Good morning. Here’s what’s happening:

Market moves: Bitcoin led crypto’s small recovery from last week’s sell-off, but spot volume remained thin over the weekend.

Technician’s take: BTC upside is limited as long-term technical indicators turned negative.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $41,845 +0.1%

Ether (ETH): $3,154 +2.0%

Markets

S&P 500: $4,677 -0.4%

DJIA: $36,231 -0.01%

Nasdaq: $14.935 -0.9%

Gold: $1,796 +0.2%

Market moves

Bitcoin pushed past the $42,000 level over the weekend, after last week’s broad market bloodbath, which sent the No. 1 cryptocurrency by market capitalization spiraling toward $40,000 from about $48,000. At the time of publication, ether and most of the altcoins in CoinDesk’s top 20 by market capitalization were up significantly, although still way down over the past week.

Bitcoin and most other cryptocurrencies fell last week amid the Federal Reserve’s release of minutes from its December meeting. The Fed signaled that it would tighten monetary policy faster than was once expected.

The leading cryptocurrency fell to as low as $40,505.3 on Coinbase on Saturday, its lowest level since Sept. 21, before it rebounded above $42,000, data from TradingView and Coinbase show.

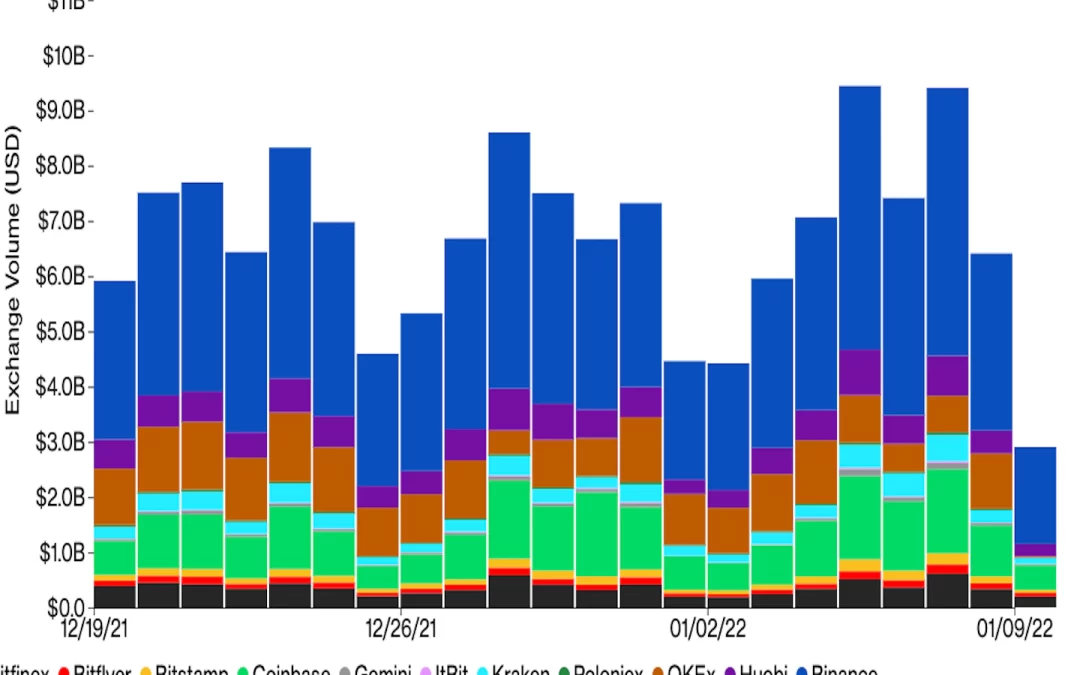

But as markets in Asia open, it remains uncertain whether the recovery will last since bitcoin’s spot trading volume across major centralized exchanges on Sunday was thin, according to data compiled by CoinDesk.

Bitcoin fell for six straight days before the weekend and the downward move escalated after the Fed minutes showed that policymakers discussed aggressive interest rate hikes and a faster pace to normalize its balance sheet.

“The minutes confirmed a strong hawkish bias with markets now pricing in a 90% chance of a Fed [rate] hike in March,” Singapore-based crypto quant trading firm QCP Capital wrote in its Telegram channel on Sunday. “…In the bigger picture, it seems likely that the all-time highs in BTC and ETH will remain capped for most of 2022 as a result of central bank tightening.”

Technician’s take

Bitcoin Oversold Within Downtrend; Resistance at $45K

Bitcoin (BTC) remains in a two-month long downtrend, defined by a series of lower price highs.

The cryptocurrency was down about 9% over the past week as upside momentum continued to slow.

There is minor support around $40,000, which could stabilize the current pullback. However, upside appears limited around the $45,000 resistance level. This means buyers could quickly take profits if a price bounce occurs.

The relative strength index (RSI) on the daily chart is the most oversold since Dec.11, albeit within a price downtrend.

Over the long-term, BTC is vulnerable to further selling, especially if buyers fail to hold the $38,000-$40,000 support zone over the weekend. On the weekly chart, the RSI is not yet oversold, which suggests the downtrend remains intact.

Lower support is around $28,000, which is near the June 2021 low.

BTC is roughly two weeks away from registering a downside exhaustion signal, which typically precedes a countertrend price bounce. Still, similar oversold readings on the daily chart have been delayed as buyers remain on the sidelines.

Important events

Australia TD securities inflation (Dec. MoM/YoY)

China new loans (Dec.)

8:30 a.m. HGT/SGT (12:30 a.m. UTC) Australia building permits (Nov. MoM/YoY)

3 p.m. HGT/SGT (7 a.m. UTC) China M2 money supply (Dec. YoY)

5:30 p.m. HGT/SGT (9:30 a.m. UTC) Eurozone Sentix consumer confidence (Jan.)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

US Economy Added Fewer Jobs in December Than Expected, Paul Brody on Why He Thinks 2022 Is the Year of Ethereum and More

“First Mover” hosts spoke with Ernst & Young Principal & Global Innovation Leader Paul Brody about his outlook for Ethereum in 2022 and some of the key issues that need to be addressed. Looking at the markets, the U.S. economy added 199K jobs last month, fewer than expected. Ben McMillan, CIO of IDX Digital Assets, shared his view on the crypto markets and the impact of macro factors. Plus, Open Earth Foundation Executive Director Martin Wainstein shared insights into using NFT art to help tackle climate change.

Latest headlines

India’s Central Bank Creates Fintech Department as Challenges Posed by Crypto, CBDC Grow: According to an internal document viewed by CoinDesk, the upgrading of the unit into its own department is aimed at promoting innovation in the sector.

Industry Body for Indian Startups Seeks Crypto Rules in Coming Budget Session of Parliament: The development comes a few days after news broke that tax agencies “inspected” offices of five major cryptocurrency exchanges in the country and “recovered” over Rs 84 crore ($11 million).

Binance.US Is Building an Office in the Solana Metaverse: Several crypto companies are setting up shop in Portals.

PayPal Is Exploring Creating Its Own Stablecoin as Crypto Business Grows: Hidden code in the company’s iPhone app shows that a potential “PayPal Coin” would be backed by the U.S. dollar.

Bitcoin Falls Toward $40K, Racks Up Longest Losing Streak Since 2018: Cryptocurrency analysts had warned of the possibility of a steeper sell-off, and now traders are wondering when and where the market shakeout might end.

JPMorgan Sees More Crypto Adoption in 2022, Debates Bitcoin’s Status as Store of Value: The investment bank also continues to rate crypto exchange Coinbase as a buy.

Longer reads

The Inside Story of How India’s Crypto Exchanges Were ‘Inspected’ by Tax Agencies: Two agencies, five months, five crypto exchanges, 100-plus officers, more than Rs 700 million in tax recovery, and yet the scale of the misdemeanor, excused by “ambiguity,” remains unknown.

Today’s crypto explainer: Ethereum Nodes and Clients: A Complete Guide

Other voices: The New Get-Rich-Faster Job in Silicon Valley: Crypto Start-Ups (The New York Times)

Said and heard

“Even more than in equities, Warren Buffett’s timeless advice applies: Be fearful when others are greedy, and greedy when others are fearful.” (CoinDesk columnist David Morris)...”I look at the DAO space and definitely can see how tokens, governance systems, cross-border and trustless relationships can help with executing completely legitimate causes (like ConstitutionDAO). I also believe this may be the right path towards more complex and perhaps legally self-sufficient constructions. But we’re not there yet. (ATH21 CEO Cristina Carrascosa in a CoinDesk op-ed)…”Policymakers should think holistically about three realities. One is that climate change is not going away. The other is that Bitcoin is not going away. The third is that Bitcoin’s geography-agnostic miners are highly adaptable and will continue to seek out the most cost-effective energy sources anywhere and anyhow.” (CoinDesk Chief Content Officer Michael Casey)