Good morning. Here’s what’s happening this morning:

Market moves: All eyes were on the Chinese stock market, as bitcoin funding rates on Chinese derivatives exchanges slowly recovered from negative territory.

Technician’s take: Bitcoin was stabilizing above its 20-day average two days after its 20% plummet.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $50,509 +2.3%

Ether (ETH): $4,324 +3.1%

Markets

S&P 500: $4,591 +1.1%

Dow Jones Industrial Average: $35,227 +1.8%

Nasdaq: $15,225 0.9%

Gold: $1,778 -0.2%

Market moves

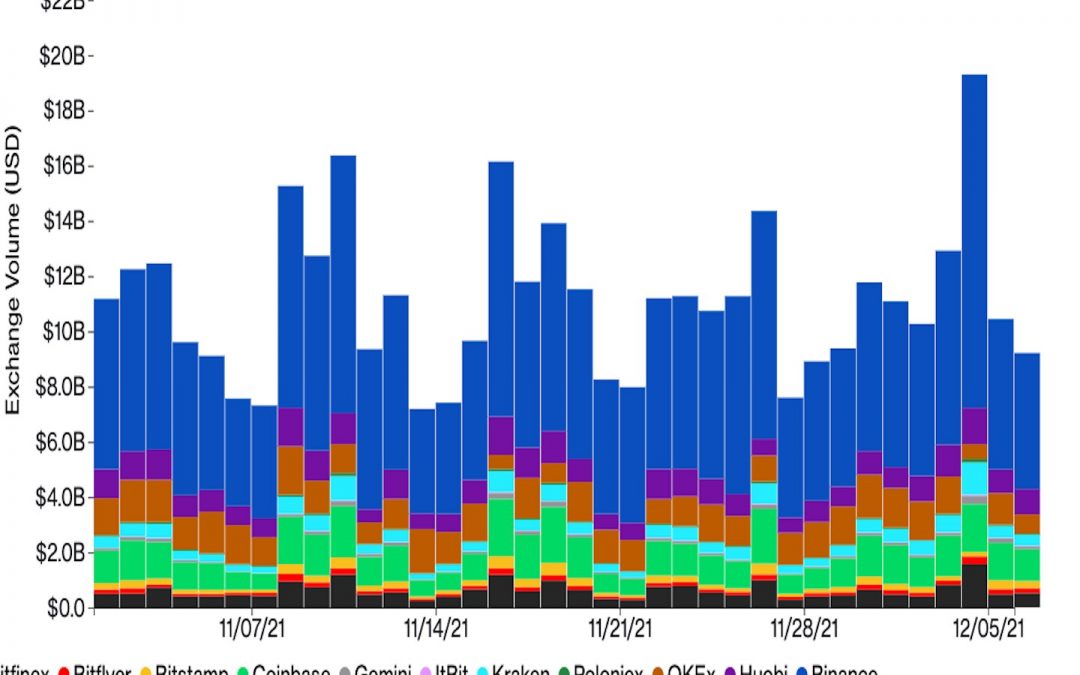

Bitcoin inched up on Monday two days after plummeting 20%, and at one point neared $51,000. The largest cryptocurrency by market capitalization was trading well over $50,000 at the time of publication. Trading volume was even lower than a day ago across major centralized exchanges. Ether was up over 3% to $4,324.

According to Singapore-based crypto trading firm QCP Capital, bitcoin’s average funding rate, or the cost of holding long positions in the perpetual futures listed on exchanges popular among Chinese traders, including Huobi, OKEx and Bybit, recovered from negative territory much more slowly than the funding rate on other major exchanges such as Deribit. (Exchanges calculate funding rates every eight hours.)

“This indicates persistent selling out of China,” QCP Capital wrote in its Telegram channel on Monday, citing “bad news” from China, including China ride-hailing giant Didi’s announcement to delist from the New York Stock Exchange. Other Chinese tech stocks tumbled following the news, as investors worried that other Chinese tech firms would be pressured to follow Didi’s move.

Meanwhile, China real estate giant Evergrande Group’s stocks and bonds both fell to historically low levels, as the Chinese government stepped up its involvement in the company’s management. The deeply indebted Chinese real estate developer has been an important factor in the performance of crypto and broader financial markets, CoinDesk has reported previously.

Technician’s take

Bitcoin Drops Below $56K as Momentum Slows, Support at $53K

Bitcoin is stabilizing above its 200-day moving average, currently at $46,000, after a nearly 20% sell-off over the weekend. The cryptocurrency was roughly flat over the past 24 hours, and was trading at around $49,000 at the end of the New York trading session. BTC is down about 15% over the past week.

The relative strength index (RSI) on the daily chart is the most oversold since July, which preceded a strong price recovery. Still, oversold conditions could persist for several days as sellers gradually exit positions.

BTC is poised for a short-term bounce, although upside appears to be limited toward the $55,000-$60,000 resistance zone. Over the long term, weekly momentum indicators have shifted negative for the first time since April, which preceded a brief crypto bear market.

Important events

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia house price index (Q3 YoY/MoM)

10 a.m. HKT/SGT (2 a.m. UTC): China exports of goods and services (Nov. YoY)

10 a.m. HKT/SGT (2 a.m. UTC): China imports of goods and services (Nov. YoY)

10 a.m. HKT/SGT (2 a.m. UTC): China trade balance (Nov.)

1 p.m. HKT/SGT (5 a.m. UTC): Japan leading economic index (Oct.)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Bitcoin, Altcoins Regain Ground; What Caused the Weekend Crash? Trung Nguyen on Axie Infinity’s Next Move

“First Mover” dove into crypto markets to discuss what happened over the weekend when bitcoin and altcoins suddenly dropped dramatically. Rufus Round, CEO of GlobalBlock Digital Asset Trading, shared his analysis and outlook. Also, Sky Mavis co-founder and CEO Trung Nguyen spoke about Axie Infinity’s popularity and the future of non-fungible token (NFT) gaming.

Latest headlines

Craig Wright Found Not Liable for Breach of Kleiman Business Partnership: A jury ruled Wright must pay $100 million to W&K Info Defense Research but cleared him of all other charges.

Japan Moves to Impose New Regulations on Stablecoin Issuers: Report: The country is reportedly moving to introduce legislation in 2022 to limit the issuance of stablecoins to banks and wire transfer companies.

Crypto Mining Stocks Extend Declines as Bitcoin, Ether Prices Fall: However, D.A. Davison sees mining stocks as a better buying opportunity than bitcoin itself.

Wrapped Bitcoin’s Supply Has More Than Doubled, but BadgerDAO Hack Exposed Risks of Moving Bitcoin to Ethereum: Higher returns usually come with higher risks.

Gemini to Allow Crypto Trading in Colombia Under Government-Sponsored Pilot Program: The company plans to offer bitcoin, ether, litecoin and bitcoin cash trading in partnership with local bank Bancolombia starting in December.

Longer reads

Miami’s Multiple Money Visions: This week’s big NFT event showed an innovation moment in full swing (even if many of the ideas on show are unlikely to make it).

Olympus DAO Might Be the Future of Money (or It Might Be a Ponzi): Right now, it’s a money game. One day it could be the backbone of all of decentralized finance (DeFi).

The Big Miss in the Biden Administration’s Stablecoin Report: We know that banks will not continue to rule the payments landscape. So why give them control over stablecoins?

Today’s crypto explainer: What Are Bitcoin Mining Pools?

Other voices: Bitcoin Buyers Flock to Investment Clubs to Learn Rules of the Road