Bitcoin in China has deep roots as a vast majority of mining takes place in the region, and the country once accounted for the lion’s share of the world’s BTC trade volume. These days, however, renminbi and bitcoin volume coming from mainland exchanges is virtually non-existent, but there’s a whole lot more international and underground action happening within the over-the-counter (OTC) crypto-economy.

Also read: Japan Increases Lead – Approves Another Four New Cryptocurrency Exchanges

CNY/BTC Trade Volume Is Virtually Non-existent As China’s Market Action Has Moved to Hong Kong, OTC Markets, and Tether

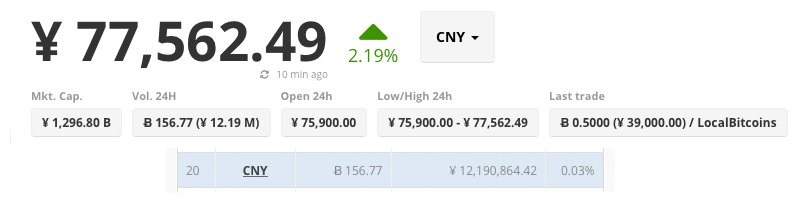

In the past Chinese bitcoin trade volume captured the majority of global trades for quite some time, and the renminbi (¥ CNY) was usually the top currency traded with BTC. However, these days CNY represents less than 0.03 percent of the world’s bitcoin trade volume and ranks number 20 amongst all the other global currencies. Even though CNY volume is down, Chinese exchanges are still functioning internationally in places like Hong Kong according to the Bitcoin Association of HK’s founder and tech-columnist Leonhard Weese. The top three Chinese exchanges Huobi, Okcoin, and BTCC now only capture 7 percent of the global trade volume Weese explains. For instance, at the time of writing, Huobi is swapping $194M USD worth of BTC paired with Tether. Okcoin only accounts for $11M worth of BTC trades and BTCC is trading $146M in BTC, ETH, BCH, and ETC. The controversial Tether (USDT) medium of exchange has interestingly replaced the CNY as far as worldwide volumes by currency.

Over-the-Counter Dealers Reap the Benefits, But China’s Government Is Watching

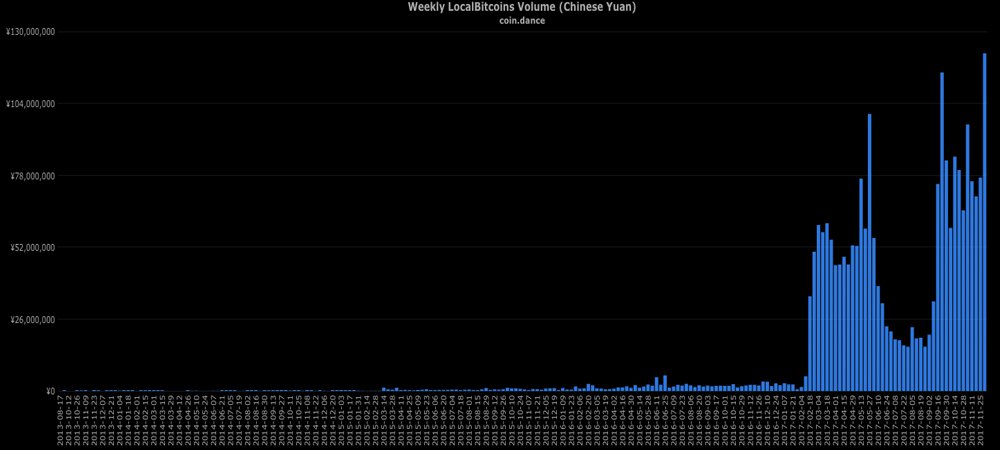

Even though Chinese exchange volume is lower than in the past, and renminbi pairs are not taking place within the region — OTC trading is booming. This week Chinese Localbitcoins trades are at an all-time high outpacing the last time exchanges went on hiatus. Additionally, other OTC platforms are also seeing a surge in demand like Poim, Richfund.pe, and Coincola. These companies not only provide substantial orders of bitcoins to investors, but also contribute liquidity to the top three Chinese exchanges who are utilizing international borders as a shield. Richfund is well known as a significant bitcoin hedge fund and OTC dealer within the region and supplies funds to many institutions.

“[Richfund] makes a very large contribution for depth and volume and is a is a strategic partner of Huobi, explains CEO Lin Li on the company’s website.

However, as news.Bitcoin.com reported last month, the Chinese government doesn’t seem to appreciate the peer-to-peer markets. On November 11, China’s Central Television (CCTV-13) warned viewers of the risks involved with OTC bitcoin trades. The warning has not stopped people from trading underground via Telegram channels, Wechat, and Alipay. Chinese trade volume on the peer-to-peer platform Paxful is at an all-time high as well.

Even though there’s a lot of underground action PBOC officials seem pleased that they shut down mainland bitcoin exchanges from utilizing CNY trades. According to the regional news outlets Yicai Global the vice governor at the People’s Bank of China (PBOC) explains that the central bank was right to intervene in regard to China’s cryptocurrency economy. The central bank’s Pan Gongsheng explains;

If we didn’t shut bitcoin exchanges and crack down on initial coin offerings (ICOs) a few months ago, and if more than 80 percent of the world’s bitcoin transactions and financing activities were still taking place China, which was the case back in January, what would it be like today?

Four OTC Providers Competing for China’s OTC Spillover

The top three exchanges Huobi, BTCC, and Okcoin alongside Localbitcoins, Poim, Coincola, and Richfund are also not the only businesses competing for OTC customers. Other over the counter dealers have moved into that area including Circle Financial, Gatecoin, Octagon Strategy, and the newcomer Genesis Block. The privately owned Octagon Strategy Limited says they specialize in providing digital asset liquidity offering cryptocurrencies like ethereum and bitcoin. The Hong Kong-based cryptocurrency exchange Gatecoin is receiving a lot more attention these days since Chinese exchanges ceased operations. The platform founded in 2013 caters to both retail investors and large market makers as well.

News.bitcoin.com reported on the creation of Genesis Block in Hong Kong and how the company also helped jumpstart the Bitcoin Cash network. These OTC-centric companies have a minimum amount of how many bitcoins are required for purchase which is typically no less than $100,000 to $10Mn per order. Circle Financial had previously set up a strategic position in the region creating a Beijing-based subsidiary called ‘Circle China’ back in June of 2016. Its liquidity services arm ‘Circle Trade’ is doing quite well in the area dedicating its resources to OTC markets.

What do you think about the bitcoin and cryptocurrency situation in China? Do you think exchanges will come back and renminbi will dominate again? Or do you think China’s bitcoin dominance days as far as trade volume is concerned is over? Let us know what you think in the comments below.

Images via Shutterstock, Crypto Compare, and Coin Dance.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe).

The post Despite Warnings China’s Over the Counter Bitcoin Economy Is Booming appeared first on Bitcoin News.