We all learned about “supply and demand” in our first week of economics class. When the price of something rises because of demand, more supply is rushed to the market and the price stabilizes. The demand is satisfied at a new equilibrium. Like most things we’re taught in economics class, this model is badly flawed especially when it comes to gold. That’s because gold has both a physical market (actual gold bullion), and a much larger synthetic market (paper gold such as futures and ETFs). Gold prices are dominated in the short-run by the synthetic paper gold market; physical supply is mostly irrelevant. Players on the physical side are price takers, not price makers. This has been true for years, but now the tables may be turning. I’ve received first-hand reports of shortages of physical gold from refiners. Vault operators have told me physical gold holders are taking gold out of banks and putting it into private vaults where it is no longer available to prop up the paper market. In the article below you’ll see that now even the miners are saying they’re running out of gold. Due to the price decline since 2011, new mines are not opening, output from existing mines is declining, old mines are being shut-in, capex is being cut, and reserves are being reduced. We’re heading for a crack-up where physical shortages will cause delivery failures and ignite panic buying of physical gold that even the paper market can’t contain. This article explains why. The paper market is doing physical buyers a favor by keeping the price artificially low, making the entry point attractive. A gold price super-spike is coming. The time to get your gold is now. Says Rickards

Gold Miners Are Running Out of Metal: Five Charts Explaining Why

by Kevin Crowley

- Exploration proving more difficult and firms have cut capex

- Gold mining CEOs turning to deals to combat dwindling reserves

Gold’s had a roller-coaster year, surging as much as 30 percent before giving up the bulk of those gains. But one trend has been consistent: mining companies are finding it harder to dig up more of the precious metal.

The following charts show why, and what that means for the industry.

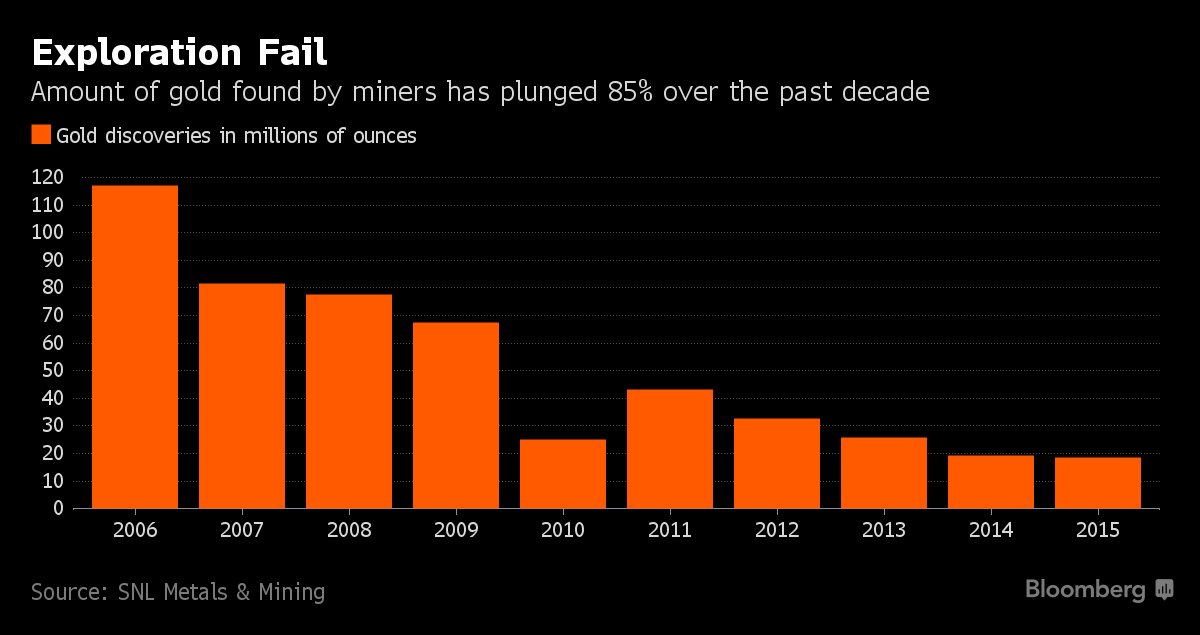

Dwindling Discoveries

Even though producers’ exploration budgets surged more than 10-fold to $6 billion a year in the decade to 2012, new finds are in decline. The amount of gold discovered last year was down 85 percent compared with 2006.

