Tesla CEO Elon Musk has confirmed that he owns bitcoin and has not sold any of his holdings. His company Tesla, however, has sold some of its bitcoins, which Musk says it’s “essentially to prove liquidity of bitcoin.” Tesla’s Master of Coin says the company believes in the value of bitcoin and will keep holding the cryptocurrency long term as well as accumulating from car sales.

Tesla Sold 10% of Its Bitcoin Holdings, Made $272 Million

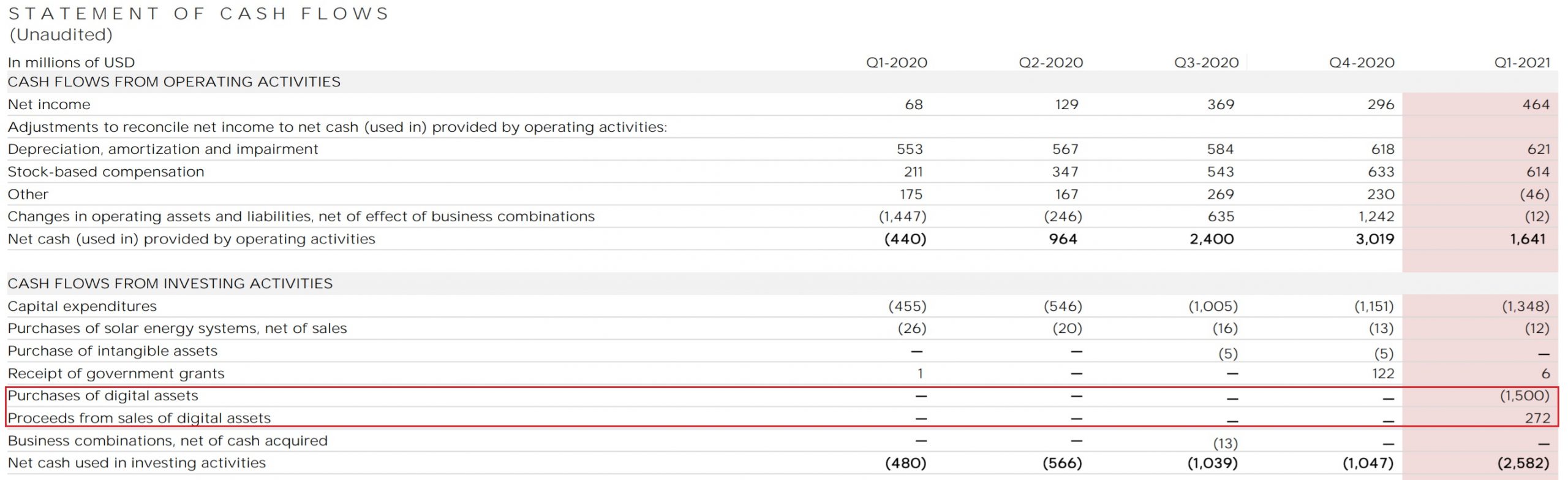

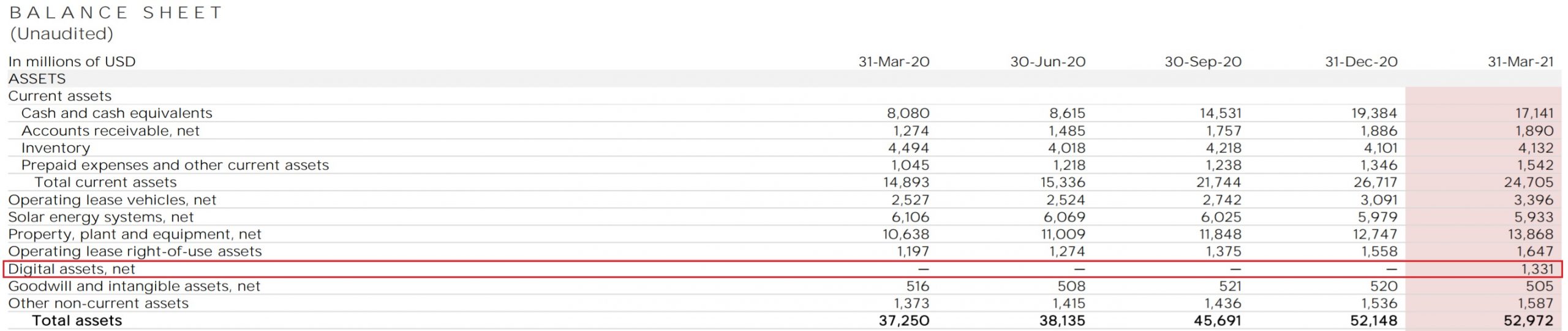

Elon Musk’s electric car company, Tesla, announced its first-quarter earnings results on Monday. Prior to the earnings call, bitcoiners were hoping to hear how many more bitcoins Tesla had purchased since its original investment of $1.5 billion early this year. However, Tesla revealed that it actually sold some BTC during the quarter.

Zachary Kirkhorn, Tesla’s chief financial officer whose title was changed to Master of Coin, said during the earnings call:

We also invested $1.5 billion in bitcoin during the quarter, then trimmed our position by 10%, which contributed to a small gain in our Q1 financials.

Tesla’s unaudited statement of cash flows shows an entry for “Proceeds from sales of digital assets” that amounted to $272 million. Its balance sheet shows a net digital asset entry of $1.331 billion.

