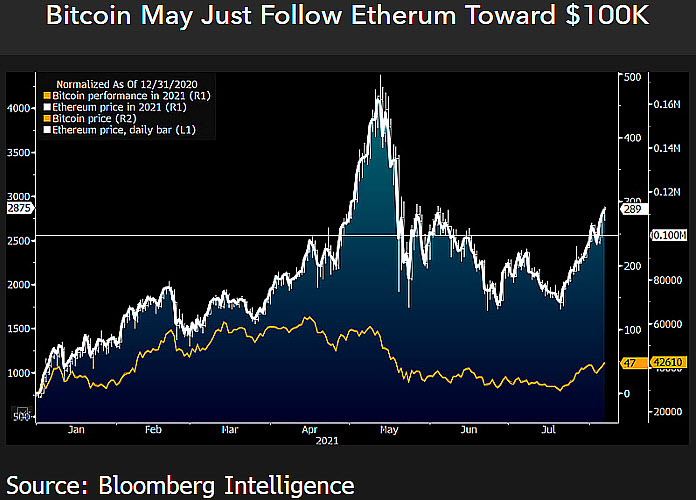

Ether (ETH) has outperformed Bitcoin (BTC) in terms of year-to-date market performance, rising more than 320% against BTC’s 54% returns. But, according to Bloomberg Intelligence senior commodity strategist Mike McGlone, Bitcoin would soon catch up to Ether’s gains, which might even push its per-unit price to $100,000.

“If Bitcoin were to catch up to Ethereum’s performance this year, the No. 1 crypto’s price would approach $100,000,” the analyst tweeted on Aug. 9 as BTC price broke above $46,000.

While McGlone did not dwell on the factors that would have Bitcoin match Ethereum’s yearly gains, his earlier report on cryptocurrencies cited a few catalysts that could propel the benchmark crypto’s prices to the six-figure club. The report notes:

“About 80% of Bitcoin and Ethereum, the majority of the Bloomberg Galaxy Crypto Index (BGCI) performance comes from the broader perception of the first-born crypto as a global digital-reserve asset, plus accelerating digitization of fintech and the monetary system.”

Trillions of dollars waiting on the sidelines

Bitcoin backers believe it can compete with the U.S. dollar to become a global reserve asset. A big reason is the cryptocurrency’s fixed supply cap that, to proponents, make it better sound money than the greenback (the Federal Reserve printed $3.1 trillion in 2020 alone).

As a result, Bitcoin closed last year 260% higher, reflecting that investors treated it as a tool against dollar-led inflation.

In its survey earlier in 2021, Goldman Sachs also noted the pent-up demand for Bitcoin among institutional investors, including pension funds, global sovereign wealth funds, and foundations. Nonetheless, even as they had trillions of dollars in reserves, a lack of clear crypto regulations kept accredited investors from putting those funds in the Bitcoin market.

Analysts at Autonomous Capital Management stated that a regulated Bitcoin exchange-traded fund would speed up Bitcoin adoption among institutions. In addition, they stated that while investors treat Bitcoin as a highly volatile asset, its lack of correlation to traditional risk factors will be like music to their ears.

The Autonomous analysts added:

“If we were to assume that Bitcoin gets the same weighting as the current gold weighting in investor’s portfolios, its price would be 2.8x times higher or roughly $112,000.”

Ethereum rivalry

Despite its adoption prospects on Wall Street, Bitcoin’s dominance has fallen severely after topping out at around 73% in December 2020. It now stands at 47.17%, reflecting that traders have shifted around their investments to other digital assets.

Ethereum, in particular, has become the biggest benefactor of the falling Bitcoin dominance index. Its own dominance in the cryptocurrency industry has climbed from 10.06% in December 2020 to 20.05% at the time of writing.

Part of the reason behind Ether’s rising dominance has originated from the explosion of non-fungible tokens (NFT), which are digital files whose originality and scarcity can be validated by a public ledger.

In addition, a boom in the decentralized finance space, consisting of lending, borrowing, and other financial services built atop the Ethereum blockchain, has pushed the adoption of Ether among crypto masses.

Ethereum developers are also taking steps to scale the blockchain. On Aug. 5, Ethereum updated its software with a so-called London hard fork with an aim to become a full-fledged Proof-of-Stake protocol in the future.

The update also added deflationary pressures on the supply, with an improvement proposal EIP-1559 bringing a fee reduction feature. On the first day alone, EIP-1559 enabled the elimination of $2 million worth of Ether tokens.

As of Monday, the feature burned about $5.5 million worth of ETH, as per data fetched by the website Ultrasound Money.

Related: Vitalik: ‘More confident about the merge’ following Ethereum’s successful London upgrade

McGlone noted that Ethereum’s past performance indicates possibilities that it could surpass Bitcoin in terms of market cap by 2022 or 2023. The analyst maintained his $100,000 price target for Bitcoin, nonetheless.

“Though we see Bitcoin on that path, there appears little can stop the process of Ethereum flippening,” he said.

To date, Ethereum has surpassed Bitcoin in terms of network transactions and total transaction fees, data from Blockchain Center shows.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.