ETH/USD trades above $420 as data by Skew shows traders expect a short term price surge

While Bitcoin aims to hold above $11,600 going into the monthly close, Ethereum bulls are eyeing prices above $440 as they move closer to a two-year high.

Elsewhere, Litecoin (+6.2%) and Vechain (+6.3%) are the biggest gainers among the top 25 cryptocurrencies in the last 24 hours.

Ethereum price

As of writing, the price of Ethereum against the US dollar is up 4.25% in the past 24 hours, changing hands around $423 on most major exchanges.

The second-largest cryptocurrency by market cap has surged more than 10% in the past 48 hours to see bulls crack resistance around $400 once more. ETH/USD rose to highs of $430 during early morning trades on Monday, before a slight retreat to the $420 region.

If bulls manage to revisit the area, sustained momentum above the zone could set up a potential assault on the major resistance area at $450.

The last time Ether traded this high was on August 17 when prices touched highs of $462, closer to two-year highs around $467 level.

Open interest in Ether Options up

At the moment, DeFi and yield farming appear to be the main drivers of Ethereum’s gains. Sentiment has improved significantly for Ethereum and options open interest data suggest traders are increasingly bullish.

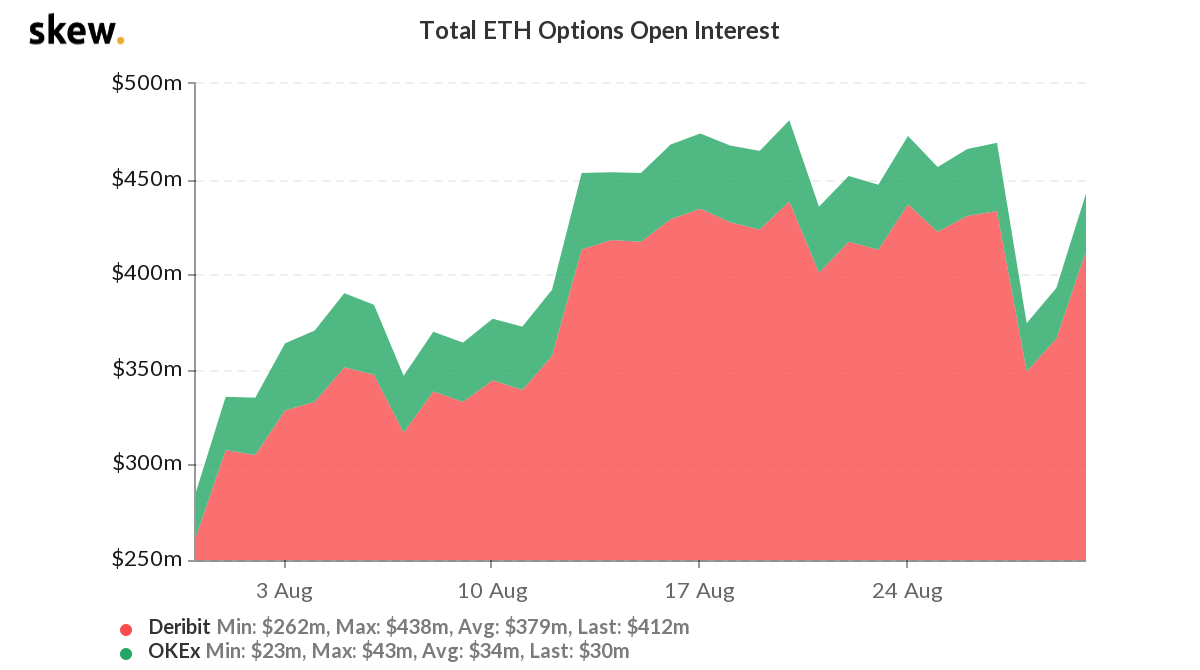

Open interest has surged by 230% since May, with close to $394 million recorded over the period. Meanwhile, the put-call ratio chart shows that this value has declined gradually over the same period.

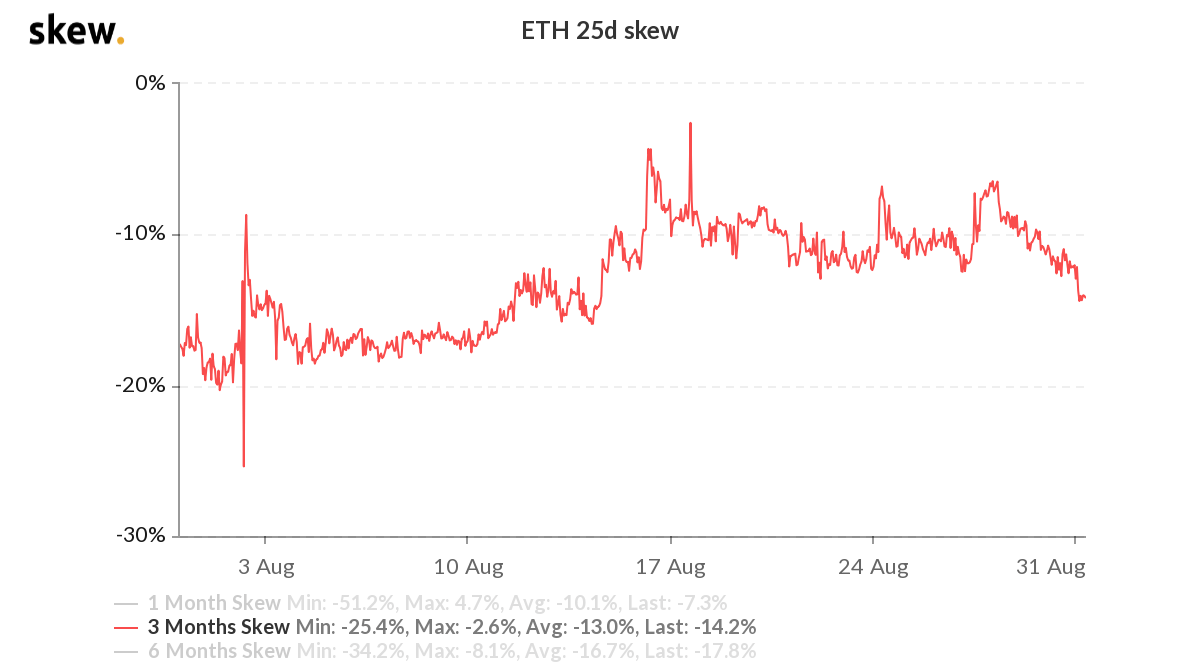

A look at the Ethereum options open interest indicates that most traders remain bullish despite the recent bull run that saw prices surge from lows of $350 to $400. The put-call ratio is printing green for the token, with the bullish sentiment also confirmed by the 25% delta skew chart.

Per the chart, optimism touched the 20% level at the end of July just as ETH/USD began to soar again. Traders are still bullish albeit with some caution. According to Skew Analytics, this is down to the uptick in price after calls for it over the last few weeks.

However, even as traders remain cautious, the 25% delta skew currently lies around 13% to suggest the sentiment is leaning towards ETH/USD surging short term.

Over the weekend, the total crypto market cap added nearly $20 billion to reach $385 — the highest level since May 2018.

The post Ethereum options data is bullish following two-year high appeared first on Coin Journal.