(Edited by Greg Ahlstrand and James Rubin)

Good morning. Here’s what’s happening:

Market moves: Bitcoin traded in a narrowed range after “crypto witching day” ended

Technician’s take (Editor’s note): Technician’s Take is taking a hiatus for the holidays. In its place, First Mover Asia is publishing CoinDesk contributor Jeff Wilser’s Q&A with Cathy Hackl, sometimes called the Godmother of the Metaverse,” on the future of the metaverse, includinbg why brands will need a metaverse strategy.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $47,348 -0.02%

Ether (ETH): $3.825 +1.96%

Markets

S&P 500: 4,766.18 -0.26%

DJIA: 36,338.30 -0.16%

Nasdaq: 15,644.97 -0.61$

Gold: 1,829.05 + 0.73%

Market moves

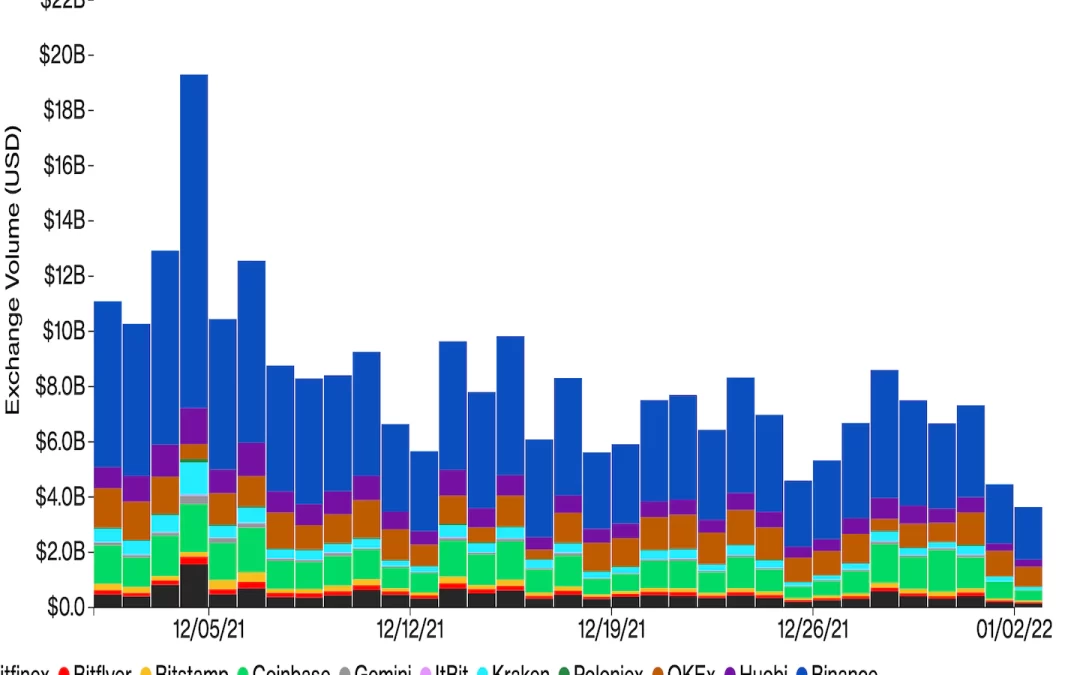

Bitcoin’s price was ranging between $46,000 and $48,000 during the weekend, after “crypto witching day” ended Friday with the expiration of roughly $8.67 billion worth of bitcoin and ether options contracts.

Bitcoin, the oldest cryptocurrency, experienced a small price recovery to as high as about $47,961.0 on Saturday, before it fell into red again on Sunday, based on data from TradingView. But its overall spot trading volume across major centralized exchanges declined on the weekend, meaning that the price move was not supported by strong market activities.

On Friday, about 115,000 bitcoin options and roughly 882,000 ether options contracts, worth a total notional value of $8.67 billion, expired, according to Cayman Islands-based crypto financial services firm Blofin. After the settlement was completed, bitcoin’s price briefly went up sharply to above $48,000 on some exchanges, crypto trading data platform aICoin tweeted on Dec. 31.

Meanwhile, harmony (ONE) and chainlink (LINK) were the biggest winners among alternative cryptocurrencies (altcoins) on Sunday, at the time of writing. Harmony is the native token of smart contract platform Harmony and LINK is an ERC-20 token for decentralized oracle network Chainlink.

