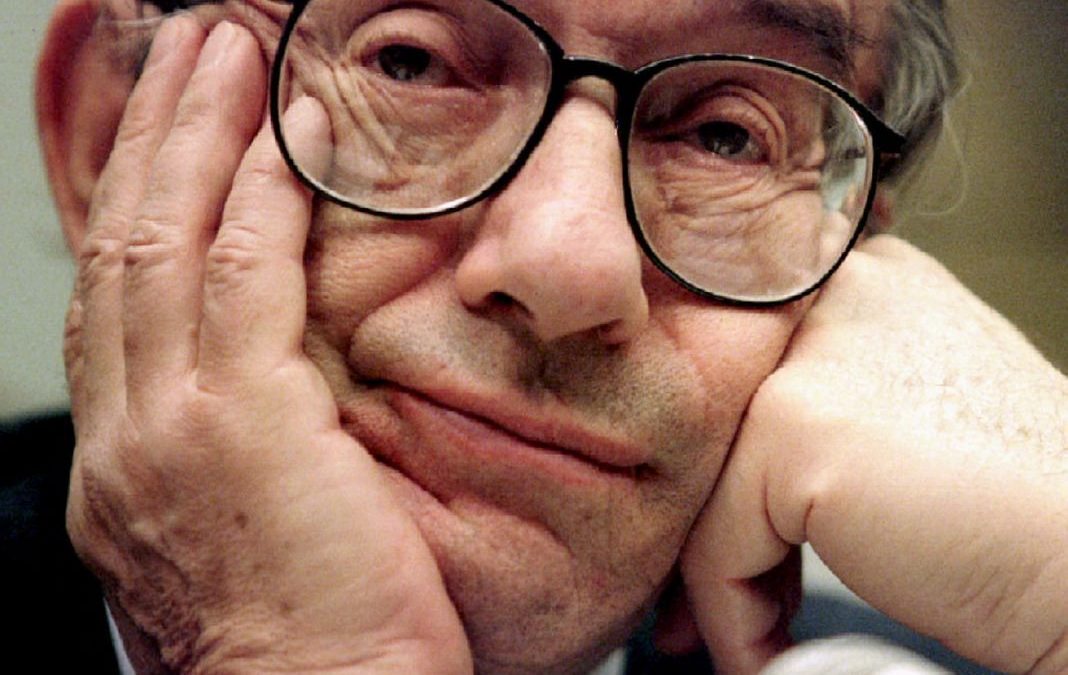

Just recently the notorious former Federal Reserve chairman Alan Greenspan gave his opinion concerning the rise of bitcoin in 2017. The 91-year old Greenspan explains that he believes the decentralized currency is very much like the world’s unbacked fiat currencies.

Also read: Are 2017’s Network Attacks ”Real” or Are Bitcoiners Growing Paranoid?

The Former Master of USD Printing Alan Greenspan Says “Bitcoin is What Used to be Called Fiat Money”

Another high profile economist has an opinion concerning the recent interest in bitcoin this year. Alan Greenspan who served as the Federal Reserve’s Chairman from 1987 to 2006 explains on the Fox broadcast “Mornings With Maria” that “bitcoin is what used to be called fiat money.” Greenspan thinks that because bitcoin isn’t backed by a traditional commodity he believes the decentralized currency is very much like unbacked notes issued in the past.

“I would use the analogy of Continental currency. Continental currency in 1775 was issued with no backing, and it sold at par in the marketplace for quite a while until they started to build up more and more printing of continentals,” explains Greenspan on the news broadcast.

Human nature is such that if you get something such as Bitcoin, you think there is some value there whether there is or there isn’t. But that’s the same thing as a Continental, greenbacks in the Civil War, all of these currencies which didn’t have any backing.

Greenspan Can’t Stretch His Imagination

Even though Greenspan spent his career managing the Federal Reserve, which is well known for printing unbacked notes, Greenspan’s economic opinions have always been respected. This is likely due to his financial background and his relationship with well-known figures like Ayn Rand. Furthermore, it’s not the first time Greenspan has taken issue with bitcoin not being backed or having intrinsic value. Back in December of 2013 when bitcoin markets were rising to $1,000 per BTC Greenspan told the press that bitcoin was “not a currency.”

“It [bitcoin] has to have intrinsic value. You have to really stretch your imagination to infer what the intrinsic value of bitcoin is. I haven’t been able to do it. Maybe somebody else can,” explained Greenspan four years ago.

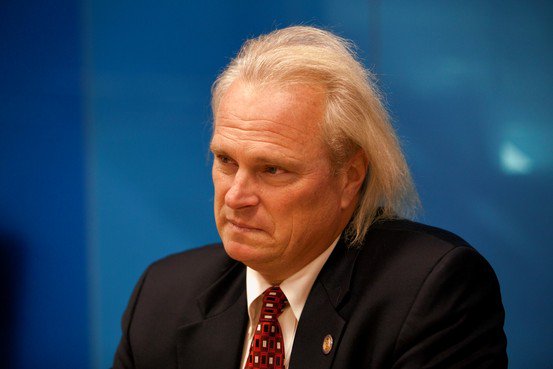

Former U.S. Regulator Disagrees With Alan Greenspan’s Statements About Bitcoin

Following Greenspan’s most recent bitcoin statements with Maria Bartiromo, the former U.S. Trading Commissioner, Bart Chilton, responded to Greenspan’s remarks on Fox broadcast. Chilton told Bartiromo that he believes bitcoin is sustainable and he hopes upcoming events like CME’s futures markets will help regulate the currency more. Chilton explained his thoughts on the show saying;

I do think it’s sustainable, I don’t know if it’s sustainable at these prices — I mean, the only difference is, with Chairman Greenspan is that, you know, people are willing to pay for it and so if they’re willing to pay for it there is a demand.

The former U.S. regulator is a firm believer that regulation will help curb bitcoin’s volatility and explained his opinions in a guest written article for CNBC this past September. He believes market volatility tethered to cryptocurrencies would be investigated if these markets were regulated. “There’s no questions – zero – that had digital currencies been regulated, I would have sought an investigation into the precipitous price changes we’ve witnessed,” Chilton notes. However, unlike the former Federal Reserve Chair Greenspan, Chilton does believe bitcoin could be a sustainable currency if it weren’t so volatile.

What do you think about former Fed Chair Alan Greenspan’s recent remarks about bitcoin? What do you think about the response from the former U.S. regulator Bart Chilton’s response? Let us know what you think in the comments below.

Images via Getty Images, Alchetron, and Pixabay.

Need to calculate your bitcoin holdings? Check our tools section.