Bitcoin and other cryptocurrency assets are precious and some of them have grown over 1300 percent in value this year. Although, with the price on exchanges being higher than ever before its now a bit more difficult for those who want to ‘cash out’ or make significantly large purchases without being watched by the prying eyes of tax collectors and governments.

Also read: Russian Regulators Draft Law to Restrict Crypto Mining, Payments, and Token Sales

Buying That Lambo May Not Be So Easy

Lately across social media and forums, you can find posts written by individuals who have ‘cashed out.’ Maybe they bought a luxury car like a Lambo, paid off their mortgage, or cleared their student loans with cryptocurrency gains. However some of conversations online concerning how to cash out detail how difficult it is without being watched, or being stopped by the third party payment processors.

For instance exchanges like Coinbase, Bitstamp, Kraken, and many others require a good amount of verification to revert bitcoins to fiat or vice versa. And just because you are approved it doesn’t mean you’ll be able to throw US$100,000 worth of BTC down on an exchange and expect to have the funds sent to your bank account without issue. The exchange may cancel the process even after the sale has been made. Furthermore, on the bank side, your financial institution may also stop you from cashing out large sums or freeze your account.

Typically in the U.S. and many other regions, anything between $5,000-10,000 deposits and withdrawals are monitored for money laundering and tax evasion. In essence, if you want to exit back to fiat using an online exchange to process $5-10K, you have to trust all the third parties will execute the deal as promised. Also if it’s a regulated, exchange trades in amounts mentioned earlier are likely monitored.

Two-Way Bitcoin ATMs and Taking It to the Streets With Localbitcoins

Then maybe you say to yourself, “well I could sell my funds to a two-way BTM.” Well, most of the two-way bitcoin automated teller machines only allow users to sell $200-500 per day. At that rate to cash out $10,000 worth of bitcoin, you would have to visit the BTM for twenty days straight and pay a 7-10 percent fee as well. Another talking point that always enters the conversation is those who believe it’s simple to use Localbitcoins to cash their BTC into fiat. In some areas of the world it’s easy to do this, but in countries like the U.S., they are arresting large Localbitcoins sellers for illegal money transmission and other charges.

Further, it takes quite a bit of time and well-executed trades to become a trusted trader on the peer-to-peer platform. Much like eBay, it’s not easy to build robust reputation immediately. Lastly, if you choose to try and get direct cash for your BTC from Localbitcoins traders in person, you have to be completely comfortable with the deal and your surroundings. There have been many instances of street traders being robbed or scammed during a trade.

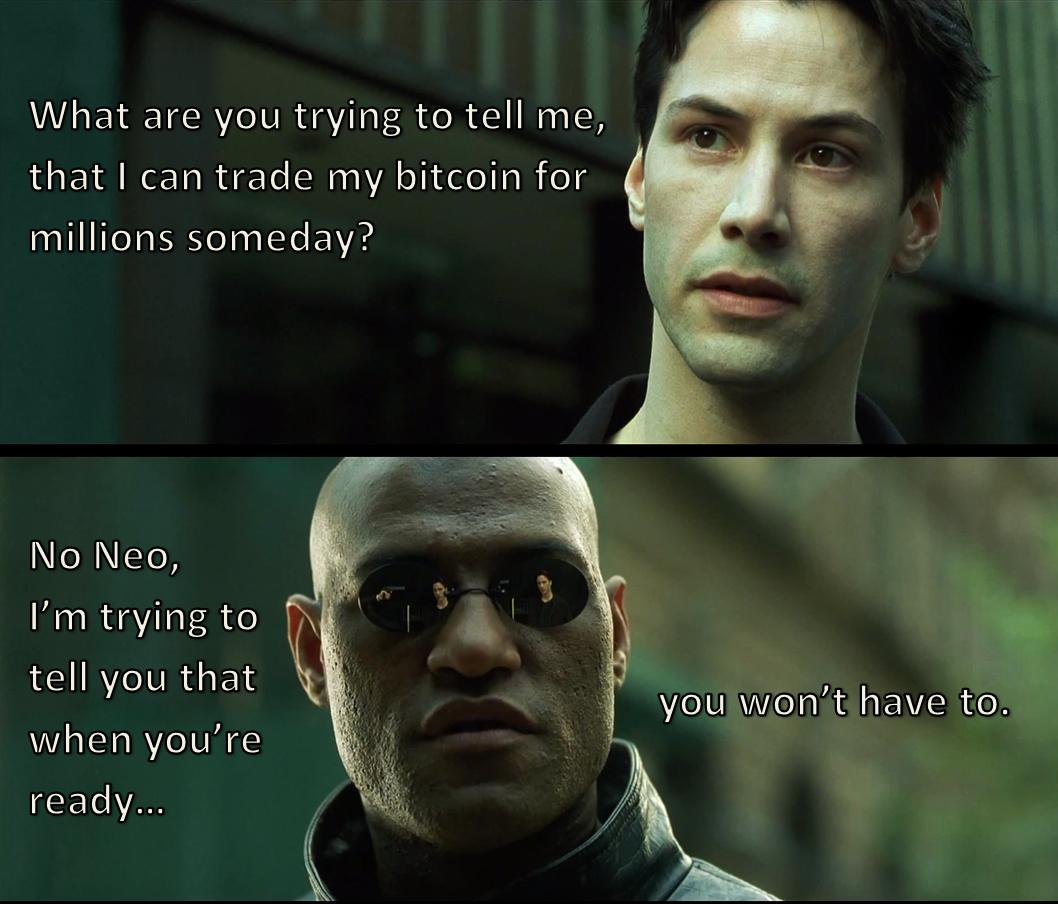

‘Someday Neo, You Won’t Have To’

It’s true many cryptocurrency enthusiasts have been able to cash out using the methods mentioned above, but there are always risks involved with converting back to fiat. Some people don’t care as they’ve done nothing ‘wrong’ and have no problem shelling out 33 percent for capital gains or other taxes involved. Also, there are many different ways people have found to be a reliable way to sell large amounts of cryptocurrencies as well. This includes people who know someone at an exchange, someone who is friendly with a miner or big over-the-counter (OTC) dealers.

Lastly, there are cryptocurrency advocates who just don’t care about the difficulties presented when going back to fiat. These people have the firm belief that digital assets like bitcoin, ethereum, and a few anonymous coins just might be the world’s dominating currencies. The “someday I won’t have to” exit back to fiat people exist in significant number and believe the renminbi, dollar, euro, and yen are doomed.

Do you think it’s difficult to exit back into fiat? Do you think you will never go back to nation state-issued currencies? Let us know about your experiences selling large sums of cryptos and exit strategies in the comments below.

Images via Shutterstock, the Matrix, and Pixabay.

Make your voice heard at vote.Bitcoin.com. Voting requires proof of bitcoin holdings via cryptographic signature. Signed votes cannot be forged, and are fully auditable by all users.

The post Dancing With the Devil: ‘Cashing Out’ Cryptos Into Fiat Not So Easy appeared first on Bitcoin News.