Elon Musk Owns Bitcoin and Has Not Sold Any

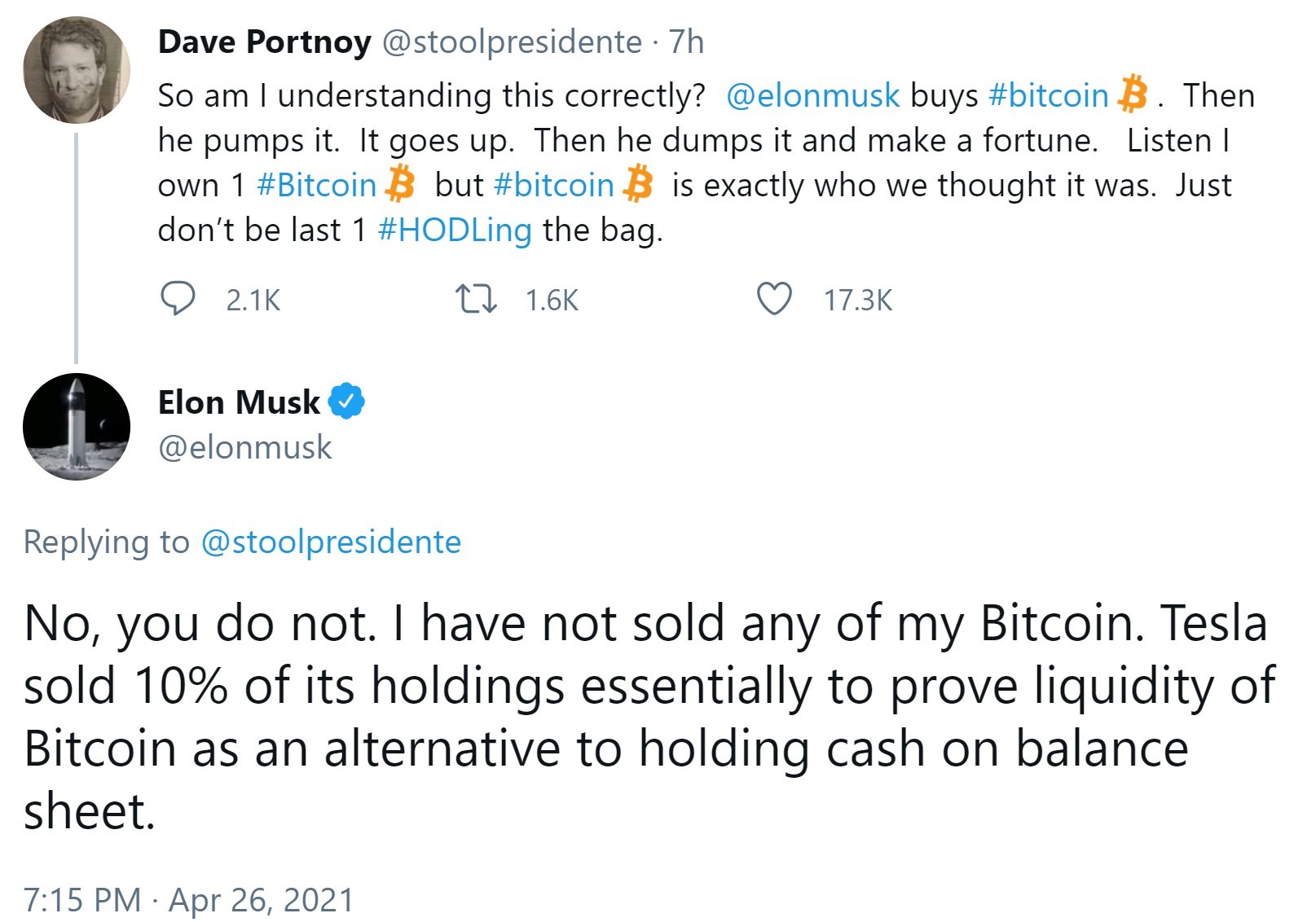

The news of Tesla selling some of its bitcoins went viral on social media and many people on Twitter are upset with Elon Musk, the CEO whose title was changed to Technoking of Tesla.

Stock trader Dave Portnoy, who recently became a proud owner of one bitcoin, commented in a tweet: “So, am I understanding this correctly? Elon Musk buys bitcoin. Then he pumps it. It goes up. Then he dumps it and make a fortune.”

Musk replied: “No you do not.” He proceeded to reveal, “I have not sold any of my bitcoin,” confirming that “Tesla sold 10% of its holdings.” The Tesla technoking claims that the BTC sale was “essentially to prove liquidity of bitcoin as an alternative to holding cash on balance sheet.”

Tesla’s Bitcoin Strategy Going Forward

Kirkhorn explained during the earnings call: “Elon and I were looking for a place to store cash that wasn’t being immediately used, trying to get some level of return on this, but also preserve liquidity … Bitcoin seemed at the time and so far has proven to be a good decision.”

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

He continued, “Thinking about it from a corporate treasury perspective, we’ve been quite pleased with how much liquidity there is in the bitcoin market.” Kirkhorn elaborated: “Our ability to build our first position happened quickly. When we did the sale later in March, we also were able to execute that very quickly. And so as we think about kind of global liquidity for the business in risk management, being able to get cash in and out of the market is something that I think is exceptionally important for us.”

Tesla’s Master of Coin emphasized:

We do believe long term in the value of bitcoin. So it is our intent to hold what we have long term and continue to accumulate bitcoin from transactions from our customers as they purchase vehicles.

How many bitcoins do you think Elon Musk owns and what do you think about Tesla selling some to prove liquidity? Let us know in the comments section below.