Ether (ETH) holding above $1,300 to suggest the next upside could take it past the current all-time high of $1,476

Ethereum has dropped nearly 8% over the past 24 hours, trading as low as $1,293 (Bitstamp). The increase in selling pressure comes after ETH/USD hit a new all-time high of $1,476, which means some traders are likely taking profits.

Despite the dip and the struggles around $1,300, the technical outlook for Ether short term suggests bulls might resume the uptrend into uncharted territory. If bulls manage to recover above $1,400, sustained momentum could push ETH towards $2,000, or even higher.

The recent spike in exchange withdrawals of Ether is also a positive signal, which suggests more people are hodling Ethereum, or that more ETH is locked up in contracts for staking and farming. All these factors have the potential to increase demand as coins in circulation reduce, likely pushing prices higher.

ETH/USD price outlook

ETH/USD 4-hour chart. Source: TradingView

Ether (ETH) traded lower as shown on the 4-hour chart since touching its all-time high of $1,476 before bulls rallied to stem the decline. Ether currently trades around $1,333, with bulls pushing higher after sellers successfully retested the 50-day EMA support level.

Ethereum’s price above $1,340 would effectively invalidate the sell signal recently flashed on the 4-hour time frame. The indicator had suggested a potential dip to the previous resistance level of $1,272, which currently acts as the initial support level in case of a downside flip.

If ETH/USD continues to trend upwards towards the ATH, increased buy pressure could see it extend gains to $1,650. The next targets from here would be moves towards $2-$3k.

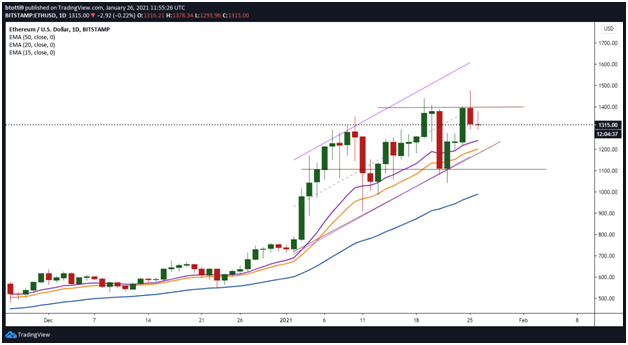

ETH/USD daily chart. Source: TradingView

On the daily chart, the RSI is above 60 to suggest the advantage is with the bulls despite the negative divergence. The MACD also remains in the bullish zone and suggests bears have begun to weaken.

The recent bounce off the 15-day EMA and subsequent support at the zone indicate strong support above $1,200. That explains the increased buying seen near the price zone.

Buyers need a daily close above $1,300 to preserve the upward move towards a new record price. But if sellers force bulls back under $1,300, the main support levels are at the 20-day EMA ($1,201) and 50-day EMA ($989).

Even with a retest of the above price levels, Ethereum will still be above an uptrend line in place since the upsurge from lows of $710. It means that the second-largest cryptocurrency by market cap remains positive until the price dips under $800.

The post Ethereum technical outlook is positive despite 8% dip appeared first on Coin Journal.