Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin fell as U.S. stocks sagged and the U.S. dollar strengthened.

Technician’s take: Buying activity remains weak, which reduces the chance of a significant price rise into January.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $48,123 -4.7%

Ether (ETH): $4,183 -5.3%

Markets

S&P 500: $4,667 -0.7%

Dow Jones Industrial Average: $35,754 -0.0001%

Nasdaq: $15,517 -1.7%

Gold: $1,775 -0.4%

Market moves

Bitcoin fell toward $48,000 on Thursday, sliding nearly 5% after hovering over $50,000 for much of the previous two days.

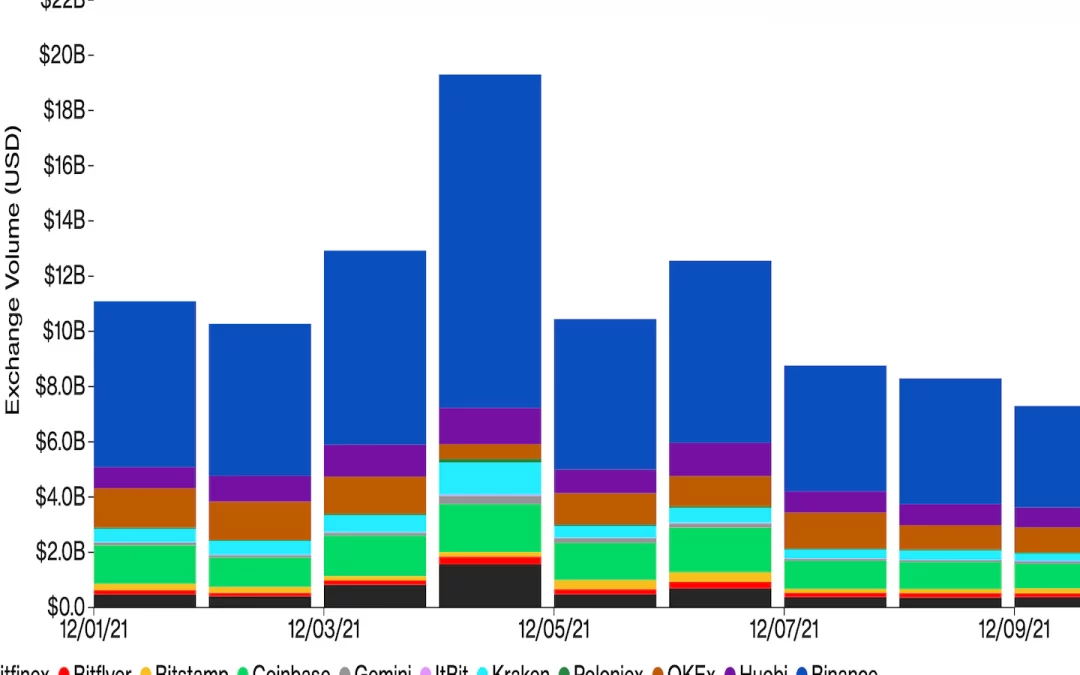

Trading volume of the No.1 cryptocurrency by market capitalization across major centralized exchanges, however, continued to drop.

The majority of the crypto market was also in red: Ether was down by more than 5% to around $4,000. The bearish market performance occurred as U.S. stocks fell and the dollar index (DXY), which tracks the greenback’s value against major fiat currencies, rose by 0.28%.

As CoinDesk reported, a strengthened U.S. dollar brings downside pressure on bitcoin’s prices.

“The long-term bull case remains for bitcoin, but everything in the short-term seems bearish,” Edward Moya, senior market analyst at Oanda, said in an email. “Bitcoin will need to overcome growing expectations for a stronger dollar, an extended altcoin season and short-term bearishness for risk assets as Omicron derails reopening momentum.”

Technician’s take

Bitcoin Drops Below $50K; Support Between $43K-$45K

Bitcoin (BTC) continued to struggle below the $50,000 resistance level.

The short-term downtrend over the past month remains in effect, which could limit further upside beyond $50,000-$60,000.

The cryptocurrency is down about 4% over the past 24 hours, although support around the 200-day moving average (currently at $46,500) could stabilize the current pullback.

BTC buying activity remains weak despite several oversold signals on the charts. That reduces the chance of a significant price increase heading into January, especially given the loss of upside momentum on the weekly and monthly charts.

Important events

3 p.m. HKT/SGT (7 a.m. UTC): U.K. trade balance (Oct.)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. industrial production (Oct. YoY/MoM)

3 p.m. HKT/SGT (7 a.m. UTC): Germany consumer price index (Nov. YoY/MoM)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. consumer price index (Nov. YoY/MoM)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Crypto CEOs Defend Industry as Congress Weighs Regulation, Terraform Labs Co-founder and CEO Do Kwon on Future Plans

“First Mover” hosts spoke with CoinDesk’s managing editor for global policy and regulation, Nikhilesh De, on the key takeaways from Wednesday’s hearing where House Financial Services Committee members questioned crypto executives. Terraform Labs co-founder and CEO Do Kwon was named ranked in the top 10 of CoinDesk’s Most Influential list this year. Kwon explained the plans for his company. Plus, “First Mover” covered market insights from Ava Labs President John Wu and the latest development from the Polygon network.

Latest headlines

Bitcoin Hashrate Approaches Full Recovery From China Crackdown: Mining difficulty is likely to increase this weekend as capacity recovers, but given the recent record-high bitcoin prices, that won’t discourage miners.

Polygon Acquires Ethereum Scaling Startup Mir for $400M in MATIC: The Ethereum scaling network is undertaking another big-budget buy.

Meta’s WhatsApp to Trial Novi Digital Wallet: The move comes two months after Novi’s first pilot launched.

Crypto Derivative Firm Paradigm Raises $35M From Jump Capital, Alameda Ventures, Others: More than 25 investors participated in the round, including Dragonfly Capital, Digital Currency Group and Vectr Fintech Partners.

Pantone ‘Color of the Year’ Gets the NFT Treatment: Tezos nabbed Ubisoft yesterday, now Pantone. How will XTZ react?

Longer reads

Bitcoin’s Lost Coins Are Worth the Price: And the network’s core principles are invaluable.

The Three Types of Crypto Investors: Advisors should know the different types of clients they’ll encounter who might want to invest in crypto and understand their particular goals and needs.

CoinDesk Most Influential 2021: 50 people who defined the year in crypto.

Most Influential 2021: Elon Musk: The impresario runs hot and cold on crypto, confusing fans and detractors alike. But his market influence is undeniable.

Addressing Clients’ Fear, Uncertainty and Doubt (FUD) About Bitcoin: Why three popular investor fears about bitcoin are overblown.

Today’s crypto explainer: What Is a Bitcoin Futures ETF?

Other voices: Why have prices of cryptocurrencies, such as bitcoin, fallen—again? (The Economist)