Stablecoins, or crypto assets which peg their value to less volatile fiat money, are useful tools for a variety of reasons. They can be used to cash out crypto investments, send or receive stable money abroad, and to pay for everyday consumer transactions without fear of fluctuation. A recent estimate from the Bank for International Settlements, or BIS, put the total stablecoin supply at roughly $150 billion.

But central banks, the issuers of traditional fiat money around the globe, do not seem to be big fans of stablecoins. A sharp increase in supply coupled with a lack of relevant regulations has led to concerns that these stable blockchain assets could threaten the current financial order. Fiat money stablecoins, such as those created by Circle (USDC) and Tether (USDT), may require banking licenses in the future to operate. Thus far however, regulators have not been keen to take aim on algorithmic stablecoins, which are governed by automated expansion and contraction of the monetary supply.

In an exclusive interview with Cointelegraph, Sam Kazemian, the co-founder of the Frax stablecoin protocol, discussed the regulatory outlook for the sector and algorithmic stablecoins in detail.

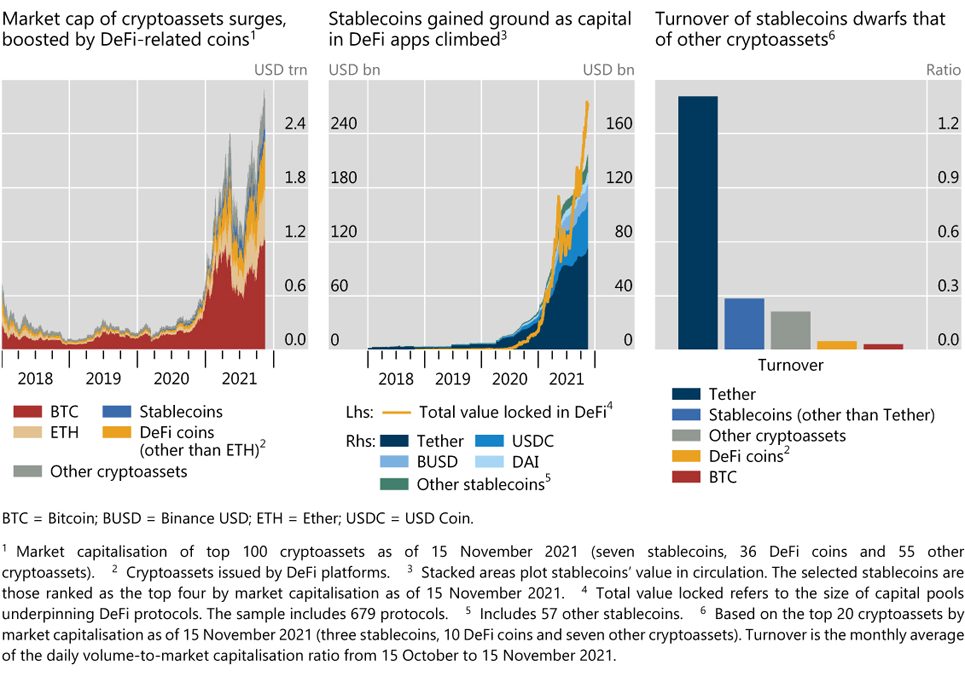

Growth in cryptocurrency activities | Source: BIS

Cointelegraph: There are many algorithmic stablecoins out there, such as Terra USD, Ampleforth, etc. In your opinion, what makes Frax unique?

Sam Kazemian: What makes Frax unique is that we have a system where our protocol expands and contracts supply in various places across blockchain protocols, and targets the exchange rates of the Frax stablecoin out in the open market. We like to compare it to a central bank. When it issues a currency, it never says ‘hey, you can come to redeem it for this amount of gold, or you can come and redeem it at the central bank for something dollar-pegged.’ They don’t say that anymore. And so, what a central bank does, is that it targets their currency in the open market’s exchange rate.

If a central bank pegs their currency to gold, what they’ll do is look at the price of gold against their national currency. If it’s lower than what they want, they’ll buy some of the currency back. If the other side is higher than what they want, then they’ll print more of the currency. Frax takes this kind of approach. That’s how we developed our algorithmic stablecoin thesis, and it’s worked well. We’ve never broken our peg, even during [the major market crash in] May.

Stablecoin market capitalization statistics | Source: U.S. Treasury Stablecoin Report

CT: Do you see a potential crackdown looming in stablecoin the sector? And what is Frax doing to comply with relevant stablecoin regulations?

SK: There are two parts to this. I don’t know if I would call it a crackdown, but I do see a lot of regulation coming for at least the fiat coins, which have traditional financial assets that back them; like cash equivalents, or actual cash in depository accounts. I don’t know that this affects truly decentralized stablecoins though. I believe that Frax is not only compliant, but it will keep complying with all requirements just by existing and being fully decentralized.

The second part to your question is interesting because I think the current stablecoin regulation they’re proposing is a little bit reactionary. What’s currently going on is that people are saying that stablecoin issuers like a Circle and Tether need to have banking licenses. That’s the conversation. But that doesn’t make sense if you think about it, because there’s a lot of experimentation allowed in even the traditional financial space. Things like money market funds don’t have a banking charter. It’s not a bank. It’s not FDIC [Federal Deposit Insurance Corporation] insured. People either don’t realize this or they’re not informed.

Money market funds are regulated in the sense that you need to have [and disclose] cash equivalents. But they are not regulated with the same harshness that they’re currently proposing [for] stablecoins. This doesn’t apply to fully decentralized ones like Frax that have absolutely no claims on real-world assets, or even advertise any form of redeemability. The whole point of Frax is that our protocol works by targeting the open market exchange. I think I’m pretty open to the belief that the regulation portion will work itself out.