Some popular projects are as much as 90% down since September highs

Tokens in the DeFi sector have been some of the biggest losers over the past week, with heavy losses coming despite the space seeing more money put into projects by yield farmers.

In June 2020, the decentralized finance (DeFi) sector had about $1 billion in total value locked in various protocols. An explosion in yield farming and liquidity mining however helped push the sector to new highs. By the end of September, the total value locked in DeFi had exploded nearly 1,000% to hit $11.23 billion.

TVL plunged to $7.74 billion but a 40% rebound since means that as of October 6, over $10.7 billion is locked in these projects.

Elsewhere, Uniswap, the largest decentralized exchange (DEX), has seen its trading volume balloon to over $15 billion over the past month.

However, DeFi prices have sunk following an extended sell-off, with most of the tokens trading as much as 90% down from their peaks.

DeFi tokens down 60%

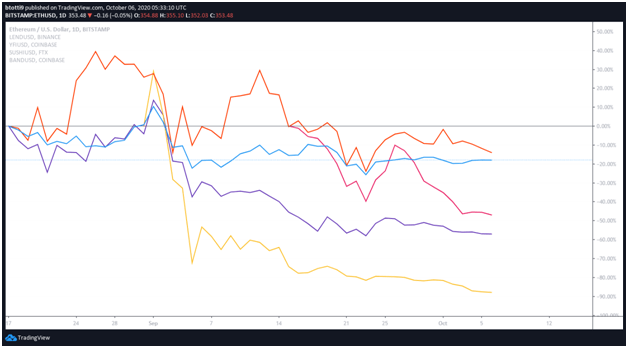

As Bitcoin declined from highs of $12k to test sub-$10,000 prices and Ethereum plunged from highs of $488 to lows of $348, so did DeFi tokens.

A look at how these tokens have performed over the last couple of months shows that the majority are an average 60% down since hitting new all-time highs around July/August.

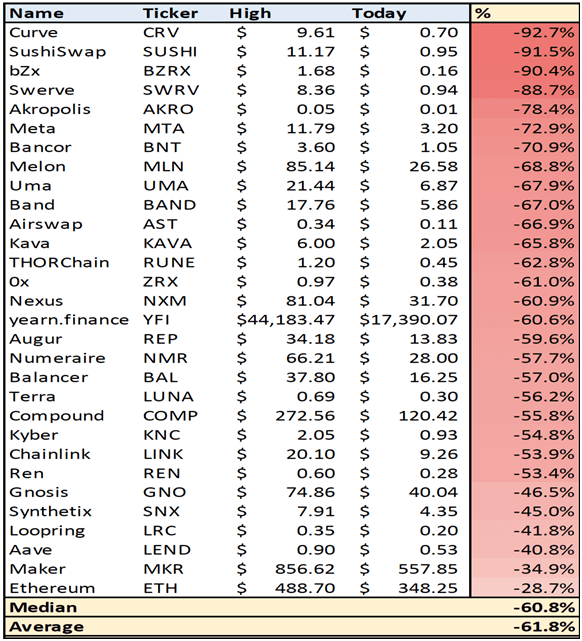

Although it’s probably not yet time to call out a DeFi bubble, the table below highlights just how bad it has been for some tokens.

Curve (CRV) is more than 90% off its peak of $9.61 as are SushiSwap (SUSHI) and bZx (BZRX) that are miles off their all-time highs at $11.17 and $1.68 respectively. Other tokens that have lost more than 60% of their value since the summer rally are Band Protocol (BAND), Uma (UMA) and Bancor (BNT).

BAND/USD is changing hands around $5.86 as of writing, nearly 9% down over the past seven days. UMA/USD is trading around $7.18, having shed around 27% since last week.

Yearn.finance (YFI), which rallied to highs of $44,180 in August, has dropped to lows of $17,000 before recovering to trade around $18,670 as of press.

Meanwhile, projects like Augur, Balancer, Compound, ChainLink, Loopring and Aave have all lost between 40%-59%.

The DEFI Composite Index launched by Binance Futures in August is also down. Comprising assets like ChainLink, Aave, Band Protocol, Compound, Kava, Kyber Network, Maker, Synthetic Network, Swipe and 0x (ZRX), the index price has dropped from $1,189 to around $508 as of writing.

The post DeFi tokens have retraced an average of 60% since August/September highs appeared first on Coin Journal.