Good morning. Here’s what’s happening this morning:

Market moves: Investors bought up bitcoin quickly after Saturday’s sharp sell-off. Trading volume spiked on Saturday, although by Sunday it had leveled off as traders await Monday’s opening of equity markets.

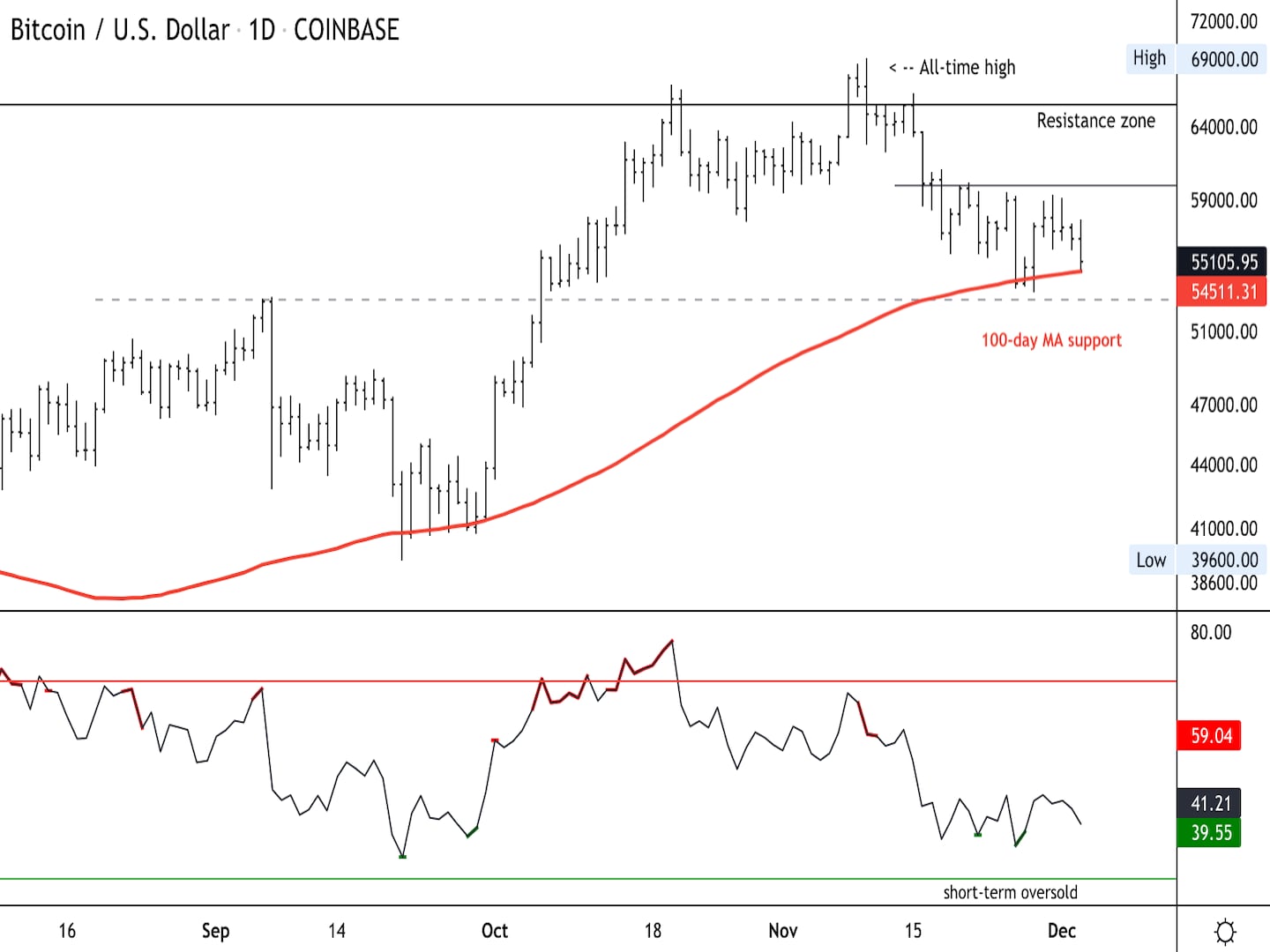

Technician’s take: BTC buying has been weak despite short-term oversold signals. ETH is also taking a breather and has not yet confirmed a breakout relative to bitcoin.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $49,179 +0.2%

Ether (ETH): $4,153 +1.4%

Markets

S&P 500: $4,538 -0.8%

Dow Jones Industrial Average: $34,580 -0.1%

Nasdaq: $15,085 -1.9%

Gold: $1,784 +.06%

Market moves

Bitcoin slowly recovered to the $49,000 level over the weekend after dropping nearly $10,000 in roughly an hour to as low as around $42,000 early Saturday. The precipitous decline came in response to a broader sell-off across financial markets, which have been spooked by the omicron coronavirus variant.

