If the words “derivatives trading” conjures up images of men in suits with disheveled white sleeves rolled up to the elbows and exacerbated expressions on their faces — like something out of The Big Short — then the word decentralized exchanges (DEXs) must conjure up, well, nothing.

There are no offices, no floor traders waving papers and certainly no men in suits. DEXs are managed automatically or semi-automatically with the involvement of platform participants in the process of making mission-critical decisions. DEXs are a bulb of a system that is sprouting groundbreaking opportunities for many, but they are not yet suited for the soil of derivatives trading in this season of the crypto market.

The technological gap

The technology isn’t available right now to have a proper options market on a DEX with the level of sophistication that you find in the traditional space. Current offerings, therefore, suffer from capital inefficiencies, poor pricing and added risk for traders. Instead of tech first, the people must be put first and the tech layered in as it matures, providing decentralization in progressive components. The success of dYdX’s hybrid approach of a centralized order book with decentralized custody shows that this is the viable route for a full derivatives options suite as well.

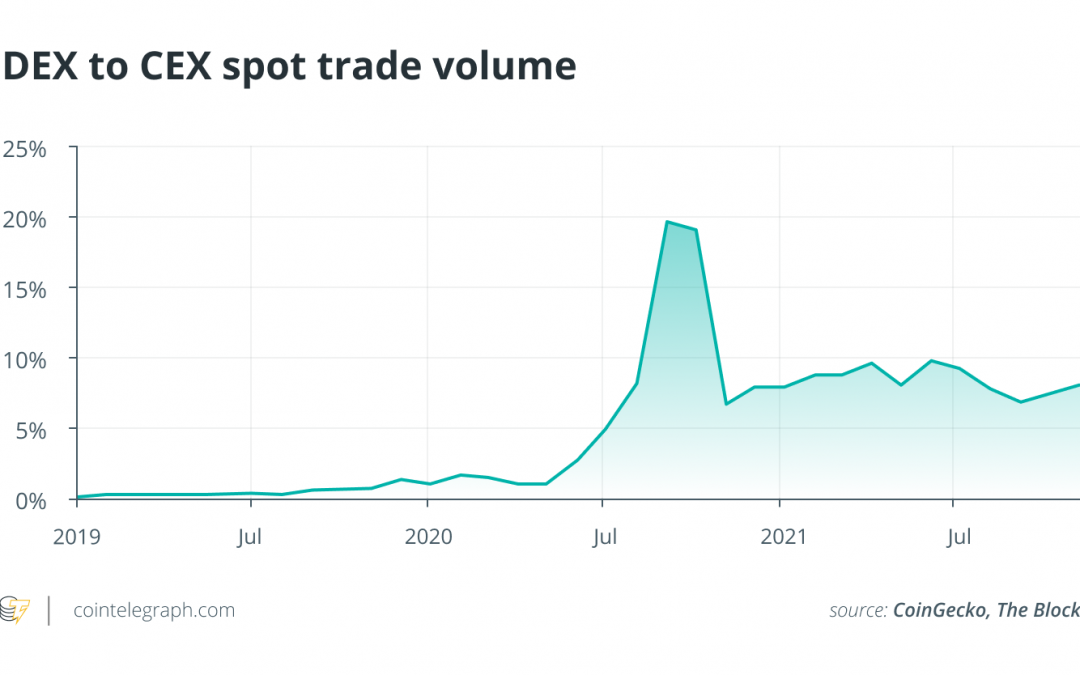

The percentage of DEX to centralized exchanged (CEX) spot trade volume was at 9% in June, which was the peak of the regulatory crackdown.

You can also see that during this time, dYdX also recorded an $11.6 million spike in revenue in August — leading to a higher adoption rate of DEX, thanks in part to its hybrid approach.

A more centralized hybrid approach provides the opportunity for the usage of these sophisticated financial tools sooner and at scale. Rigidly prioritizing true decentralization over a more centralized hybrid approach is a noble one, but it delays the accessibility of these financially transformative opportunities.

User experience powering the way

Central exchanges are a gateway to a larger audience that is not yet comfortable with the full self-custodial experience. Not everyone wants to have self custody of their funds. The fact that you could lose your entire life savings by misplacing a piece of paper is a pretty scary concept.

For example, when looking at the chart below, you can see that the volume, which can be inferred as a certain percentage of new entrants into crypto, tends to flow to more centralized exchanges.

Tom Bilyeau, co-founder and CEO of Impact Theory, might be the perfect anecdotal example of this preference of centralized exchange sentiment over decentralized exchanges. Tom is relatively new to crypto, he knows he “should” self-custody his assets. In an honest admission in his recent interview with Robert Breedlove, however, he explains his preference to keep his crypto on an exchange because of the security and friction of the alternative process. Of course, Twitter was buzzing with “don’t be like Tom,” counternarratives, but if we want to grow as an industry, we can’t write stuff like this off. Tom is going through the same crypto-adoption lifecycle of many people. There is a large segment of the population that doesn’t want to even think about security. They want exchanges to take on the counterparty risk so they can go on living their lives.

This is valid, if for no greater reason than this sentiment merely exists just as the self-sovereign vision of the Crypto-Utopiates is valid.

Of course, there are solutions to solve this and a variety of reasons people might prefer to self-custody, but the fact remains that this is not an ideal experience for everyone. The point here is that we must meet people where they’re at.

Related: Decentralization vs. centralization: Where does the future lie? Experts answer

The future is accessible for everyone

Cryptocurrency is a massive financial literacy project. Take, for instance, the subprime mortgage crisis in 2007. The problem was not that complicated derivatives tools, like tranches or CMOs, were inherently wrong, it was the fact that there was no transparency or audibility of the products that were being sold. Unseen risks resided in the system that no one knew existed and then it collapsed. With crypto, everything in the entire financial stack is fully transparent and auditable in real-time. Out of necessity, people learn about margin systems, lending systems and other traditional and complex concepts that were otherwise unappealing or unavailable to them.

Centralized crypto exchanges know that anyone can learn, audit and shift their assets to another platform if they’re not satisfied, which holds exchanges accountable. Unlike banks, users can withdraw their assets directly to the blockchain. Exchanges need to do right by the user, lest they go elsewhere. In a DEX, this is a glaring accountability gap. If something goes wrong, who is behind there to help fix the mess?

This is especially important when you consider that, according to a report by crypto research company Messari, DeFi protocols have lost about $284.9 million to hacks and other exploit attacks since 2019. At this point in time, the decentralized insurance industry only covers a fraction of the total value locked (TVL) in DeFi, which represents the sum of all assets deposited in DeFi protocols earning rewards, interest, new coins and tokens, fixed income, etc.

With new DeFi hacks popping up in crypto in what feels like every other day, centralized exchanges or custodians that can offer greater peace of mind through insurance and counterparty risk are the smoothest on-ramps for the industry.

Decentralization is the end goal

Of course, decentralization is the end goal. Users controlling their own assets is ideal. Directionally, this is where the industry is headed, but we can’t ask that users jump in before the tech is ready at their expense. The onus is on technologists to get decentralized technologies where they need to be first. DEXs conceivably hold great promise for the future of derivatives trading, but not at the cost of security, speed and availability for all.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.