Litecoin prices fell roughly 20% in less than 24 hours, and the culprit is apparently a single tweet.

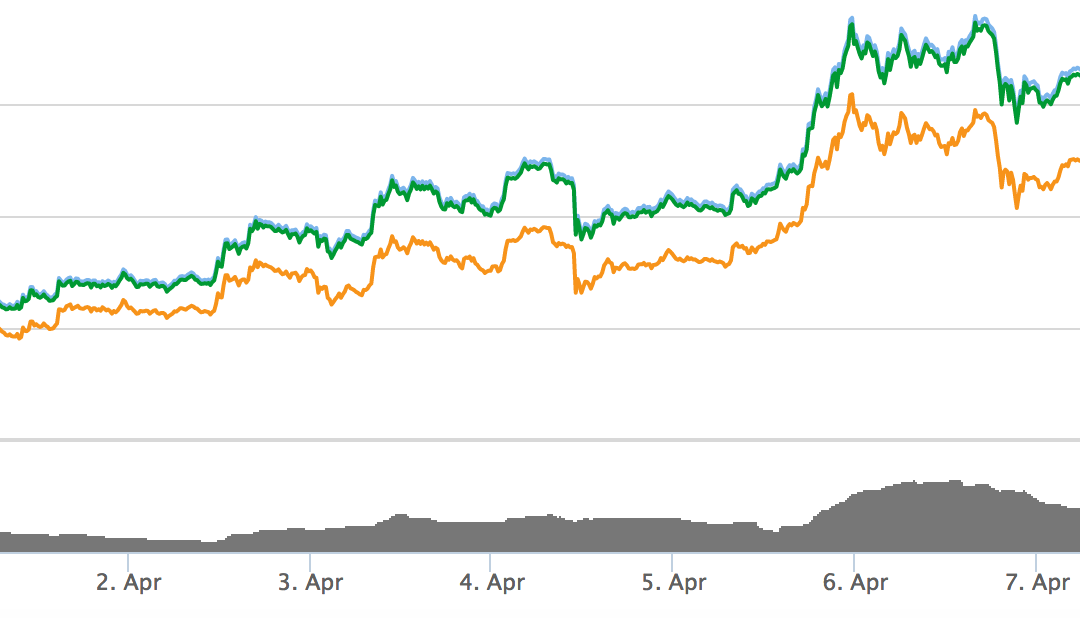

The digital currency declined to as little as $9.19 at 12:29 UTC today, after reaching a high of $11.45 yesterday. According to data source Coinmarketcap, this represented a 19.7% loss for the digital currency.

Yet, analysts suggest the price movement is the latest example of how cryptocurrency prices can be impacted by relatively minor events, in this case, speculation about the future of an upgrade to the litecoin protocol.

First developed for the bitcoin network as a way to increase the capacity of network transaction blocks, there are now high hopes litecoin could be a useful proving ground for Segregated Witness, a blockchain scaling solution.

Developers, for instance, have expressed their interest in testing SegWit on litecoin as a way to ease concerns about its deployment on bitcoin, and traders have responded in turn.

The tweet that analysts identified as triggering this sharp drop, however, shook confidence in this outcome.

In the message, Wang Chun, co-owner and chief administrator of mining pool F2Pool, expressed his concerns about Segregated Witness and warned that he may need to pull his mining pool’s support for the proposal.

At issue is that F2Pool accounts for roughly 35% of the network’s mining power.

Still, less than two hours later, litecoin creator Charlie Lee tweeted that he had spoken with Chun, who would continue to signal for SegWit.

Though with the scare over, it seems markets were still affected.

Over the last several days, the litecoin network has repeatedly approached the key 75% support level it needs to activate SegWit, and as such, the tweet sparked concerns the technical proposal might not be activated.

At the time of report, 67% of miners were signaling their support for the change, including F2Pool.

Trend forming

Going forward, analysts said the blockchain asset will likely experience continued volatility on the outcome of this upgrade.

“Litecoin’s jumps and drops lately all seem to be tied to speculation as to whether it will manage to activate SegWit,” algorithmic programmer Jacob Eliosoff told CoinDesk.

Harry Yeh, managing partner of investment manager Binary Financial, offered a similar sentiment, stating that a lot of litecoin’s price movements had to do with SegWit activation.

The drama takes place as the price of litecoin has enjoyed sharp increases over the last several trading sessions, with data suggesting it has surged roughly 175% from its peak to trough over the last week.

Twitter chalkboard image via Shutterstock