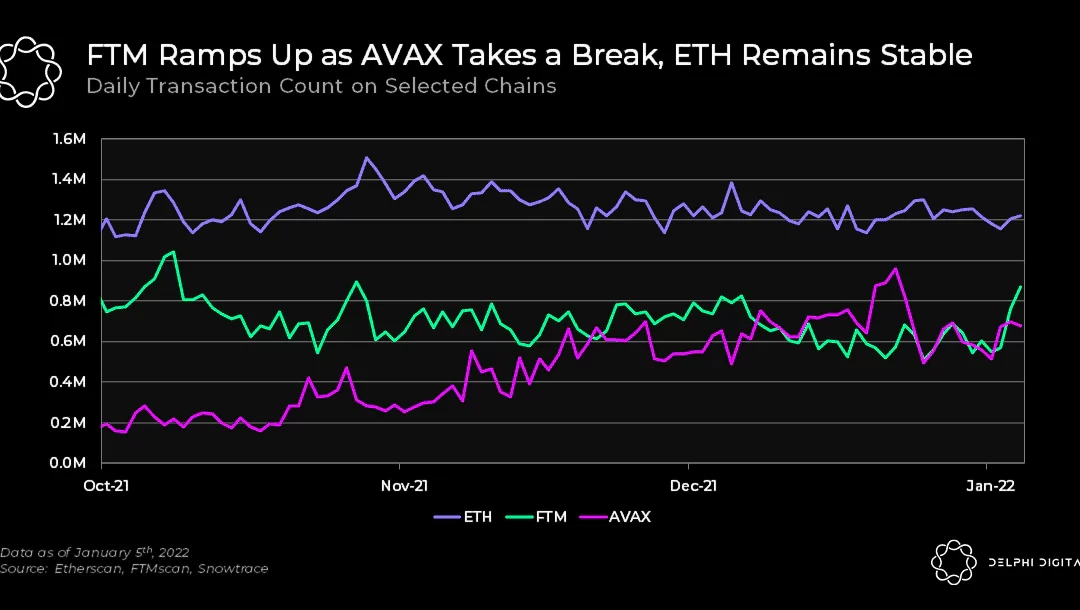

Transactions on emerging layer 1 blockchain Fantom crossed those on Avalanche this week as crypto users looked for the next decentralized finance (DeFi) play. Layer 1 blockchains refer to individual blockchain platforms, such as Ethereum, Solana or Fantom, which can support products and services built atop their networks.

Over 1 million transactions were processed on the Fantom network compared to 728,000 transactions on Avalanche earlier this week, research from Delphi Digital found. Such transactional activity on Fantom was previously seen in September 2021, data from blockchain trackers show.

“As the narrative rotates from Avalanche to Fantom, it’s not surprising to see it reflected in transactions. Opportunistic capital moved over to yield farm on Fantom with high yields on stablecoins of around ~30-60% APR,” Delphi Digital analysts said in the note.

Both networks have processed over 853,000 transactions in the past 24 hours, with the surge in Fantom mainly driven by upcoming DeFi projects and users interacting with current ones.

Interest in Fantom saw a bump as Daniele Sestagalli and Andre Cronje, developers known for launching protocols on Ethereum, Avalanche and Fantom that lock billions of dollars in value, announced a collaboration on an upcoming project that will deploy on Fantom.

Some say the announcement has contributed to a shift in focus on Fantom.

“The news of collaboration on an upcoming project that will use Fantom as the foundation for multi-chain deployment with a new token model quickly shifted the L1 narrative away from other Layer-1s such as Avalanche, and toward new Fantom project launches,” Yun Heng Lin, special projects analyst at Delphi Digital, told CoinDesk in an email.

“Hundred Finance is a new project on Fantom that has recently received a lot of attention, and it is leveraging the now-popular ve-token model with high stablecoin yields of up to 30% APY. This, in turn, generated a lot of hype and speculation, as evidenced by Fantom surpassing Avalanche in daily transaction count,” he added.

DeFi emerges on other networks

Blockchains like Solana (SOL), Avalanche (AVAX), Terra (LUNA) and Fantom (FTM), have witnessed growth in both their native tokens and value locked on DeFi protocols in the past few months as industry participants sought DeFi opportunities away from Ethereum.

DeFi activity on Avalanche saw seen a multifold increase last year as projects after projects like decentralized money market Wonderland and decentralized exchange Trader Joe grew in popularity.

Total value locked (TVL) on the Avalanche network grew to as high as $13 billion in December 2021 from $72 million in February 2021, making it the fourth-largest DeFi network in the world by TVL.

But the likes of Fantom are catching up.

Fantom-based DeFi protocols lock up over $6 billion as of Friday, up from a mere $2.9 million in April 2021. A bulk of the value is locked up on cross-chain exchange Multichain and decentralized exchange SpookySwap, which together account for nearly $4 billion of the TVL.

Future projects are expected to see even more inflows of funds into the Fantom market.

“Felix, Fantom’s Binance-powered hybrid exchange will ship early Q1 2022 and provide retail entry into Fantom’s ecosystem, and the Fantom Virtual Machine (FVM) upgrade are upcoming catalysts for Fantom,” Delphi’s Yun said.