Column

How Brands Can Build in the Metaverse: Cathy Hackl, aka “the Godmother of the Metaverse,” on how crypto-oriented virtual worlds can be useful for marketers. (By Jeff Wilser)

Clinique had a problem. The brand wanted to “enter the metaverse,” but it didn’t want to do it in a way that was cringey. So, they called a woman named Cathy Hackl: The “Godmother of the Metaverse.”

Her credentials? Hackl, the “Chief Metaverse Officer” of Futures Intelligence Group, has worked in metaverse-related fields for nearly a decade – or basically since the dawn of meta-time.

This post is part of Crypto 2022: Culture Week.

Just ask Steven Spielberg. When filming “Ready Player One,” Spielberg partnered with the virtual reality headset company HTC Vive, where Hackl served as “VR Evangelist.” At Magic Leap, an augmented reality company, she worked with the man who coined the term metaverse, Neal Stephenson. And over a year before the current craze, she wrote articles for Forbes like “The Metaverse Is Coming And It’s A Very Big Deal.”

It was such a big deal that Hackl left a cushy job at Amazon Web Services to “take a big bet on the metaverse.” Now she advises brands – like Clinique – on how to position themselves in this strange new space. (Her work with Clinique fetched a glowing write-up from Vogue business.)

The Godmother shares why the metaverse is larger than perhaps the crypto crowd realizes, why avatars are fast becoming “emotional surrogates of ourselves,” and how in the future, “every company is going to need a metaverse strategy.”

CoinDesk: The term “metaverse” can mean 10 different things to 10 different people – even inside the crypto space. When you start working with clients, how do you explain it to them?

Cathy Hackl: I usually start from the past. Web 1 connected information, so you got the internet. And did that change anything for your brand? It probably did. Web 2 connected people and you got social media, the sharing economy. Did that change anything for your brand? Of course it did, right?

CoinDesk: Right.

Hackl: And now we’re in the evolution of Web 2 going into Web 3. And Web 3, it connects people, places, and things – or people, spaces and assets. And those people, spaces and assets can sometimes be in a fully virtual environment, like most people tend to think.

Read more: Play-to-Earn Is Already the Biggest Star in the Metaverse – Jeff Wilser

But it’s also going to be in our real world with some level of augmentation, probably through a wearable. So, Web 3 is kind of enabling the creation of the metaverse, and the metaverse is a convergence of physical and digital. Think of it as the successor of what comes next on the internet. It’s like your digital lifestyle catching up to your physical life.

CoinDesk: That’s a pretty expansive view. So, it includes not just blockchain projects, like Decentraland, but also augmented reality from traditional platforms?

Hackl: Yeah. Even Snapchat, the things that they can do with the camera for augmented reality – that’s a metaverse play. That’s all part of the metaverse. I have a pretty expansive view, and part of that comes from working in VR [virtual reality] hardware, spatial computing and augmented reality hardware. And when people think the metaverse is only virtual reality, or only fully immersive, I think that’s a pretty narrow view. And a pretty dystopic one.

CoinDesk: With that wide of a definition, I’m guessing the blockchain metaverse projects are only a small slice of the overall “metaverse pie”?

Hackl: It is small, but it’s ever increasing. You’ve got SoftBank leading the investment for $93 million in a Series B [for The Sandbox]. Upland just raised $18 million, I believe, with a $300 million valuation. You’ve got a lot of these blockchain projects – like NFT [non-fungible token] gaming metaverses – growing really fast.

CoinDesk: How does blockchain fit into your vision for the metaverse?

Hackl: You cannot enable the open decentralized metaverse that many of us dream of without blockchain, right? Blockchain is the underlying component. NFTs are a bit of a stepping-stone into the metaverse when it comes to ownership of digital assets and digital identity. How do you actually enable that? NFTs are a big part of that equation.

CoinDesk: What’s the biggest potential for brands?

Hackl: One of the big things that I try to explore is, “Is direct-to-avatar the next direct-to-consumer?” Again, it’s stepping-stones. When we text people we use emojis; we don’t even write anymore. We use an emoji to represent a message. Our emojis – and by extension our avatars – are becoming emotional surrogates of ourselves.

In order to represent yourself as an avatar, that’s a big thing. Because it’s a moment of self-expression, it’s a moment of self-exploration. And how do brands play into that? Well, I’m going to have to outfit my avatar. Maybe I want to make a statement and wear Supreme. Fashion and culture go together. How does your avatar show up, right? What does it look like, what does it wear? There are going to be a lot of opportunities for brands. And there will be opportunities for them to engage with the younger generation.

I can see how it’s obvious for some brands – especially in wearables and fashion – to get involved in the avatar game. But how about for less obvious brands? I mean, how does a food company make a metaverse play?