Capex Cuts

To cope with bullion’s 41 percent price plunge from a record in 2011, miners have cut capital expenditure. That’s shortened the lifespans of many mines as firms haven’t been able to build the infrastructure needed to access more ore.

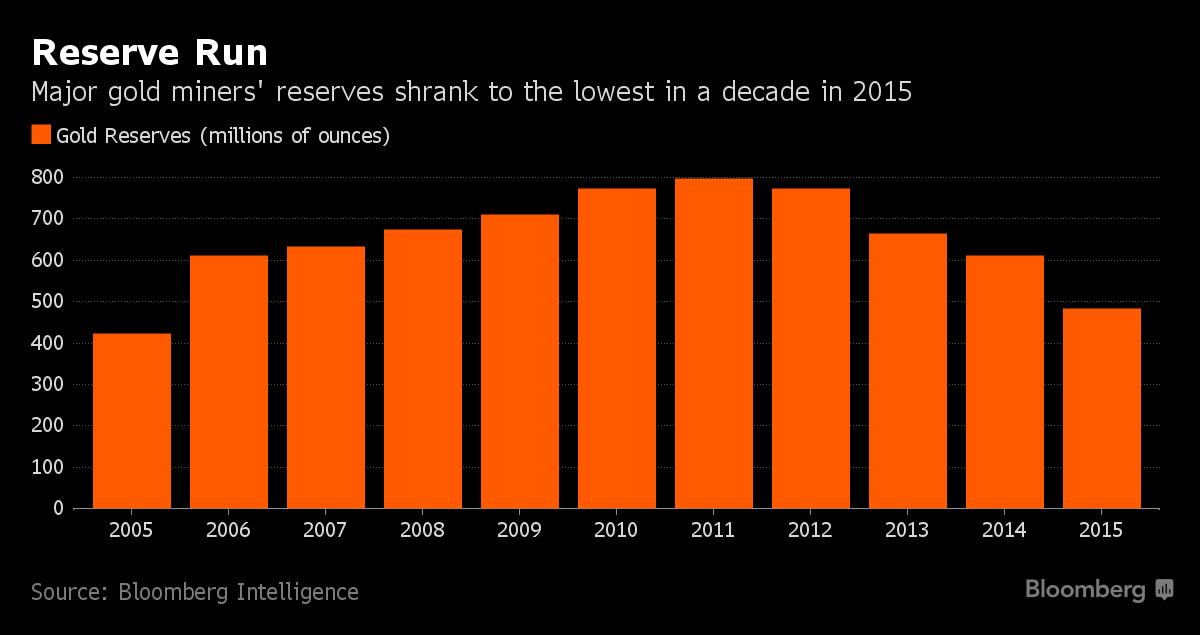

Falling Reserves

Because of fewer discoveries, reduced mine life and a lower gold price, the amount of known metal that’s economically worth mining is falling. Major producers’ reserves have slipped 40 percent since 2011.

