As price volatility of many of the major crypto coins and tokens has increased in the second half of this year, many market participants are shifting their focus from price to yield. Decentralized derivative markets and derivative liquidity pools are fast emerging as ways to generate superior yields than basic lending and swaps within decentralized finance (DeFi).

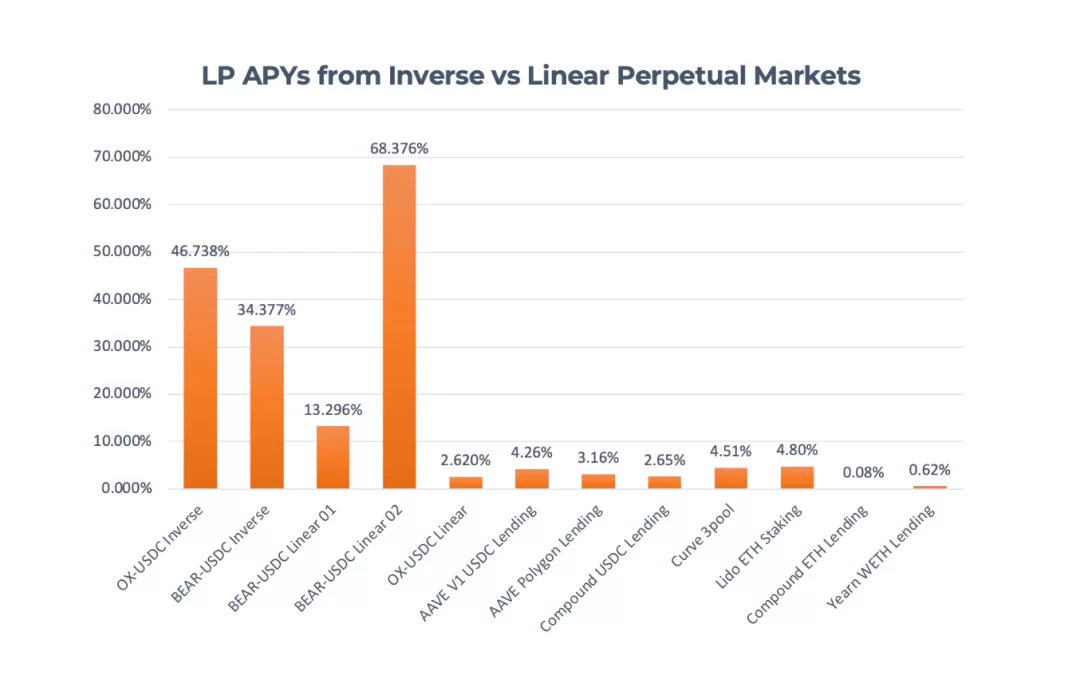

This can be seen by the results of the testnet that Qilin Protocol ran from Nov. 16 to Dec. 7 this year. During this period, over 800 unique addresses provided $650 million accumulated volume from five perpetual pools. This generated an average, non-inflationary pool annual percentage yield (APY) of 33.8% and a gross profit of over $16 million.

On a granular, comparative basis these results are even more impressive. The Qilin BEAR-USDC Linear Pool generated an APY of almost 13.3%, while the Qilin BEAR-USDC Linear Pool 02 generated a return of almost 68.4%.

The key to these APYs lies in Qilin Protocol’s risk mitigation design, which incorporates three sources of return. Firstly, there is Qilin’s rebase funding rate. This funding rate is completed in one tokenized action with a rebase, which reduces the gas fee. Moreover, the funding rate is sent directly to the liquidity pool as the liquidity pool bears the counterparty risk to exposed positions. The funding rate itself is applied on a per-block basis to the next block and the rebase is calculated and stored locally as an accumulating value.

Next, there are the dynamic slippage and liquidity debt mechanisms. The slippage is risk-adjusted by defining the overall risk exposure by taking the size of the short positions from those of the longs. Then the sensitivity index is derived based on the exposure, and then this index is applied on the oracle to derive price.

The liquidity debt mechanism is intended to prevent a permanent liquidity provider (LP) loss. A liquidity pool is allowed to take on a certain percentage loss as a counterparty in the peer-to-pool structure. Traders receive Liquidity Debt tokens representing their profit when an LP’s loss goes beyond the percentage threshold. When the liquidity pool recovers in value, traders can realize the profit through the Liquidity Debt tokens.

When compared to other decentralized derivative systems such as Perpetual Protocol and DYDX, Qilin stands out for its innovations, while staying true to the ethos of decentralization. Its liquidity design is peer-to-pool, rather than a virtual automated market maker (vAMM) or even a centralized order book, while the liquidity providers are token holders not approved market makers. Its perpetual offering is settled in both stablecoins and tokens, rather than only being stablecoin settled. This means that its market scalability is theoretically infinite, as opposed to being controlled by either the market makers or by the team.

Qilin Protocol is scheduled for full release at the end of December this year and then into early January. Institutional crypto market players who are looking for innovative ways to generate yield in the decentralized derivative markets and derivative liquidity pools can find out more by clicking here.