This post is part of Crypto 2022: Culture Week.

Well, people are saying that Chipotle caused the [Roblox] outage. (Of course they didn’t cause the outage – let’s get that straight.) But a brand like Chipotle can come in and say, “We’re going to do a burrito, and we’re going to give away $1 million worth of burritos in the game.” I think those types of things are interesting and fun, and the audience is engaged, they enjoyed it.

CoinDesk: What do you see as some of the biggest obstacles that need to be overcome for the metaverse to become more mainstream?

Hackl: There are a lot of things that need to happen. If you look at how many people actually have [digital] wallets, it’s actually a very small number. And it’s a generational thing. My kids understand digital ownership in a way that maybe older generations don’t. They love buying digital assets and their skins. Once my kids get older, they’re going to question, “Why can’t I take this asset that I paid so much money for in Roblox, and move it over to Fortnite?” Eventually they’re going to expect that.

CoinDesk: And that leads to more of an appreciation for NFTs and a desire for open worlds, got it. What else is needed for the metaverse to take off?

Hackl: There will be a serious need for computing power. And right now, obviously you’ve got supply chain issues related to chips, so that might slow things down.

There also needs to be a lot of education within organizations – and not just the brand team – to understand where this is headed. And for companies, there’s already a talent war so it’s hard to hire people. When you realize that every company is going to need a metaverse strategy, then hiring is going to get even harder. That’s why I partnered with Republic Realm to create the Republic Realm Academy, for executive education.

CoinDesk: How does Facebook fit into all of this? What’s your reaction to Zuckerberg’s meta play?

Hackl: I take the good with the bad. I mean, it is a validation of the work that many of us have been doing for years. So, I’ll take that. On the other side, with Facebook being so literal with the name “meta,” it does cast a bit of doubt and shadow on the metaverse. The big thing is confusion – people thinking the metaverse is Facebook. It is not.

I was at an event having breakfast with some speakers. I sat down, and someone asked me what I do. I said, “I do metaverse strategies.” And they said, “Isn’t that Facebook?”

Read More: Note to Brands: Crypto Isn’t Funny Money. It’s Community

CoinDesk: No!

Hackl: [Laughs.] Yeah. So, I think there is that level of confusion. I don’t know how many people read the news that Facebook rebranded to meta, and they learned the word because of that.

CoinDesk: How many years until we get to a “Ready Player One”-style metaverse?

Hackl: First of all, I will say “The Oasis” [the fully immersive platform in “Ready Player One”] is not what we should aim for. That’s pretty dystopic, where the real world has gone to s**t, and you have to escape reality. [Laughs.] I don’t want to escape reality, but I want the metaverse to be somewhere fun when I want to have fun – instead of Instagram.

CoinDesk: So how long until we get there?

Hackl: I don’t think anyone can put a time or date, but I will say that this decade is a decade of building and pioneering. We’re all testing, trying to understand how it all works. This is the decade where those foundations are created. It’s a time of change and a time for creators. Now is the time to build. Now is when you start to figure out, what does this mean? Where are we going? And what does our company or brand have to do to be prepared for the future?

Important events

9 a.m HK/SGT (1 p.m UTC) Italy November unemployment (previous 9.4%)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

SEC Commissioner Peirce on 2022 Outlook for Stablecoins, NFTs, Bitcoin ETFs, New Legislation and More

Securities and Exchange Commission (SEC) Commissioner Hester Peirce joined “First Mover” to discuss a wide range of topics affecting the crypto industry and markets in 2022. That includes the future of stablecoins, the prospects for a U.S. bitcoin ETF, regulatory concerns around NFTs, and the status of Peirce’s Safe Harbor proposal. Also, a look back at top NFT stories that helped drive mainstream crypto adoption in 2021.

Latest headlines

Shiba Inu Launches Beta Version of DAO to Give Users More Authority Over Crypto Projects The Dogecoin rival is aiming to provide its users with more control over crypto projects and pairs on the ShibaSwap platform.

Half a Dozen of India’s Crypto Exchanges Searched After Alleged Rupee 700M Tax Evasion Detected: Sources The sources said the searches were initiated after a Mumbai tax authority recovered funds from crypto exchange WazirX.

Grayscale Holds $43B in Crypto Assets Under Management, Down From $60.9B in Early November Grayscale Bitcoin Trust and Ethereum Trust AUM have dropped 30% and 22%, respectively over this time period.

Today’s crypto explainer: Cardano vs. Ethereum: Can Ada Solve Ether’s Problems?