Analysts predict that plummeting Ethereum (ETH) reserves on centralised exchanges could help ETH price soar to $3k in weeks

ETH currently trades above $1,200, posting a bullish outlook given its recent dip to lows of $900. Although the cryptocurrency’s all-time high (ATH) of $1,432 remains elusive, some analysts are now saying that the next bullish impulse for Ethereum could see ETH/USD value more than double.

This is the view of one analyst, who says ETH could jump to $3k within weeks of breaking its ATH. Another expert has pointed to hodlers strategy of not selling in the short term as bullish for the coin and has predicted ETH targets of $5k, $10k, or even $20k in the long term.

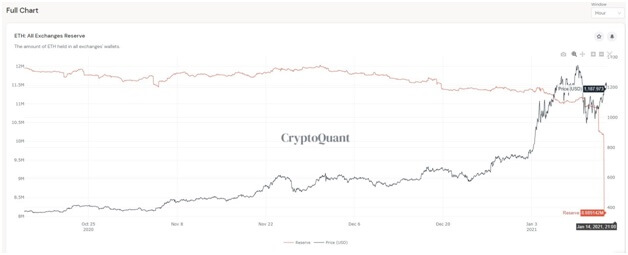

On-exchange reserves plummeting is bullish for ETH

According to the CEO of Nugget News Alex Saunders, ETH reserves on exchanges have plunged massively in the last few days, and “exchanges could be out of ETH within 48 hours“. As such, demand for Ether is rocketing, but there seem to be very few people looking to sell short term.

The same view is shared by Byzantine General, another highly respected crypto analyst and trader who says the above scenario is creating a sell-side liquidity crisis for Ether.

Saunders says the data points to an imminent explosion in ETH price.

“We all know what happened when demand outstripped the supply of $BTC. It quadrupled in 90 days.”

Chart showing ETH all-exchange reserves. Source: Alex Saunders

“I’m not gonna share all the data, I’m just gonna tell you what you need to know. There is an extreme $ETH sell-side liquidity crisis“, the analyst teased.

Simply put, it appears investors are looking at Ethereum as an intrinsically valuable asset to hold for the long term and are thus moving assets off exchanges presumably for hodling. This is creating massive demand for ETH, leading to a spike in buying pressure.

ETH/USD 1-hour chart. Source: TradingView

ETH/USD has climbed to highs of $1,230 in the past hour. However, bulls are facing resistance at this level, which coincides with the barrier provided by the middle line of an ascending parallel channel. Buyers need an upside to the upper boundary that extends to prices above $1,300.

If they manage it, a breakout above the channel’s apex line could see bulls retest recent resistance levels around $1,350 and possibly hit a new all-time high above $1,500. Ether in price discovery mode could rocket to $2k, $3k, or higher in the next 1—3 months.

On the flip side, a decline below $1,200 could see prices fall to the 100 hourly simple moving average at $1,105. From here, sellers can target recent lows of $900.

The post Ethereum could rocket to $3k as demand outstrips supply appeared first on Coin Journal.