The U.S. Federal Reserve announced plans to taper its $120-billion-a-month of asset purchases, taking the first step toward winding down a crucial post-coronavirus money-printing program that has inspired many investors to buy bitcoin as an inflation hedge.

The Fed said Wednesday in a statement that it would reduce the pace of asset purchases by $15 billion a month, starting in November. Purchases of U.S. Treasuries will drop to $70 billion a month from $80 billion, while purchases of government-backed mortgage bonds will decline to $35 billion a month from $40 billion.

Under the plan, the monthly asset purchases would continue to taper by $15 billion every month henceforth, so that the program would conclude altogether by the middle of next year.

“The committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook,” the Fed’s monetary policy committee, known as the Federal Open Market Committee, or FOMC, said in the statement.

The asset purchases – a form of stimulus funded by newly created money, known as “quantitative easing,” or QE – have helped to more than double the size of the Fed’s balance sheet since March 2020, to about $8.6 trillion as of last week.

The U.S. central bank left interest rates unchanged close to 0%, but a growing number of analysts in traditional markets are predicting the Fed might have to start hiking the benchmark rate after that soon afterward – to tamp down inflation at a time when U.S. consumer prices are rising at a clip not seen on a sustained basis in three decades.

So If the Fed stays the course and tilts hawkish on inflation, bitcoin might look incrementally less attractive as a hedge against dollar debasement, and the cryptocurrency’s price could come under downward pressure similar to the predictions for the stock market.

‘Expected to be transitory’

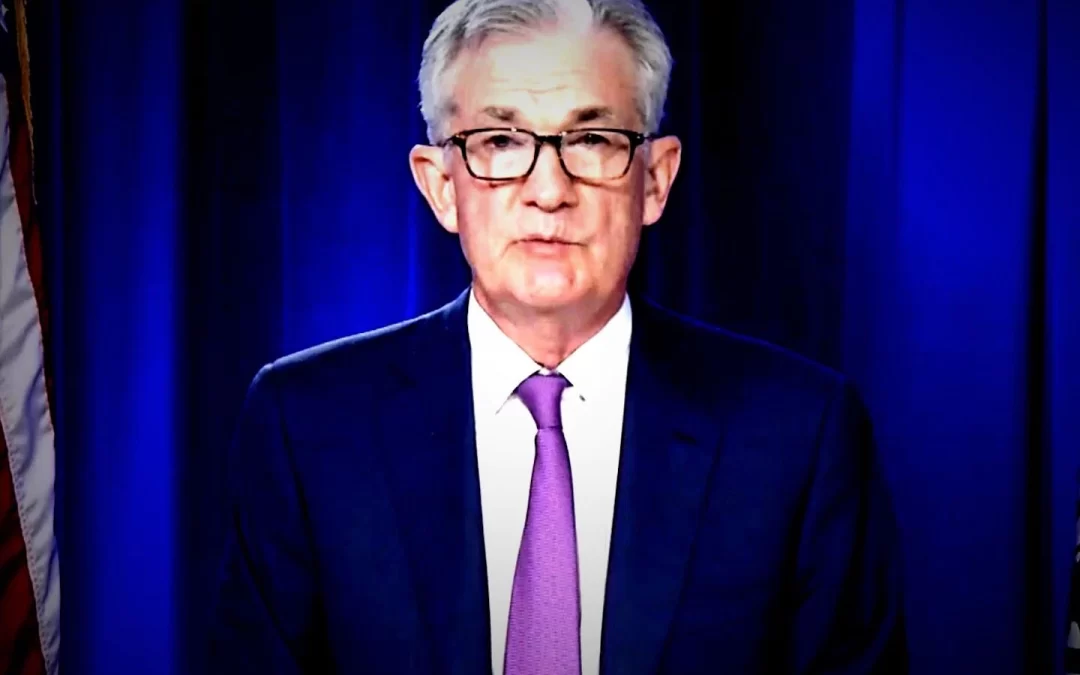

Fed Chair Jerome Powell had signaled during a meeting in September that there was “broad support” to begin tapering of the asset purchases, based on a plan to complete the effort “sometime around the middle of next year, which seems appropriate.”

A growing group of high-profile investors including the legendary hedge fund manager Paul Tudor Jones II and the venture capitalist Peter Thiel have joined many crypto traders in betting that bitcoin can be effective as a hedge against inflation. That’s mainly due to the limits on new supplies of bitcoin, as hard-coded into the 12-year-old blockchain’s underlying programming.

Analysts for the big U.S. bank JPMorgan wrote recently that more investors are seeing the cryptocurrency as an inflation hedge.

But bitcoin also has often been highly correlated with U.S. stocks, which can come under downward pressure when the Fed tightens monetary policy – since higher borrowing costs often translate to higher financing costs for companies, potentially becoming a drag on quarterly profits.

In Wednesday’s statement, the FOMC said it noted that inflation was “elevated” but said the factors behind the consumer price increases were “expected to be transitory.”