For the price of one millibit – or a thousandth of a bitcoin – you can buy 700 verge or 1,300 reddcoin. These microcap coins lack bitcoin’s luster, but they do have two things in their favor: there’s a lot of them and they’re ”cheap”. Priced out of being able to afford a whole bitcoin, many first-time investors are setting their sights lower.

Also read: Markets Update: Bitcoin Price Moves Sideways During the Holiday Lull

Expensive Bitcoin or Cheap Altcoins?

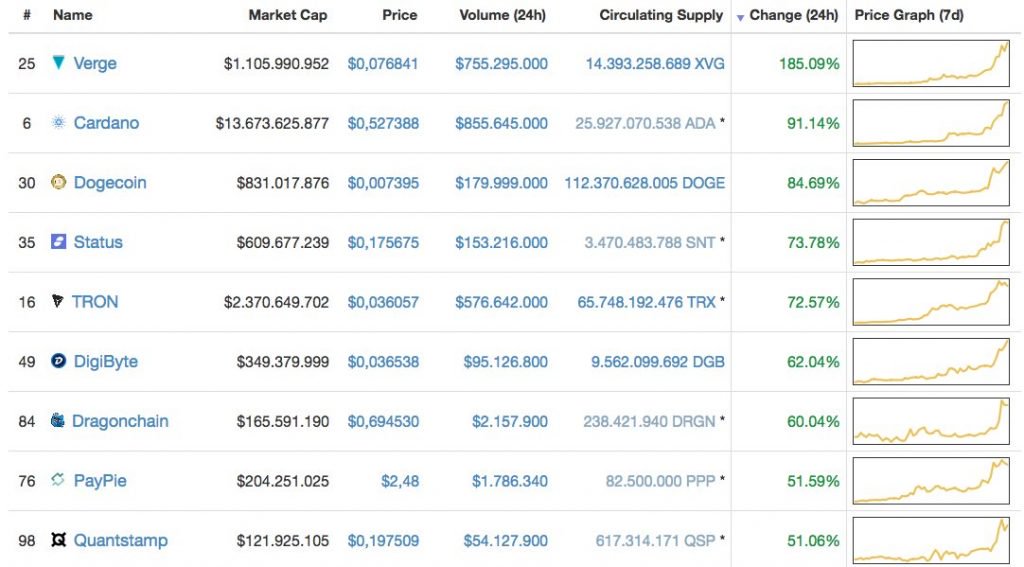

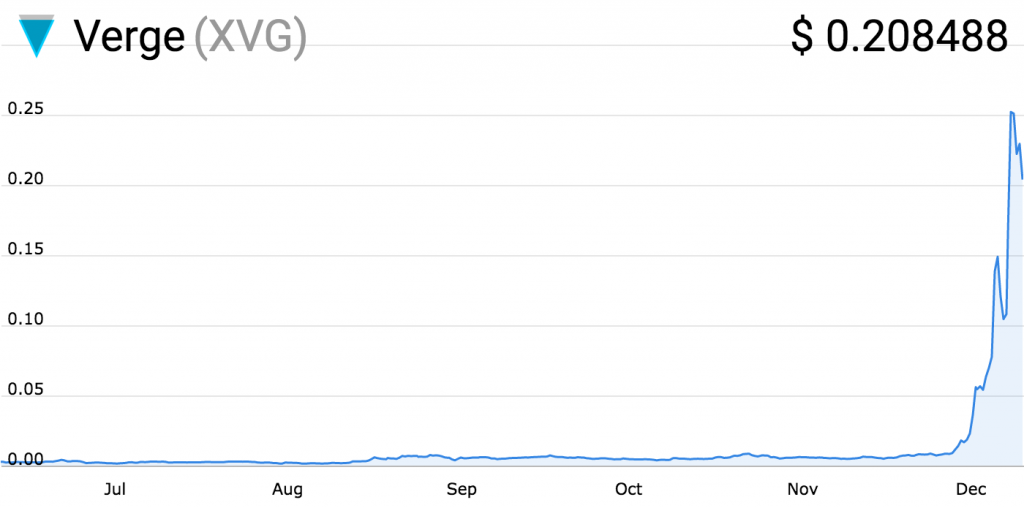

As experienced traders will aver, the best time to buy altcoins is when bitcoin is stagnating. When bitcoin is rocketing or plummeting, the altcoin markets tend to suffer, as money flocks into BTC or back into fiat. In the last few weeks, however, as bitcoin has moved sideways, altcoins have soared. At times, every single cryptocurrency in the top 100, save for bitcoin, has been in the green, as altcoin markets, which have been starved of attention for months, have enjoyed an influx of capital.

Established altcoins such as litecoin and monero have fared well amidst the flood of new money, but it is the smaller priced coins that have benefited the most. The biggest winner this month, up a staggering 3,600%, is verge, but tron (1,600%), and reddcoin (1,450%) have also prospered. What’s telling is that despite their astronomical gains, none of these coins costs more than 4 cents.

Newcomers to the cryptocurrency space are faced with a quandary: to spend months chipping away until they finally acquire a whole bitcoin (assuming it doesn’t rise faster than they can buy) or to snap up a cheap coin and become an instant thousandaire.

“I’m a completist,” one cryptocurrency trader told news.Bitcoin.com. “It actually bugs me seeing fractions of a coin in my Blockfolio [cryptocurrency app]. This might sound silly, but it just looks better seeing hundreds of coins in there. Buying tiny pieces of a bitcoin is quite demoralizing, because you’re spending a lot of dollars, but your BTC balance is barely moving.”

A Wild Doge Appears

