely sold within the allotted time, all issued NFTs are burned, and the refund option becomes available to users.

PH: Do art collectors receive proof of ownership when they buy an artwork piece on 10101.art?

AK: Of course. NFTs act as digital proof of ownership for the portion of the artwork purchased. They reside on a blockchain which tracks ownership and verifies its authenticity. Additionally, new artworks owners also receive a physical certificate of ownership upon purchase.

PH: How do you decide which artworks to list on 10101.art?

AK: Our goal is to provide people with the most promising pieces possible, and to achieve that, we rely on a team of highly respected art experts and dealers from around the world. They evaluate each artwork meticulously based on a number of key factors.

One of the top priorities is artistic significance. We want to feature works by the most influential artists throughout history, those who have truly shaped the art world. These could be from any country or era, as long as their artistic impact is undeniable.

Another important factor is recognizability. There’s power in iconic styles. Our experts look for works with a clear artistic identity, pieces that are instantly recognizable by the artist’s signature style.

Finally, authenticity is absolutely crucial. Our team carefully examines all documentation associated with a piece, including expert reports, certificates of authenticity, and a clear ownership history. This process ensures that the artwork we offer is genuine and has a verifiable past.

PH: When a new artwork is listed on 10101.art, how do you determine its valuation?

AK: We obtain this information from our network of curators and art dealers and align it with our business model, sticking to the principle of making the work accessible to our collectors, while maintaining margins that allow the business to grow.

PH: How do you handle the physical storage and display of those artworks? Are they displayed publicly?

AK: Every artwork presented on 10101.art is stored in Monada Art gallery in Dubai, DIFC. The gallery opened in 2023 and is now our official partner on exclusive terms who shares our vision and mission to make art accessible.

PH: Can art collectors visit the artworks they have bought to see them in real life?

AK: Yes. Monada Art is open for anyone who wants to see our collection in person and get closer to fine art. Every visitor is welcomed there, so if you’re eager to visit the gallery we offer a tour with our gallery manager Dayana.

PH: If an art collector wants to sell their NFTs at a later date, will 10101.art eventually offer a secondary market for this?

AK: Yes, we’re working on the development of a secondary platform. We’ll announce its launch soon on our social media. Keep posted!

PH: How has your background in finance influenced your approach to running 10101.art?

AK: My background in finance has been incredibly valuable in building 10101.art. You might think finance and art are separate worlds, but financial literacy is crucial in the art market as well.

For example, risk management is a core skill in both fields. As an art platform, we need to carefully evaluate artists, artwork provenance, and market trends. This financial lens helps me steer 10101.art towards pieces that hold strong potential for our users.

Strategic thinking is another big one. Finance is all about planning for the long term, and that’s exactly what we’re doing at 10101.art. We’re not just chasing the next hot artist or trend. We’re building a platform that will reshape the art market for years to come. It’s about making high-value art accessible to a wider audience, while creating a new way to own a piece of art. By the way, let’s connect on LinkedIn if this idea resonates with you.

PH: Can you offer our readers a sneak peek into any well known artworks you hope to list on 10101.art in the future?

AK: Every new artwork in our collection is a valuable masterpiece, so we’re willing to make every new arrival special. We’re ready to surprise you, so stay tuned for the updates!

PH: What are some of the most exciting trends you’re seeing in the art market today?

AK: Real world assets are a huge trend in the art market today. More and more art tokenization platforms, such as 10101.art appear. Even apart from art, lots of other industries started to tokenize physical objects valuable in real life.

We in 10101.art are not just seeing this exciting trend, we’re leading it with a mission of making fine art more reachable.