Some of the wealthiest families in Latin America now have access to a new way to invest, thanks in part to a former senior manager at consulting firm Bain & Company.

Announced today, the newly formed Crypto Assets Fund, co-founded by former senior manager at Bain, Roberto Ponce Romay, is helping raise $50m with the purpose of buying cryptocurrencies for family offices. Revealed exclusively to CoinDesk, Crypto Assets Fund will invest directly in bitcoin, ether, zcash, ripple, litecoin and dash.

The first tranche of the fund, estimated to be valued about about $10m, is in the final stages of closing, and is expected to be announced by the end of this month.

In interview, Romay explained that the purpose of the fund was two-fold. First, it was designed to give investors in some of Latin America’s more unstable economies a new way to hedge their investments, and second, it was meant to provide the opportunity to safely learn about these new stores of value for possible future investments.

According to Romay, as the fund’s investors are becoming increasingly familiar with the crypto-asset class, the CAF could eventually raise new funds that also include tokens sold as part of initial coin offerings, or ICOs.

“This fund is investor driven,” said Romay, who is now the director of investment banking boutique, Invermaster. “It is a simple strategy to give access.”

He added:

“The [investors] wanted to be exposed.”

Dissecting the fund

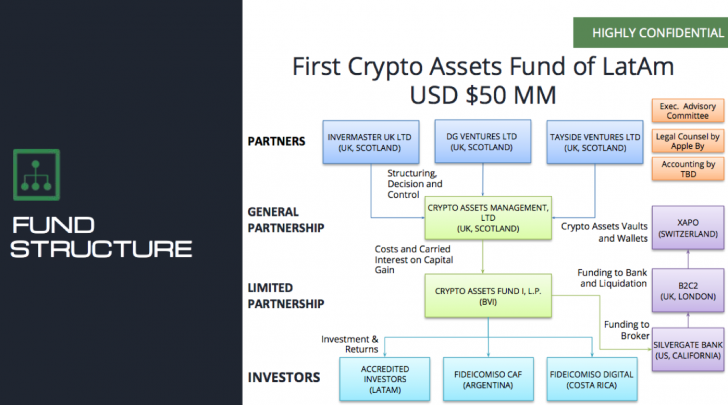

Investment documents provided to CoinDesk further reveal details about how the British Virgin Islands fund intends to invest capital provided by its limited partners.

Fund co-founders, including the vice president of bitcoin payments startup Ripio, David Garcia, and, ARG Capital partner Miguel Iribarne, are raising the cash from accredited family office investors in Argentina, Costa Rica and other Latin American nations.

The service is designed to give new crypto-asset investors exposure to bitcoin and ether without taking on the added risk of regulatory and tax compliance and storage. No fee is being charged for the service, but 30% of the carried interest will be collected by the fund based on certain conditions.

At the time of launch, the funds are expected to be held by Switzerland-based Xapo, with over-the-counter trading services provided by B2C2, an electronic market maker regulated by the Financial Conduct Authority in the UK, and broker funding provided by Silvergate Bank.

Half of all initial funds raised will be invested in bitcoin, with the other half divided between the remaining cryptocurrencies. Initially, the fund is open to accredited investors in Latin America, with a special focus on family offices Argentina and Costa Rica. But future funds could include new assets and other investors.

Funds will not be liquidated until 180 days after the next bitcoin halving, when the reward to mine bitcoin is reduced. Investors who put up a minimum of $2.5m will be allowed to hold their funds for the maximum period of five years.

“We are mainly targeting family offices in Latin America,” said Garcia. “But there are other players interested in the fund, because the fund strategy also fits with what they’re looking for.”

Innovative wealth

While bitcoin and other cryptocurrencies were originally heralded as new ways for the unbanked populations of developing countries to participate in the global economy, that has been changing in recent years.

As early use cases including remittances were targeted largely at workers looking to send money home, this latest development shows how services are now being aimed at the wealthy. CoinDesk first reported on this push by family offices into the cryptocurrency space last March.

Now, based on previous growth trajectories of CAF’s crypto-assets, the fund lists a minimum target return of 26% per year for three years with an “expected” target return of 71%.

But Garcia said Latin American family investors are looking for more than just a new way to make money. Depending on the nation, they are also looking for a way to hedge against less stable fiat currencies.

He explained:

“Storing their savings in the local currency is not a smart option.”

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Xapo.

Costa Rican coins image via Shutterstock

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Have breaking news or a story tip to send to our journalists? Contact us at [email protected].