Perhaps the biggest indicator that cheap coins are en vogue is the return of doge. It’s had a bumper month, gaining 475%, and is currently the only coin left on Bittrex trading for less than 100 sats. The meme coin has eased past that threshold several times this week, and is currently trading at around 98 sats. Once doge permanently moves into three figures, it will signal the end of cheap coins on major exchanges.

Cheap is the New Expensive

The number of people who own at least one bitcoin is estimated to be less than one million, though the exact number is hard to determine due to the fact that many holdings are stored in pooled exchange wallets. What is indisputable is that the vast majority of cryptocurrency investors will never own a whole bitcoin. The beauty of bitcoin is that it can be divided into 100 million parts, so there’s plenty to go round. For $14, you can own one millibit – or 1,000th of a bitcoin.

The trouble is, no one talks in millibits. Nor do they talk about owning 0.0001 of a bitcoin. Discussing small quantities of bitcoin is downright awkward. Moreover, in cultures that pride themselves on status symbols, particularly in the east, owning a whole bitcoin is something to aspire towards.

Given the security baked into every bitcoin, enforced over the course of half a million blocks, there’s a case for saying that the world’s leading cryptocurrency is fairly valued. In fact many of bitcoin’s proponents believe it to be underpriced. From a psychological perspective, however, having a wallet loaded with 1,000 coins sounds a lot better than one containing .0001. It’s a vanity thing, but it’s also a practical thing, for it’s not just the price of bitcoin that’s turning many would-be investors away: it’s also the price of sending it.

Because a store of value can be transferred just as efficiently using doge or reddcoin, cheap coins are finally starting to provide a tangible use case – even if the end goal is to convert back into bitcoin. Throw in the prospect of ridiculous gains, should your chosen altcoin moon, and it’s no wonder that cheap is the new expensive.

Why do you think sub-$1 coins have been faring so well lately? Let us know in the comments section below.

Images courtesy of Shutterstock, Coinmarketcap and Coincodex.

Need to calculate your bitcoin holdings? Check our tools section.

The post Faced With Never Owning a Whole Bitcoin, Investors Are Turning to Altcoins appeared first on Bitcoin News.