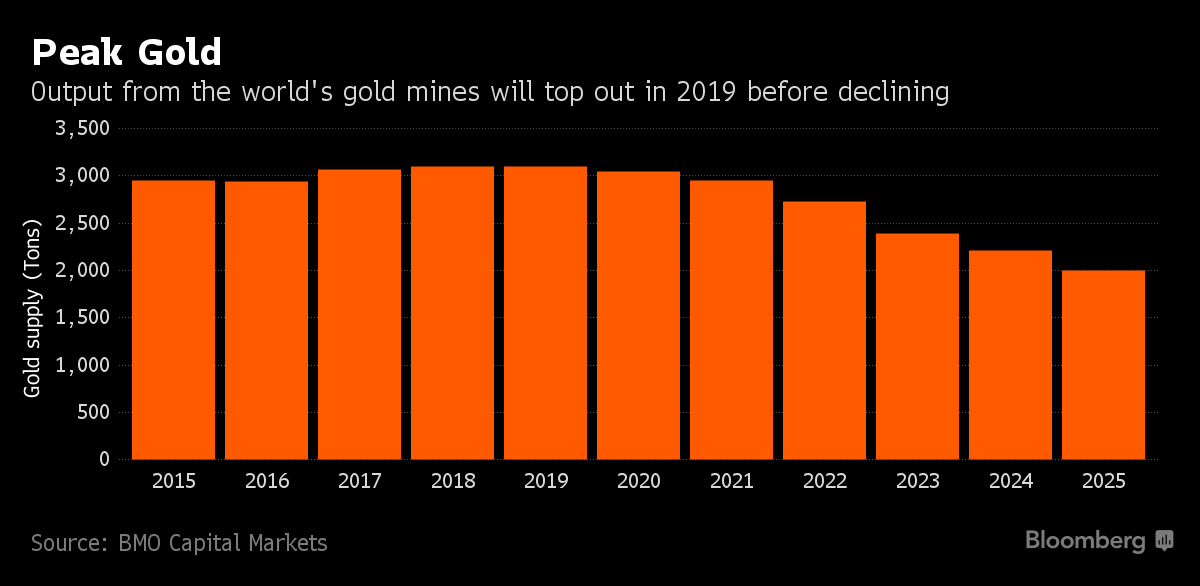

Supply Crunch Coming

Annual production might be near a record, but it’s not expected to last for long. Mine supply will peak in 2019 and keep falling through at least 2025, according to BMO Capital Markets. Randgold Resources Ltd. Chief Executive Officer Mark Bristow is among those expecting so-called peak gold in the next few years.

But there’s a caveat: Annual mine output totals less than 2% of all the gold that’s thought to have ever been produced and unlike commodities such as oil or copper, most of that gold is sitting in vaults or in jewelry form. That makes it easier for old metal to come back into the market if supply tightens.

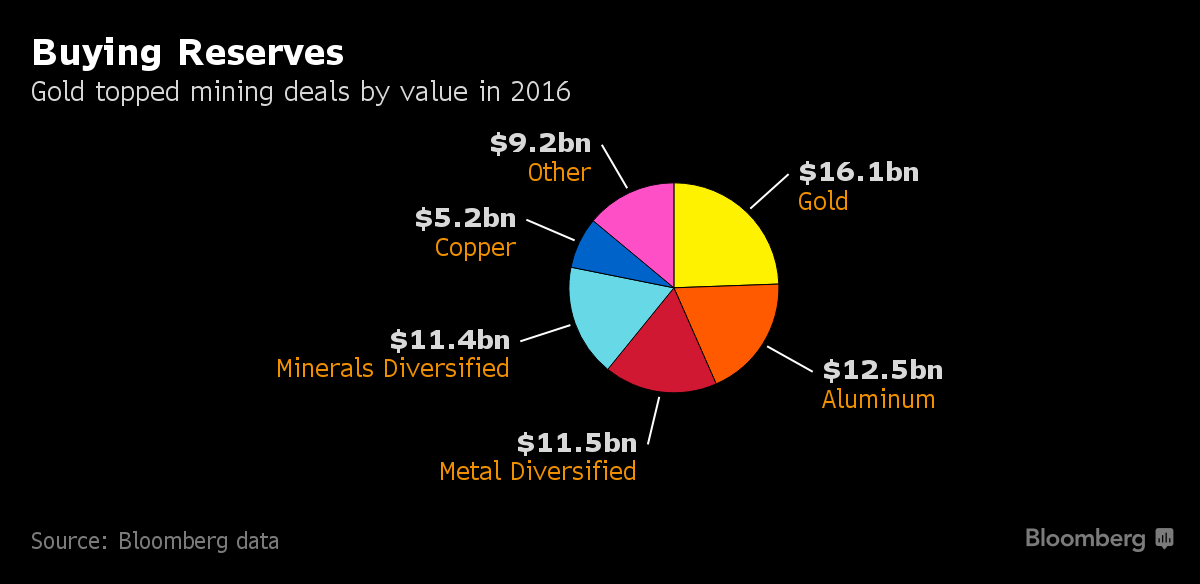

The Race for Reserves: M&A

With their industry facing a tougher production future, gold mining CEOs have been on the hunt to buy up competitors to replace dwindling reserves. Deals for bullion producers have topped those for other commodities so far this year.