Bitcoin mining operations are on the path to full recovery following the most dramatic short-term disruption in network history earlier this year, and miners are reaping the rewards in revenues.

In its Oct. 4 Week on Chain report, on-chain analytics provider Glassnode reports that Bitcoin hashrate has largely recovered despite 50% of the network’s hashing power going offline in May following China’s crackdown on the sector. Hash rate measures the total computational resources of a Proof-of-Work network.

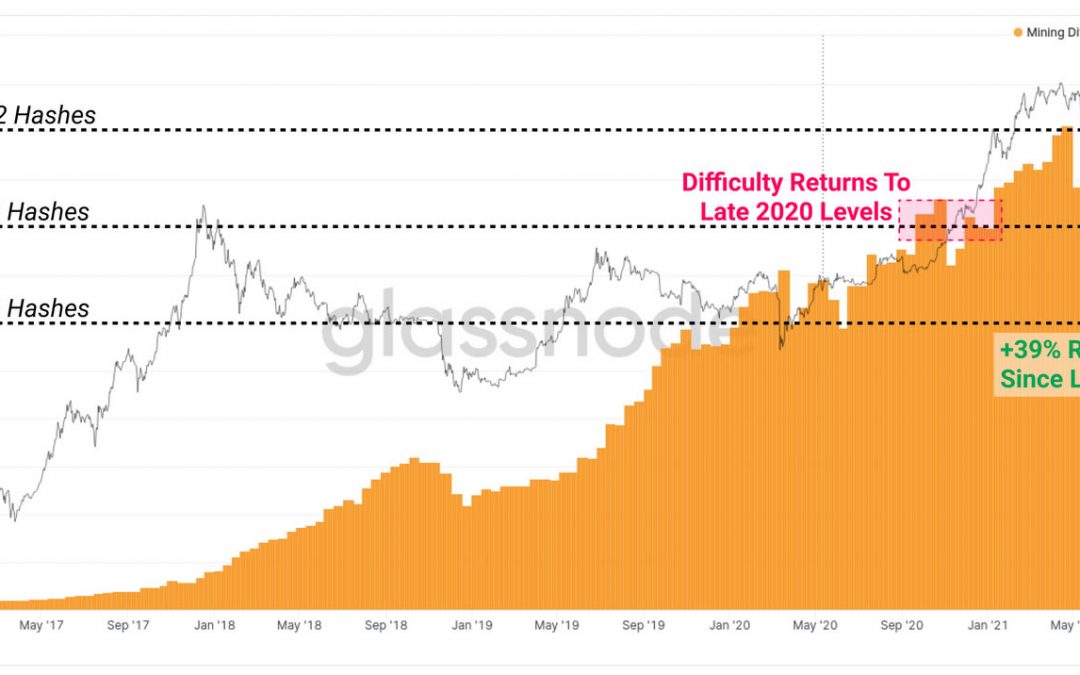

Glassnode asserts that both hash rate and mining difficulty — which measures competition among miners seeking to solve the network’s next block — are both on a “consistent path to recovery.” Cointelegraph reported that difficulty slumped by 28% in early July.

Having increased 39% since late July, mining difficulty has nearly returned to its pre-China exodus levels, with an additional upward adjustment expected to take place this week.

Glassnode also reported that the difficulty ribbon has posted its strongest reversal since December 2018.

Related:Bitcoin mining difficulty surges 31% since July

Despite block rewards having been slashed by 50% from 12.5 BTC to 6.25 BTC in May 2020 halving event, mining profitability has increased significantly since.

Glassnode noted that the current mining profitability of $40 million daiy is up 275% since before Bitcoin’s May 2020 halving, and has increased by roughly 630% compared to June 2020’s lows of roughly between $6 million and $8 million.

“Despite dramatic shifts in the mining market, multiple deep price corrections, and a halving event in May 2020, the Bitcoin block reward value continues to rise, creating incentives for the market to adapt, innovate and recover,” the report added.