Every once in a while, a new indicator pops out that can be used to detect price tops and bottoms in the market. This assertion is even more evident in cryptocurrencies because the data comes from exchanges and on-chain data extracted from the blockchain.

These indicators are constantly monitored and commented on by analysts and traders. Some of the lesser-known metrics use data from altcoin derivatives volumes and the Bitfinex U.S. dollar lending rate.

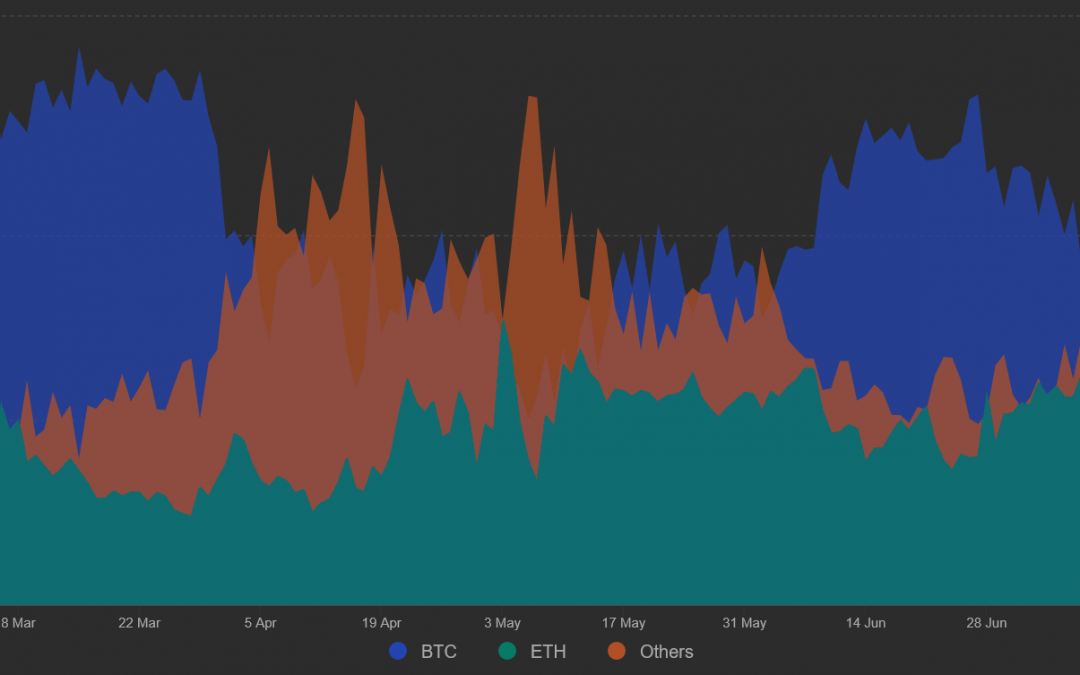

Altcoin volumes in futures markets indicate overheat

The futures contract volume is usually triple that of, or even five times higher than, regular spot markets. This phenomenon is not exclusive to cryptocurrency markets, as these contracts allow leverage trading, but the comparison isn’t exactly fair because the contracts are synthetic products, while Bitcoin (BTC) is digitally scarce.

By measuring the market share of Bitcoin, Ether (ETH) and the remaining altcoins, it is possible to analyze exactly what traders are focusing on.

The chart above shows that Bitcoin and Ether represented 65% to 85% of the aggregate volume in March. Still, as altcoins gained relevance, this figure dropped to 45% for the first time ever on April 6. 11 days later (April 17), the total cryptocurrency market capitalization tanked 20%.

This phenomenon repeated itself on May 6 as the Bitcoin and Ether market share in derivatives volumes reached a historical low at 39%. On May 10, the total market capitalization dropped 12%. It seems like too much of a coincidence, and it makes sense to consider whether the market overheats whenever the market share held by altcoin derivatives spikes.

There are multiple reasons to relate a sharp increase in altcoin volume to excessive optimism. For example, changing focus from Bitcoin and Ether indicates that investors no longer see much upside and are seeking options elsewhere.

The Bitfinex U.S. dollar lending rate usually spikes ahead of crashes

Margin trading allows an investor to leverage their trading position by borrowing money. For example, borrowing dolla will allow one to buy Bitcoin, thus increasing their exposure. Although there’s an interest rate involved with borrowing, the trader expects BTC’s price appreciation to compensate for it.

Whenever there’s excessive demand for the dollar lending rate, it is usually an indicator that the market is becoming reckless.

The above data shows that such an event happened four times in 2021, and the last one occurred on April 13, one day before the $65,800 all-time high for Bitcoin. For example, reaching a 0.16% daily rate is equivalent to a 5% monthly fee, which is costly even for the most optimistic investors.

Traders should keep in mind that markets can remain irrational longer than any investor can remain solvent. This means that irrationality can prevail for long periods, including altcoin euphoria and the excessive use of leverage by buyers.

Whenever multiple indicators point to an overheating market, traders should always consider reducing their positions. Going forward, the altcoin futures market share and the Bitfinex dollar lending rate should be carefully monitored when searching for market tops.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.