Ethereum’s London upgrade is scheduled for roll out on 4 August.

Sentiment going south could see ETH price dump more before its London upgrade

The price of Ethereum has slipped by 7% in the past 24 hours, crashing to lows of $1,720 amid another market slump that has also pushed Bitcoin (BTC) to lows of $29,400.

After trading at intraday highs of $1,840, ETH prices fell below a critical support line at $1,806 before touching intraday lows near its previous 30-day of $1,715. Together with the 24-hour downtrend, ETH is now nearly 14% in the red over the past week.

ETH price outlook

Ethereum is inching closer to 4 August, the date of the highly anticipated London hard fork that will see the activation of EIP-1559. The upgrade aims at moving Ethereum to a deflationary supply mechanism, with the fee burn likely to be bullish for ETH long term.

The picture over the last few weeks has been anything but bullish though, with today’s dump adding to the downward pressure just weeks to EIP-1559 going live on the Ethereum mainnet.

Anthony Sassano, the co-founder of EthHub, has ominously suggested that “$1,559 by 1559 may come true after all.”

For this to happen, the ETH price only needs to tank 9% over the next two weeks- something that’s entirely possible given the above picture. The bleak outlook is also supported by market data from CoinGecko, which shows that ETH/USD is down 21.3% over the past two weeks and nearly 20% in a month.

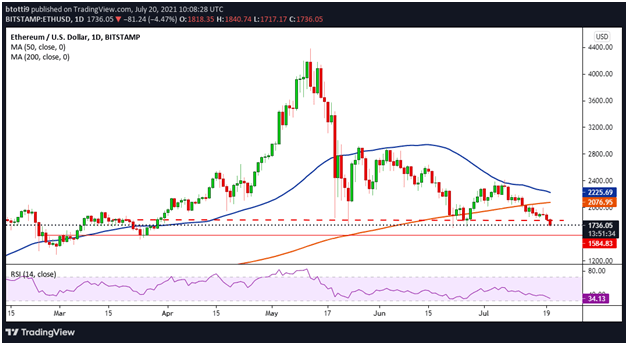

ETH/USD daily chart

As seen on the daily chart, ETH has broken below a long-term horizontal support line. The price is also below the 50 and 200-day moving averages, with the likelihood of a death cross given the trajectory of the two curves.

The daily RSI is also below 50 to give sellers the advantage. What this means is that if ETH/USD dips below another horizontal support level at $1,584, the market could see Ethereum’s price dump past $1,559.

At the time of writing, ETH/USD is trading around $1,736 as bulls look to stem the dump. A positive flip could yet see the second-largest cryptocurrency by market cap break above $1,800 to target fresh gains. In this case, the 200 SMA ($2,076) AND 50 SMA ($2,225) provide key hurdles.

The post Ethereum price slips 7%,could test $1,500 ahead of London upgrade appeared first on Coin Journal.