Saturday’s sudden decline marks bitcoin’s biggest price drop since a May sell-off when bitcoin slumped from over $43,000 to under $32,000 over a 24-hour period, a nearly 27% decline.

The trading volume of roughly $20 billion on Saturday across 11 major centralized exchanges reached an unprecedented level, according to data compiled by CoinDesk, although by Sunday the volume had dropped sharply as traders and investors await the opening of traditional markets.

But unlike the aftermath of the May drop, investors this time have bought up bitcoin quickly. Some, including El Salvador, announced that they have bought “the dip” following the price slump. At the time of publication, bitcoin was trading at $49,179, 0.2% in the past 24 hours, according to CoinDesk data. Ether was at $4,153, up 1.4%.

Other cryptocurrencies also fell sharply on Saturday. But many of these altcoins, led by ether, have been showing more resilience compared to bitcoin. Over the past week, ether’s price was down 3.7% versus bitcoin’s 14.6% drop-off. How cryptos perform in the days ahead is difficult to predict.

Technician’s take

Bitcoin Drops Below $56K as Momentum Slows, Support at $53K

Prior to early Saturday’s massive sell-off, Bitcoin (BTC) sellers were active the previous day, pushing the cryptocurrency toward the bottom of its weeklong price range. Lower support at about $53,000 could stabilize the current pullback.

Upside momentum was starting to slow on the daily and weekly price charts, which means upside could be limited toward $60,000 resistance. For now, the intermediate-term uptrend remains intact given the upward sloping 100-day moving average.

Further, the relative strength index (RSI) on the daily chart was just below neutral territory, although buying was weak following an oversold reading on Nov. 26.

Also, on a relative basis, ether was poised to outperform bitcoin if a breakout above 0.08 in the ETH/BTC ratio is confirmed next week. Charts still show significant resistance, which preceded downturns in ETH/BTC during the 2018 crypto bear market.

How all of the above evolves remains to be seen once equity markets that have been jittery as the omicron variant of the COVID-19 virus spreads globally reopen on Monday.

Important events

8 a.m. HKT/SGT (12 a.m. UTC): Australia TD Securities inflation (Nov. MoM/YoY)

3 p.m. HKT/SGT (7 a.m. UTC): Germany Deutsche Bank factory orders (Oct. MoM/YoY)

5 p.m. HKT/SGT (9 a.m. UTC): Italy National Institute of Statistics retail sales (Oct. MoM/YoY

7:30 p.m. HKT/SGT (11:30 a.m. UTC): Speech by Ben Broadbent, Bank of England deputy governor for monetary policy

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

US Job Growth Disappoints in November While Omicron COVID-19 Variant Now Detected in 5 States, Messari CEO Reflects on the Year in Crypto and More

“First Mover” hosts spoke with Messari CEO Ryan Selkis for his view on the crypto space in the year 2021 as well as the outlook for 2022 after his firm released its annual “Crypto Theses.” Bitcoin was rangebound. Horizon Fintex President Mark Elenowitz shared his market insights. Plus, what’s the Indian government’s plan with crypto regulation, and how does that impact its own CBDC rollout? WazirX CEO Nischal Shetty shared his take.

Latest headlines

How Bitcoin Set Itself Up for This Sell-Off: Conditions like what we had over the past few weeks usually set the stage for a big move in one direction or the other.

Crypto Exchange Bitmart Hacked With Losses Estimated at $196M: Bitmart’s CEO has confirmed what the company is calling a “security breach.”

FTX to Seek $1.5B in New Funding Round at $32B Valuation: Report: The company’s CEO Sam Bankman-Fried will ask investors to purchase shares in its U.S. affiliate, FTX.US, at an $8 billion valuation.

Crypto Lender Celsius Admits Losses in $120M BadgerDAO Hack: However, the company didn’t specify the amount it lost.

Blockchain.com to Introduce NFT Marketplace as Interest Booms: The company has opened a waiting list for the new platform, which will allow users to buy, sell and store NFTs.

Longer reads

Universal Stablecoins, the End of Cash and CBDCs: 5 Predictions for the Future of Money: Decentralized and centralized finance will blur together, El Salvador will be a reality check, and cash and CBDCs will fade away.

Jack Dorsey Takes Square Deep Down the Bitcoin Rabbit Hole: The payments giant’s name change to Block caps off a transformational year.

Ethereum in 2022: What Is Money in the Metaverse?: DeFi, NFTs, stablecoins – most of it started on Ethereum. What about next year? This post is part of CoinDesk’s Future of Money Week.

Today’s crypto explainer: How to Set Up a Bitcoin Miner

Other voices: A Normie’s Guide to Becoming a Crypto Person (New York Magazine)