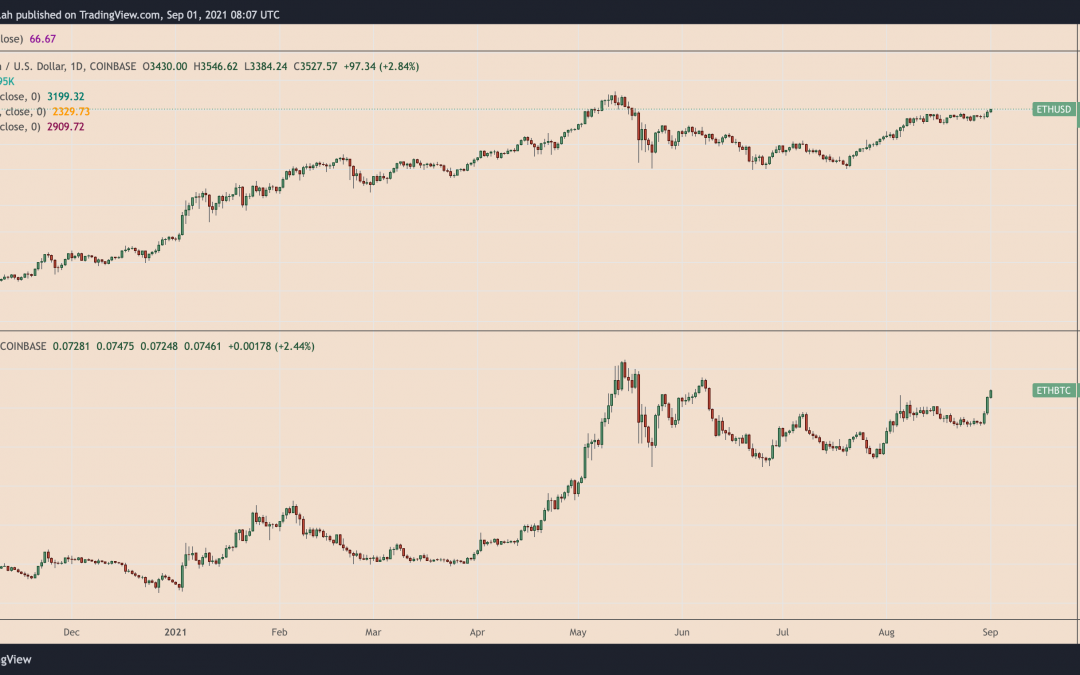

Ethereum’s native asset Ether (ETH) has extended its rally on Sep. 1 to log multi-month highs against Bitcoin (BTC) and the United States dollar (USD).

The ETH/BTC exchange rate rose 3.13% to hit 0.07475 for the first time since June 9. Meanwhile, bids for ETH/USD climbed 3.4% to $3,546, the highest since May 18, showcasing a renewed upside sentiment in the second-largest cryptocurrency market after it consolidated sideways for more than three weeks.

Ether’s price jump appeared despite a wobbling price behavior across the cryptocurrency market. For instance, Bitcoin prices remained stuck around $47,000 while eyeing a clear breakout move above their psychological resistance level of $50,000.

Similarly, Ethereum’s top rival Cardano (ADA) also consolidated sideways following its 100%-plus price rally in August, while its market dominance fell from 4.54% between Aug. 8 to 4.26% at the time of writing.

The same period witnessed Ethereum’s market dominance rising from 18.17% to 19.65%, hinting that Ether attracted capital out of assets with interim overstretched valuations.

Hodling detected

Ethereum’s run up above $3,500 coincides with a decline in ETH reserves across all exchanges.

Blockchain analytics firm CryptoQuant reported that the amount of Ether held in exchange wallets has declined from 19.45 million on Aug. 18 to 18.75 million today.

However, analysts perceive falling reserves as bullish, arguing that traders primarily withdraw their coins from exchanges because they choose to hold them instead of selling them for other assets.

Additionally, more upside cues for Ether prices have emerged due to supply squeeze prospects.

CryptoQuant data shows that more than 6% of Ether’s supply now stands locked inside the Ethereum 2.0 smart contract, i.e., about 7.28 million ETH, worth $25.77 billion at current exchange rates.

Additionally, a new Ethereum network update, dubbed “London Hard Fork,” has introduced a protocol that burns a fraction of its gas fees. Since its introduction on Aug. 5, the so-called EIP-1559 has removed 156,986 ETH worth over $555 million out of supply, per data provided by WatchTheBurn.com.

Demand prospects against supply squeeze

Ether has already climbed over 380% in 2021, its gains boosted by the emerging decentralized finance (DeFi) and nonfungible token (NFT) sector. In comparison, Bitcoin has gained 62% year-to-date against the dollar.

Payal Shah, director of equity and cryptocurrency product development at CME Group, noted that Ethereum is equivalent to DeFi, a sector that enables users to trade, as well as borrow and lend directly assets to one another without involving central authorities like banks.

“Ethereum hosts more than 200,000 ERC tokens, some of which are part of the top 100 largest cryptocurrencies,” Shah wrote in a note published mid-August.

“Together, with the accessibility of DeFi and the draw of better interest rates, more and more retail consumers will likely turn to the DeFi space.”

Data tracker Dapp Radar reports that the total value locked inside Ethereum-backed DeFi protocols has crossed $100 billion.

Cardano rivalry

But Ethereum is racing against a long list of rivals as it grapples with network congestion and higher fees issues. For instance, Cardano employs a dual-layer design to perform computations and settlements separately and thus solve the network congestion issues.

Additionally, Cardano consumes almost no energy due to its PoS system. Ethereum expects to switch fully to proof-of-stake by 2022-2023, which gives Cardano and similar Ethereum rivals a lot of room to grow.

But Ethereum has a first-mover advantage in the blockchain space, compared to Cardano, which has very few decentralized applications to show.

Related: Institutions remain bullish on Cardano and Ether, while BTC outflows persist

“Ethereum is the place to be, already boasting thousands of DApps,” said investment analysts at the Value Trend, adding that:

It simply makes more commercial sense, at the moment, to build an app on Ethereum.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.