There are many benchmarks for measuring IEO success. Token price, community size, code shipped, and milestones met are all yardsticks for gauging the progress of a tokenized project. For projects seeking to create the biggest possible splash, however, liquidity is the crucial factor. The more exchanges an IEO reaches, the greater its prospects of survival.

Also read: How Crypto Winters of Bitcoin’s Past Compare to Today

Multiple Exchanges Multiply Projects’ Prospects

Initial exchange offerings are big business: according to Inwara, IEO projects raised a cool $1.625 billion in the first half of 2019. H2 has continued that trend, with the leading exchange launchpads maintaining their aggressive IEO schedule – one a month in the case of Binance; 24/7 in the case of smaller platforms such as Latoken. Investor demand for initial exchange offerings also remains robust: the leading crypto Telegram channels, maintained by the likes of Coinidol, attest to this, as investors clamor to catch wind of pre-sale and seed rounds for projects that will eventually IEO on Binance or Huobi.

While the initial exchange offering brings benefits to investors and project teams, compared to the ICO, it is hamstrung by a flaw that is inherent to this fundraising model: often, there is little incentive for other exchanges to list the token. As a result, most IEOs will live and die on the exchange that hosted their token sale. For the handful of IEOs that have thrived post-sale, both in terms of token price and other benchmarks, it’s no coincidence that they’ve transcended their issuing platform, and gained deep liquidity in the process.

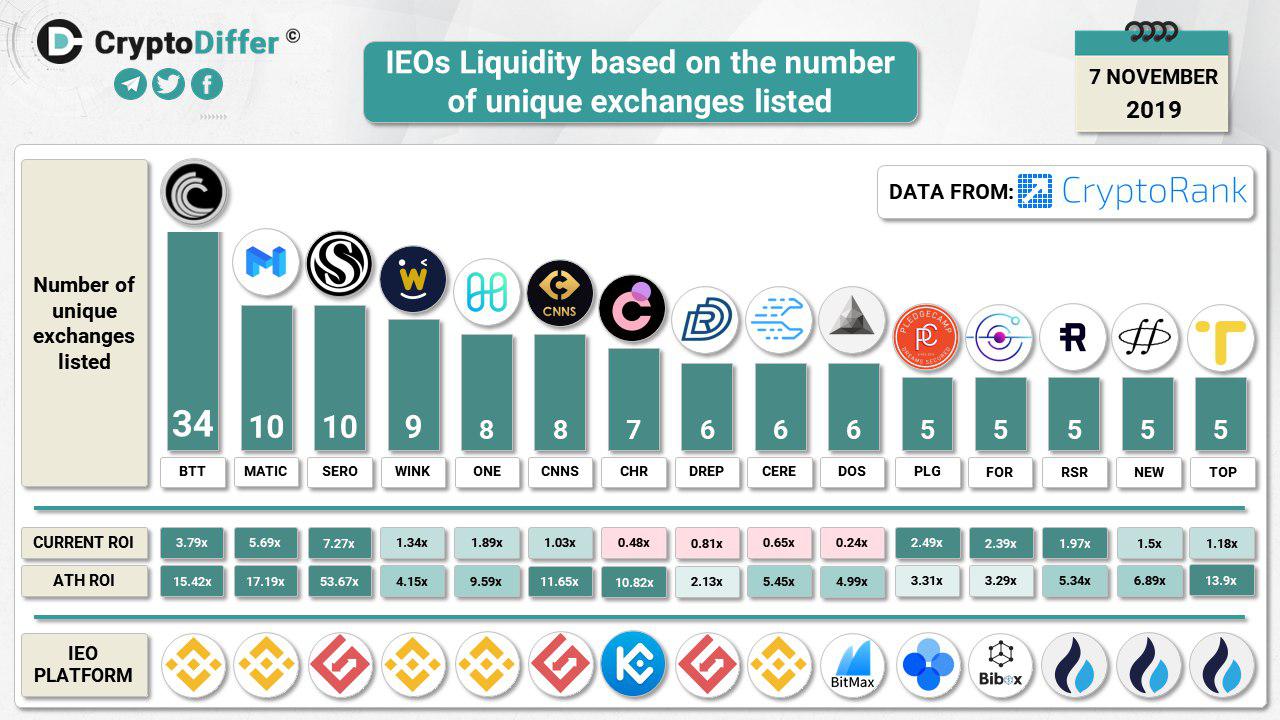

Bittorrent Remains the Liquid Leader

The most liquid token IEO to date, based on the number of exchanges where it’s listed, is also one of the earliest: Bittorrent (BTT), which launched on Binance last year. Today it appears on 34 exchanges – 24 more than the next most-listed tokens. It’s no coincidence that tokens listed on the most exchanges – namely BTT (34), MATIC (10) and SERO (10) – outperform all others as far as ROI and ATH ROI are concerned. The correlation between number of exchanges and project performance is inarguable.

For better or worse, IEOs have taken the crypto world by storm, but most projects will never see the sort of liquidity enjoyed by Bittorrent and Matic. In fact, of the 65 IEOs launched in the past six months, the vast majority have failed to even make it onto a second exchange. The consequence of this has been limited liquidity, low accessibility/visibility and, in many cases, a project which has effectively died before it has even gotten the opportunity to develop any serious momentum.

A final note on IEO liquidity: when it comes to securing multiple exchange listings, quality beats quantity every time. According to Cryptorank.io, Binance leads the way, with a much higher average ROI for its listed tokens (94.53%). Bittorrent’s runaway success played a part in this: it was the first IEO on Binance Launchpad, meeting its funding goal of $7.2 million in mere minutes. Every project since has struggled in vain to emulate that success.

Do you think IEOs have peaked, or are they just getting started? Let us know in the comments section below.

Images courtesy of Shutterstock and Cryptodiffer.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post For Initial Exchange Offerings, Liquidity is King appeared first on Bitcoin News.