Just recently the sponsor of the Bitcoin Investment Trust (OTCQX: GBTC), Grayscale Investments, has announced its plans for the bitcoin cash (BCH) reserves the trust is currently holding. According to Grayscale, the BCH will be sold over time, and a remittance date for shareholder proceeds will be announced upon completion of the sales.

Also read: New To Bitcoin? Welcome! Here’s How To Take Those First Steps

Grayscale to Sell Bitcoin Cash Reserves Currently Held by the Investment Trust

Two months ago news.Bitcoin.com reported on the firm Grayscale contemplating what it would do with the bitcoin cash reserves it received from the August hard fork. At the time the trust’s sponsor detailed it might create a separate trust for BCH or sell the reserves and credit shareholders. The trustee’s agent will sell the BCH over a period of time that will not exceed 90 days, explains the firm.

Two months ago news.Bitcoin.com reported on the firm Grayscale contemplating what it would do with the bitcoin cash reserves it received from the August hard fork. At the time the trust’s sponsor detailed it might create a separate trust for BCH or sell the reserves and credit shareholders. The trustee’s agent will sell the BCH over a period of time that will not exceed 90 days, explains the firm.

“[The agent] will remit the cash proceeds from such sale, net of any administrative and other reasonable expenses incurred by the agent in connection therewith, to record date shareholders upon completion of the sale,” explains Grayscale Investments plan for bitcoin cash reserves.

The agent will thereafter sell the bitcoin cash over a period of time, currently not expected to exceed 90 days, and remit the cash proceeds from such sale, net of any administrative and other reasonable expenses incurred by the agent in connection therewith, to record date Shareholders upon completion of the sale.

BCH Sale Prices Difficult for the Trustee to Determine

The New York-based digital currency investment firm explains that BCH is traded throughout multiple exchanges, and with the asset’s volatile price it’s not possible to predict the value of BCH for distribution yet. Grayscale details that BCH/USD markets reported intra-day price ranges between $310-340 per token or their equivalents measured in other cryptocurrencies. However, today’s intra-day ranges on November 4 have seen BCH between $600-650 per token as the cryptocurrency has been on a tear since Grayscale’s observation.

“There is no assurance that prices in this range (before deduction of expenses) would have been realizable had the bitcoin cash currently held in the trust been liquidated on such date,” Grayscale’s announcement details.

As a result, there can be no assurance as to the price or prices for Bitcoin Cash that the Agent may realize, and the value of Bitcoin Cash may increase or decrease after any sale of Bitcoin Cash by the Agent.

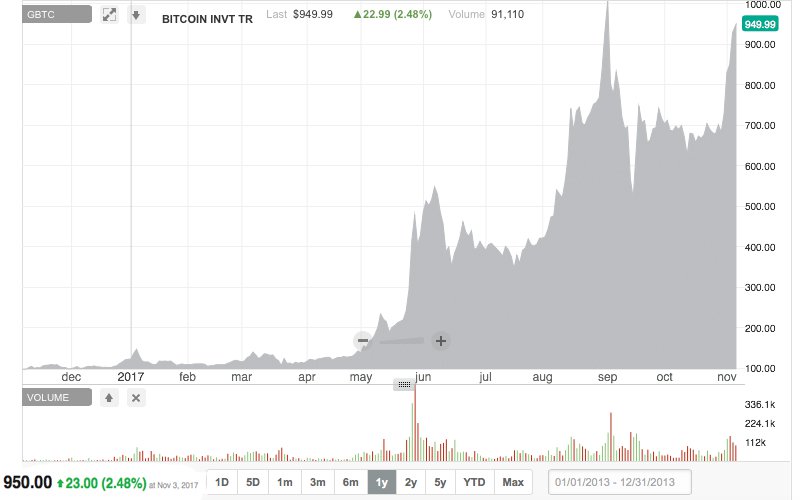

The GBTC bitcoin-based trust created in 2013 has been a popular mainstream investment model for those looking for bitcoin exposure. Many of GBTC’s shareholders have been curious to how Grayscale and the GBTC fund would handle the BCH distribution or credit for the token’s associated sales. Grayscale reminds its investors that, after the completed sales on the recorded dates, shareholders should consult their tax attorneys or accountants to avoid auditing implications.

What do you think about Grayscale selling bitcoin cash reserves and crediting shareholders? Why do you think they chose to sell rather than creating a separate BCH trust? Let us know what you think in the comments below.

Images via Shutterstock, OTCmarkets.com, and Grayscale.

At Bitcoin.com there’s a bunch of free helpful services. For instance, check out our Tools page!