Bitcoin’s steady march to near-all time highs came as traders correctly anticipated that the U.S. Securities and Exchange Commission (SEC) would approve futures-based exchange-traded funds (ETFs). But instead of it being a collective effort by both retail and institutional investors across multiple platforms, crypto exchange data shows that a large investor or investors on one particular exchange, using mostly a particular dollar-pegged stablecoin, are once again the main factor behind a rally.

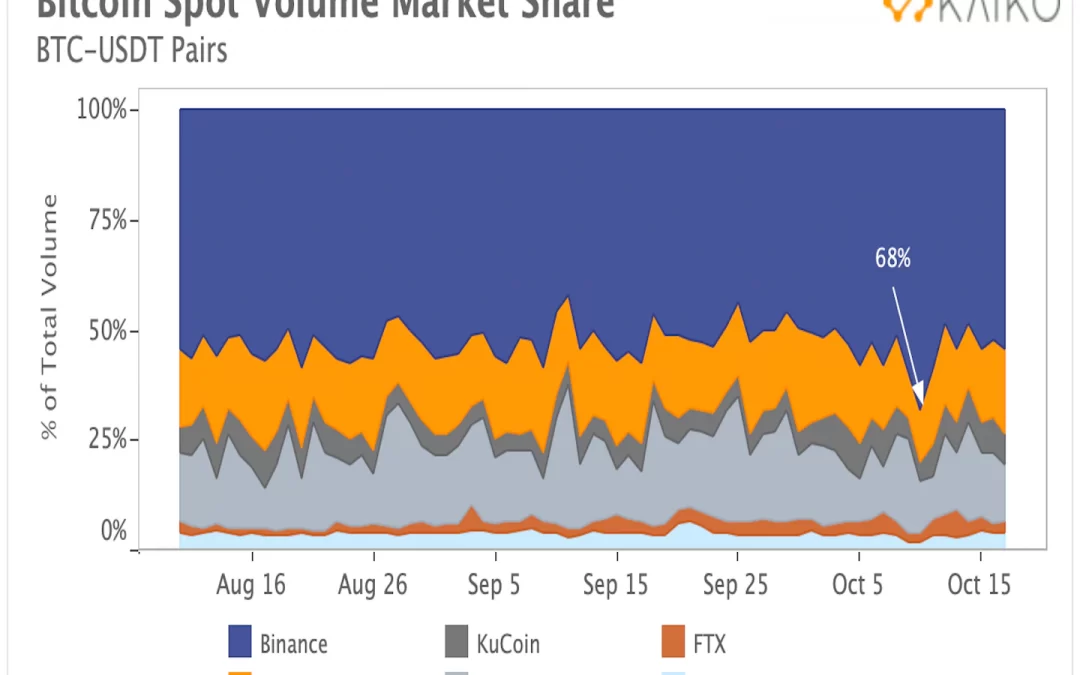

An Oct. 18 newsletter by data firm Kaiko indicates that bitcoin’s recent gains took off after the BTC/USDT spot trading pair’s volume spiked around Oct. 10 on Binance, one of the world’s largest exchanges. The spike took place just a few days after one buyer or a group of buyers entered an order on Binance on Oct. 6 to buy $1.6 billion worth of bitcoin, which sent bitcoin’s price skyrocketing 5% to about $55,500 at the time.

The finding supports the narrative that whales (large bitcoin investors) on Binance continued to purchase large amounts of bitcoin using dollar-pegged stablecoin USDT, without worrying about moving bitcoin’s price up sharply.

A breakdown of ‘abnormal’ trading activities on Binance

The volume of BTC/USDT trading spiked to “abnormally high levels” between Oct. 9 and Oct. 10 on Binance, Clara Medalie, research lead at Kaiko, told CoinDesk.

“Binance’s market share spiked at the same time to levels not seen in a very long time,” Medalie said. “This suggests that a large trader(s) were transacting on Binance at the time of the price rally.”

Individual trade data on Binance also shows that the average bitcoin trade size rose to $2,500 from $2,000 between Oct. 8 and Oct. 13, a multi-month high. On Oct. 10, as buy orders on Binance exceeded sell orders between 2:00 UTC and 5:00 UTC, bitcoin’s price went up to around $56,000 from $54,000.

Why Binance?

A buyer with a long-term perspective would usually try to avoid buying a large amount of bitcoin on one exchange in a short period of time, in order to mitigate the risk of slippage. The more appealing approach for large purchases is usually the over-the-counter (OTC) market.

When the OTC market cannot source more bitcoin, traders could turn to exchanges for new supply. But as independent analyst Willy Woo told CoinDesk, OTC desks usually outsource bitcoin through algorithmic trading programs with tools including volume weighted average price (VWAP) to break down the order into positions across all exchanges. It is unlikely that an OTC desk would conduct a large transaction at once on one exchange and cause a significant price movement.

The Oct. 6 purchase of $1.6 billion worth bitcoin using USDT happened on an exchange with ties to China in the middle of a week of severe uncertainty in the country as several real estate borrowers were defaulting on loan payments.

However, as China doubled down on its ban on crypto trading and the most popular bull narrative appears to be the hype around the SEC’s approval of a bitcoin futures-based ETF, some argue that the seemingly strange move on Binance had less to do with China’s crypto investors.

“Binance does not simply represent the market in Asia now,” said Alex Zuo, vice president of Singapore-based crypto wallet company Cobo. “It’s hard to make the connection between Asia and the recent price rally.”

The reason that the “abnormal” activity took place on Binance in particular could be that Binance’s BTC/USDT trading pair is highly liquid, according to Zuo.

He added that whales in Asia do not appear to be in a rush to dump their USDT after a story on Bloomberg indicated that the reserves of Tether Holdings, the company behind USDT, included “billions of dollars of short-term loans to large Chinese companies.”

Last week’s news that Bitfinex and Tether settled charges with U.S. regulators for a more than $42 million fine is even seen as “bullish” to many large USDT holders, Zuo said, as it removes uncertainty.

James Check, an analyst from blockchain data firm Glassnode, suggested that the latest rally is purely caused by more bitcoin demand than supply.

“I’m not really ever focused on which venue the buying occurs because I simply don’t think it is useful information,” he said.

“Perhaps there was a shortage of bitcoin,” Kaiko’s Medalie said. “As always, [it is] difficult to prove but it could explain the dramatic rise.”