By Kei K,

The price of the Chinese yuan against the U.S. dollar has gained more attention from bitcoin enthusiasts and speculators lately. They’ve held on to their belief that the bitcoin price is in close correlation with the value of CNY. How does bitcoin and CNY correlate in a quantitative term? Could it be a sheer coincidence?

Recent Historical Events

The financial markets have been a rollercoaster ride in the past months. Historical events like the ‘Brexit’ and the IMF’s addition of Chinese yuan into its SDR basket of reserve currencies have shaken up the world of economics.

The U.S. presidential election also brought very pleasant surprises for bitcoin enthusiasts — bitcoin value has gone from strength to strength. CNY has also broken new floors now and then, as President-elect Donald Trump plans to renegotiate trade deals with China.

Curiosity as to how closely bitcoin and Chinese yuan values correlate have sent bitcoin enthusiasts like me to find out.

The Beginning of Trumponomics

According to Bloomberg’s report nearly a month ago, Dr Le Xia, chief economist for Asia at BBVA Research, stated that China would intervene to stabilize its currency. However, the situation has changed since.

Banks lowered their yuan forecast as President-Elect Trump threatens tariffs on China’s domestic goods. Trump’s labeling of China as a “currency manipulator” has also sent the CNY into a downward spiral.

The Chinese currency will weaken to 7 against the greenback — a level unseen since before the global financial crisis — in the first half of next year, according to 14 of 16 analysts and traders surveyed by Bloomberg this week.

Morgan Stanley estimated as much as $44bn of net capital outflow from China in September. The country’s holdings of U.S. Treasuries also declined to $1.157 trillion in the same month.

Chinese officials have stepped in to “fill” the capital control loopholes. One such action is to come up with a potential plan to curb transactions that use bitcoin and other digital currencies to take funds out of the country.

Chinese Yuan Correlation Coefficient Findings

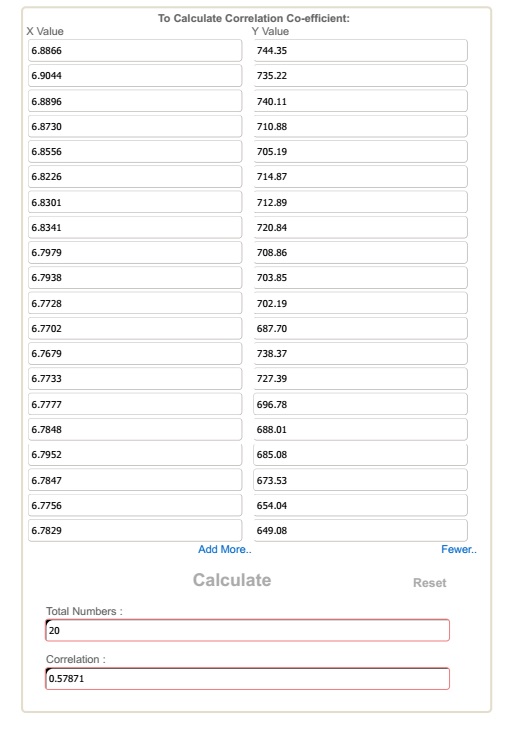

The correlation coefficient calculation can be used to determine how variables such as bitcoin and Chinese yuan correlate with each other. These are the considerations during calculation:

- Twenty daily price reading samples from USDCNH and Bitcoin Price Index (USD) were taken for the calculation.

- Data were taken from Bloomberg and Kaiko for USDCNH and Bitcoin Price Index (USD)respectively.

- The period for data reading fell between 24th October and 18th November.

- Only weekdays’ data for bitcoin daily price reading during the period were used, to accommodate for USDCNH’s 5-day trading week.

The result shows how closely bitcoin and CNY correlate — it turned out to be 0.57871. This reading indicates that bitcoin and Chinese Yuan correlate moderately positive with each other.

Correlation is Not Causation

Before anyone starts to jump into punting on bitcoin price movements based on this correlation coefficient finding, it is important to note:

- The correlation coefficient studies merely show that bitcoin and Chinese yuan correlate. In other words, only show the presence of a relationship. It does not explain the nature or effect that one variable has on the other.

- The presence of correlation, as well as the degree of correlation, could change over time.

- The uncertainties from the outcome of the presidential election are attributed to erratic market behaviors. This phenomenon may not be sustainable.

- Sampling size may have biased results based on the considerations undertaken.

- Transposition Error and Error of Original Entry from data input could also alter findings.

So Here’s the Verdict

The good news: speculators could use the findings of how bitcoin and Chinese yuan correlate as a reference to how their bitcoin trading positions would be.

In summary: Anticipating bitcoin movements remains a challenge, as it is largely based on its demand and supply in the open market.

Even though the result shows that bitcoin and Chinese yuan correlate positively by 0.57871, caution when using such finding is highly advised.