Ether (ETH) paved the way for lower transaction costs with the Berlin upgrade on April 15. However, traders already know that the Ethereum Improvement Proposal 1559 is the most anticipated and controversial change scheduled for the upcoming London hard fork.

The EIP introduces a base fee that will be burned when a transaction occurs, while miners receive a tip for validating transactions. This move would severely pressure miners’ earnings, but the proposal aims to tame the skyrocketing gas fees that have plagued the network for the past two years.

The recent rally and conflict with miners boosted demand for protective options

Both the Berlin and London upgrades are needed to achieve the non-inflationary issuance schedule, which is the basis for the network’s Eth 2.0 proof of stake (POS) network. Thus, considering the 153% accumulated gains in 2021, one should expect investors to be more actively using short-term options as a hedging instrument.

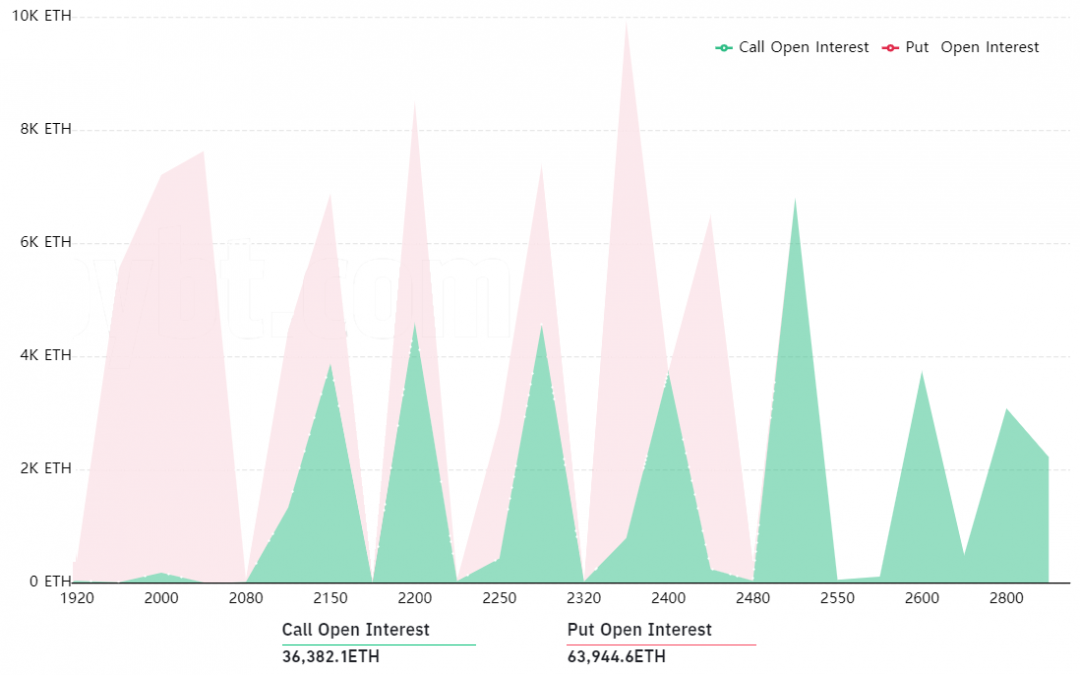

While the neutral-to-bullish call (buy) option provides the buyer with upside price protection, the opposite occurs on the more bearish put (sell) options. By measuring each price level’s risk exposure, traders can gain insight into how bullish or bearish traders are positioned.

The total number of contracts set to expire on April 23 is 101,300, or $250 million at ETH’s $2,450 price. However, bulls are apparently in lower numbers as the call (buy) options represent only 35% of the open interest.

Bulls have a slight advantage after the recent rally

While the initial picture seems bearish, one must consider that the sub-$2,000 put (sell) options are almost worthless with less than eight days left. A more balanced situation emerges when the 17,600 bearish contracts currently trading below $10 each are removed.

The neutral-to-bearish put options still dominate with 58% of the remaining 80,500 Ether contracts. Meanwhile, the open interest stands at $197 million considering the current Ether price, giving the bears a $30 million advantage.

Bears might have been caught off-guard as Ether marked a new all-time high near $2,500. A meager 6,600 Ether put options are left at $2,450 and higher, only 10% of the total.

Meanwhile, the neutral-to-bullish call options amount to 19,500 Ether contracts. This difference represents a $31 million open interest favoring bulls. Albeit small, bears would only take a similar lead if Ether’s price moves down to $2,200 on April 23.

It is worth noting that $30 million is a large enough figure to incentivize the 10% price move needed to push Ether price down to $2,200 and shift the balance in favor of the bears.

This data suggests that the upcoming April 23 expiry of $250 million in options will take place without causing much of a stir.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.