A venture capitalist and Facebook Millionaire is invested in Bitcoin, calls it the ‘Ultimate insurance policy against value destruction.’

Chamath Palihapitiya, an early member of the Facebook team, has publicly reaffirmed his belief in Bitcoin. The venture capitalist, who also owns the Golden State Warriors, is known for investing in Bitcoin, telling Bloomberg as early as 2013 that he’s investing because of the promise of the technology. Later that year, it would come out that he owned $5 million worth of the cryptocurrency, with plans to purchase more.

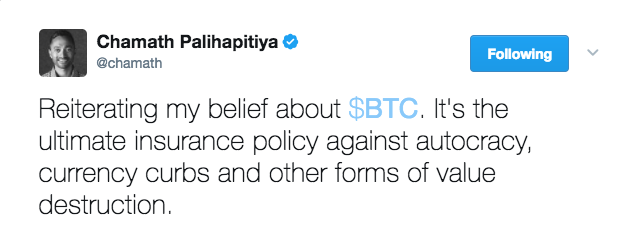

Chamath Palihapitiya on Twitter

As the founder and managing partner of Social Capital, Palihapitiya has devoted significant time, effort, and capital to bring access to high-quality healthcare, education, and financial services to populations outside of the ultra-rich. His recent message about Bitcoin reinforces his position on financial inclusion, that wealth should not be used to exclude individuals from life-enhancing industries.

Palihapitiya has long adopted a spread the wealth mentality, seeing his assets as means to an end, rather than a goal. Of that fortune, he’s said: “That money, while it is with me, should be used as a tool for change and progress. After that, it should be redistributed/reallocated to others who will do the same…” In his words, he’s focused on, “Things that leveled the playing field.”

Social Capital is a venture capital firm focused on technology startups in industries typically neglected by other investors, startups who use technology to tackle global quality of life issues. With the price of Bitcoin skyrocketing beyond all previous benchmarks, consistently breaking all time high records, it comes as no surprise that Chamath is publicly broadcasting his belief in the cryptocurrency and reaffirming the potential for it to have significant global impact.

Due to the secure, decentralized nature of Bitcoin, the cryptocurrency is well positioned to be a platform offering financial security to those without access such as the populations of developing nations, nations with corrupt or unstable fiat currencies, and individuals unable to seek out traditional channels like banks.

When asked why he believes in Bitcoin, as opposed to Ether or any of the other promising altcoins now making headway in the marketplace, Chamath compared the ecosystem to “Coke vs. Pepsi,” saying, “Pick the more mainstream option that more people can easily consume.” And he’s not alone in his belief.

Billionaires’ Bitcoin Binge

Mike Novogratz, billionaire investor, revealed that 10% of his wealth is invested in digital currencies like Bitcoin and Ether, going so far as to say it was the best investment of his life. Not long after Novogratz’s disclosure, Mike Cannon-Brookes, CEO and co-founder of software giant Atlassian, described his investment in Bitcoin is paying out well. More directly, Janus Global Unconstrained Bond Fund manager Bill Gross advised at the tail end of 2016 that Bitcoin is an attractive store of wealth for investors, harping on flaws in the administration of the banking system as a primary cause.

The list of billionaires investing in Bitcoin goes on and on. This widespread interest, serious enough to drive investors to commit significant amounts of capital not only in companies utilizing blockchain technology but in cryptocurrencies themselves, reinforces projections that Bitcoin will continue its bullish trend into the future, landing between $5,000 and $11,000 by 2020.

Featured image from Wikimedia.

Advertisement: