In recent news pertaining to cryptocurrency exchanges, Chicago Mercantile Exchange (CME) has revealed that trading volume on its bitcoin futures markets nearly doubled during Q2; lawyer Jake Chervinsky has predicted that the United States Securities and Exchange Commission (SEC) may postpone its determinations regarding Vaneck’s proposed bitcoin exchange-traded fund (ETF) until March 2019; and Bitmex has set a record for the number of XBT contracts traded on its platform in a single day – with over 1,000,000 XBT contracts exchanging hands in just 24 hours.

Also Read: Markets Update: BTC Gains 30% in Two Weeks, Alts Lose Correlation

CME Reveals 93% Growth in Daily Volume During Q2

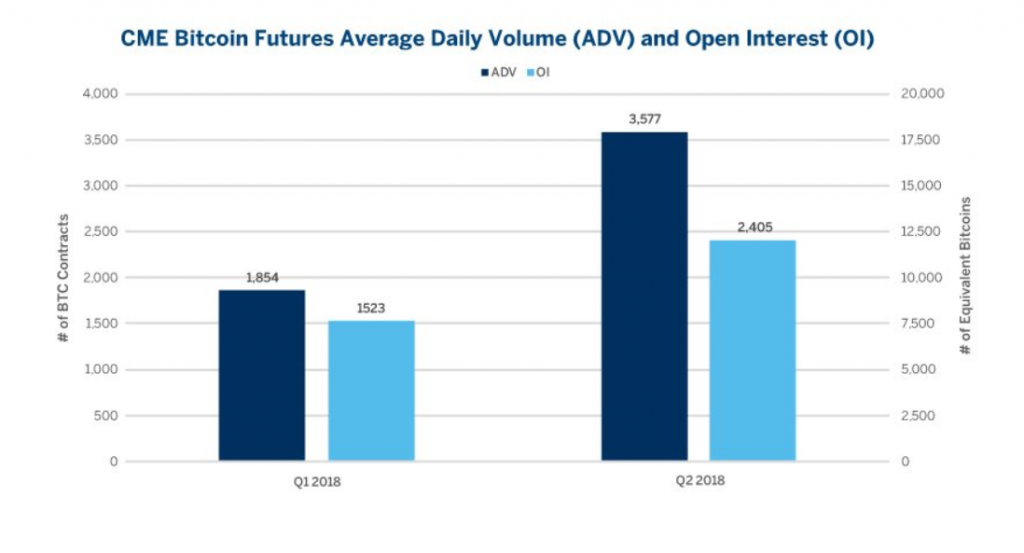

Chicago Mercantile Exchange has announced that trading volume for its bitcoin futures contracts nearly doubled quarter-over-quarter. During Q1 2018, the average daily trading volume for CME bitcoin futures was 1,854 (equivalent to 9,270 BTC), whereas the average daily volume for Q2 was 3,577 (equivalent to 17,885 BTC).

On Twitter, CME Group posted that “Bitcoin futures average daily volume in Q2 grew 93% over [the] previous quarter, while open interest surpassed 2,400 contracts, a 58% increase.”

Lawyer Predicts Vaneck ETF Decision Likely to be Postponed Until March 2019

A Jake Chervinsky, a lawyer who works for Kobre & Kim L.L.P., took to Twitter this week in order vent frustrations with the dominant narrative pertaining to “SEC rulemaking procedures” circulating among cryptocurrency users on Twitter.

A Jake Chervinsky, a lawyer who works for Kobre & Kim L.L.P., took to Twitter this week in order vent frustrations with the dominant narrative pertaining to “SEC rulemaking procedures” circulating among cryptocurrency users on Twitter.

Mr. Chervinsky asserts that “The timing of the ETF approval process follows a standard formula: the ETF files a “proposed rule change” with the SEC; the SEC posts notice of the filing in the Federal Register and solicits comments; and the SEC has 45 days from posting to approve or deny the ETF,” adding that “the SEC doesn’t have to decide within 45 days. It can extend the deadline up to three times: 45 more days if ‘a longer period is appropriate’; 90 more days for the ETF to address grounds for disapproval; and 60 more days if again ‘a longer period is appropriate’. This means the real deadline for the SEC to approve or deny an ETF is 240 days after it files notice in the Federal Register.”

Given the SEC’s potential extensions and adjusting for weekend deadlines, Mr. Chervinsky predicts that the final deadline for the “Vaneck/Solid X ETF […] should be March 4, 2019.”

Bitmex Sets Record of Over 1 Million XBT Traded in 24 Hours

On the 25th of July, Bitmex, a high leverage bitcoin derivative trading platform based in Seychelles, announced that its traders had set a new record for the number of XBT contracts traded in 24 hours. With over 1 million XBT contracts traded, Bitmex hosted over $8 billion USD worth of trade in a single day.

On the 25th of July, Bitmex, a high leverage bitcoin derivative trading platform based in Seychelles, announced that its traders had set a new record for the number of XBT contracts traded in 24 hours. With over 1 million XBT contracts traded, Bitmex hosted over $8 billion USD worth of trade in a single day.

On Twitter, the exchange claimed that the over 1 million XBT in volume was a record for the entire cryptocurrency industry, in addition to Bitmex.

What do you think of the estimate of March 2019 as a final deadline for the SEC to approve or reject the proposed Van Eck bitcoin ETF? Join the discussion in the comments section below!

Images courtesy of Shutterstock, https://twitter.com/CMEGroup, Bitmex

Now live, Satoshi Pulse. A comprehensive, real-time listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

The post Exchanges Round-Up: CME Volume Doubles Q2, Lawyer Predicts SEC Delays ETF Until March appeared first on Bitcoin News.