Major financial services firm Fidelity International will be listing a Bitcoin exchange-traded product on the SIX Swiss Exchange and Germany’s Xetra digital stock exchange.

According to a Tuesday announcement from Deutsche Boerse, a physical Bitcoin exchange-traded product, or ETP, from Fidelity International is now available for trading on the Deutsche Boerse Xetra and Frankfurt Stock Exchange under the ticker FBTC. In addition, the company reportedly said it planned to have the crypto investment vehicle listed on the SIX Swiss Exchange in the coming weeks.

Fidelity Digital Assets will act as the custodian for the physically-backed Bitcoin (BTC) ETP, which will be centrally cleared with global exchange Eurex Clearing. The ETP has a total expense ratio of 0.75%.

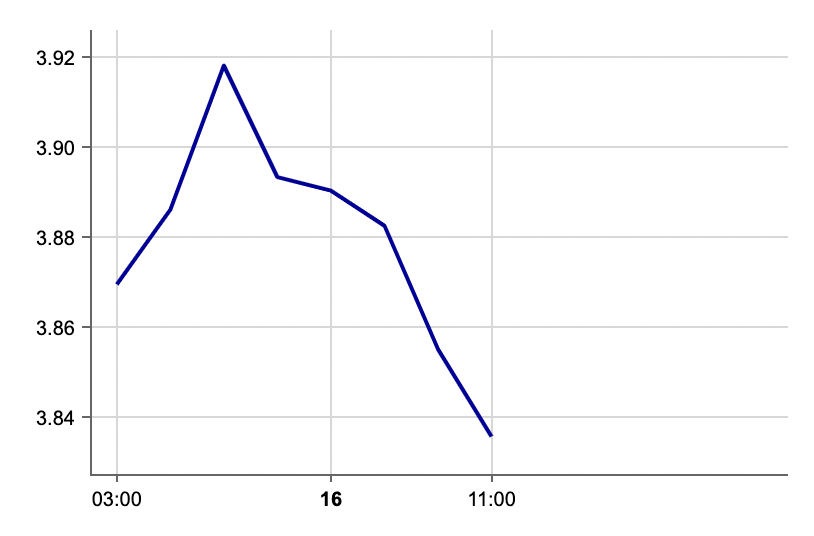

At the time of publication, FBTC was trading for roughly 3.83 euros, or $4.36, on both the Xetra and Frankfurt Stock Exchange. The price of Bitcoin is currently $43,590, having briefly risen to more than $45,000 on Thursday.

The Xetra digital stock exchange currently offers exposure to cryptocurrencies including BTC, Bitcoin Cash (BCH), Ether (ETH), Litecoin (LTC), Cardano (ADA), Solana (SOL), Stellar (XLM), Tezos (XTZ) and Tron (TRX) through exchange-traded products and notes. In November, asset manager Invesco announced it had listed a BTC ETP on the exchange under the ticker symbol BTIC.

Launched in 1969 as a subsidiary of the U.S.-based firm Fidelity Investments, Fidelity International had more than $812 billion in assets under management as of Dec. 31, 2021. The firm has previously invested in crypto-related firms across the globe including the Hong Kong-based BC Group.

While Fidelity International listed an ETP with exposure to crypto in Europe, its U.S. parent company still has applications under consideration by the Securities and Exchange Commission. The regulator rejected Fidelity’s Wise Origin Bitcoin Trust spot ETF in January.