Downward pressure could see EOS erase all gains made when it raced to a 52-week high of $14.88

The EOS price reached $14.88 on 12 May, its highest price level this year and a 52-week high that saw the coin’s performance mirror the broader market’s bull run.

However, EOS saw its value trade lower to hit $3.07 on 22 June, again mirroring the turmoil in the broader market.

As of writing, EOS is trading at $3.69 against the US dollar. Its value has declined by 7% in the past 24 hours and 10% in seven days. Yesterday’s breakdown now means that EOS is vulnerable to more losses, with its current price about 83% off the all-time high of $22.71 reached on 29 April 2018.

EOS is the 28th largest cryptocurrency by market cap, its $3.5 billion valuation putting it behind Monero (XMR) at $3.7 billion but ahead of Shiba Inu (SHIB) at $3.2 billion.

EOS price outlook

On June 25, EOS developer Block.one announced it had paid 83,000 EOS or roughly $330k to a contractor. The price of EOS dropped nearly 15% in two days, from $4.02 to $3.39.

On July 1, American CryptoFed DAO became the first decentralised autonomous organisation (DAO) to be legally recognised in the US, with the project leveraging the EOS platform for its two-token economy. The market reaction pushed EOS price back above $4.00, but weakness across the markets saw the upside fade near $4.31.

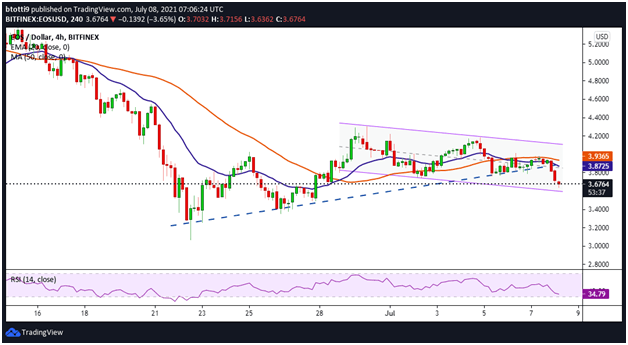

As seen on the price chart below, the price has been tracking a bullish trend line. However, the past few hours have seen bears break the support line to threaten further losses.

The Relative Strength Index (RSI) on the 4-hour chart is below the equilibrium point and suggests bears are in charge. EOS/USD is also trading well below the 50-day simple moving average ($3.93) and the 20-day exponential moving average ($3.87), with the moving averages’ curves suggesting price weakness.

Considering the strong resistance facing buyers around $3.80, price action over the next few hours/days could continue the downward trend. If bulls allow prices to dip below the support line of the descending parallel channel, then we could look at EOS retesting recent lows near $3.00.

On the contrary, a decent bounce to the 20-day EMA and 50 SMA could allow bulls to attempt a breakout to $4.00-$4.50 or higher.

The post EOS price analysis: A 7% Dip Leaves EOS/USD Vulnerable appeared first on Coin Journal.