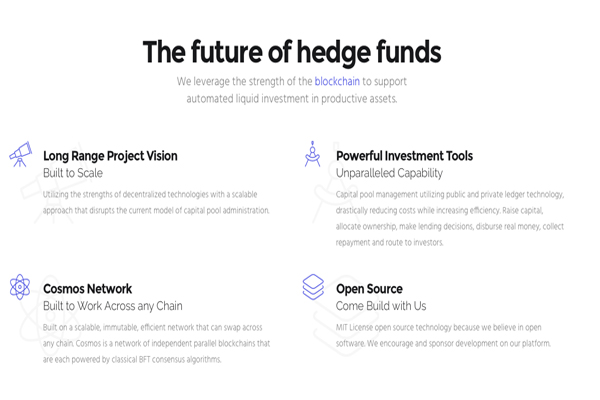

The PAR Project (par.io) a Productive Asset Record system, has released its white paper today revealing the launch of its new platform. PAR is a management application for the administration of capital pools through blockchain technology.

PAR Releases White Paper

The PAR Foundation was founded in 2016 by Brian Kelly, Jacob Dienelt, Michael Sofaer, and George Samman. The focus of PAR is development of the world’s first transparent administration and audit application for lending and hedge funds, using blockchain technology behind the scenes. Its system has foundations in both public and private ledger technology.

The PAR Foundation was founded in 2016 by Brian Kelly, Jacob Dienelt, Michael Sofaer, and George Samman. The focus of PAR is development of the world’s first transparent administration and audit application for lending and hedge funds, using blockchain technology behind the scenes. Its system has foundations in both public and private ledger technology.

The protocol will enable intelligent lending and hedge fund management using the Ripple Interledger, partnered with the Tendermint consensus mechanism. The network will provide leverage for cross-chain swapping and use Nautiluscoin (NAUT) as the native currency.

Users within the PAR network will receive discounted rates when utilizing Nautiluscoin with the application. PAR has similarities to the BlackRock Aladdin Platform but differs in various ways while acting more like a crypto-bridge.

The white paper explains:

By allowing capital pool directors to create rule sets that govern capital flow, investment return allocation, and fee collection, the system provides flexibility and automation of capital flow. […] An essential goal of this project is not only to create a crypto-bridge but also to link NAUT to a productive asset. This goal will require extensive work with regulators to determine the exact nature of digital currencies from a legal perspective.

The creators of PAR believe its system will enable greater capital formation by significantly reducing administration costs, increasing post-close liquidity, and lowering the barrier of entry for investment. By leveraging cryptocurrency and blockchain technology the organization is able to provide decentralized escrow and unique pool of ownership.

“Asset management and particularly the hedge fund industry is ripe for disruption particularly in a low interest rate, low volatility, low return, low transparency and high fee world,” George Samman explained to Bitcoin.com. “With so much excess capital floating around looking for higher returns we aim to make creating capitals pools faster and cheaper and more transparent than ever before through the use of cryptocurrencies and blockchain technology.”

Approaching Regulators & Obtaining the BitLicense

The founders say they are working “rigorously to perfect our plan and proposal.” Following the completed plan the next step will be approaching regulatory officials for permission to operate. PAR explains this will determine how to impart real world value on cryptocurrency, but regulators will need to approve the proposal and jurisdictional issues will have to be assessed. PAR founders are optimistic about approaching the authorities, stating:

This will be the first time an effort created in the crypto space is brought to regulators to unpack the differences between cryptocurrencies and equity stakes. We are hopeful that regulators will be open to our proposal, but there is still significant work to do. Transparency will be maintained throughout this process, as it is our belief that this will help the regulators understand and shape the future of this space.

The team hopes it can make headway with regulators with this project. PAR says it will try to obtain the New York Bitlicense and believes this could set a precedent for future ICO legislation. By reducing hedge fund operating costs, the founders believe the service will be a disruptive model for Wall Street.