On-chain analytics firm Glassnode published a report hinting that investors are rotating capital toward risk-off assets like stablecoins and Bitcoin. Technicals show that altcoins are at a crucial turning point between a positive and a negative breakout.

Glassnode’s analysis of Uniswap and futures trading volumes reveals that the uptrend that began in the first quarter of 2023 began cooling off in April, with regulatory concerns and a lack of liquidity promoting risk-off tendencies among traders.

The report stated that while it might appear that memecoins caused a surge in Uniswap’s trading volume, a closer look at Uniswap’s pools reveals that the majority of volume was for top cryptocurrencies in Wrapped BTC, Ether (ETH) and stablecoins.

Moreover, sandwich attacks and bot trading accounted for a significant amount of this trading activity. The report read:

“If we take into account that many bots engage in arbitrage or sandwich attacks, the degree of ‘organic’ trading volume on Uniswap may well account for over two-thirds of all DEX activity.”

The futures trading volumes for Ether on centralized exchanges contracted in May, with 30-day average trading volumes dropping to $12 billion per day against a yearly average of $21.5 billion.

Glassnode analysts suggested that the decline in futures trading volumes is a sign that “institutional trading interest and liquidity remains quite weak.”

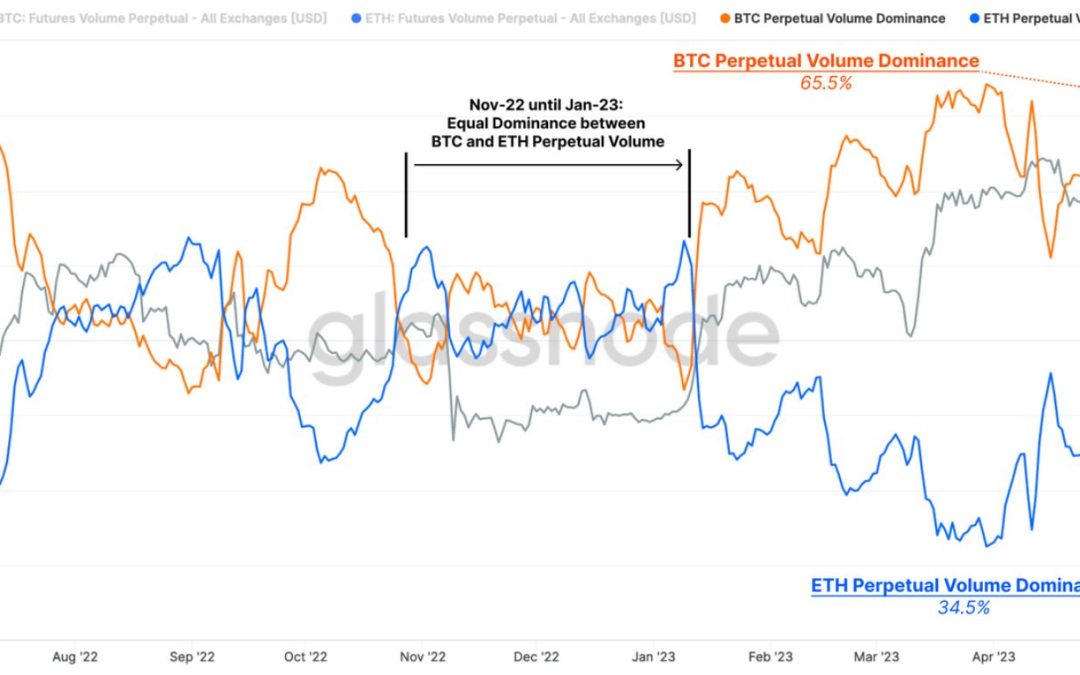

Similarly, the market share for Bitcoin (BTC) perpetuals versus their Ether counterparts shows a huge discrepancy, with 65.5% dominance for Bitcoin. In 2022, the two assets had equal shares in the perpetual swap space. However, the trend has shifted significantly in the last year.

Tether (USDT) has absorbed a significant proportion of outflows from Binance USD (BUSD) and Circle’s USD Coin (USDC), pushing USDT to a new all-time high supply of $83.1 billion.

In the crypto market, capital usually flows from the majors, like Bitcoin and Ether, into altcoins. However, the above trends show that, lately, the capital rotation is happening away from high-risk altcoins toward low-risk assets like stablecoins and Bitcoin.

Bitcoin’s relative strength versus altcoin price momentum

Technically, Bitcoin’s dominance percentage over the crypto market, which measures the share of Bitcoin’s market capitalization in the total crypto valuation, experienced an uptrend in 2023 before encountering resistance at the 48.35% level.

If Bitcoin buyers are unable to break out above this resistance, the market can expect an altcoin rally relative to Bitcoin.

On the other hand, the TOTAL2 chart, which measures the market capitalization of the cryptocurrency market excluding Bitcoin, had its positive breakout from the triangle pattern reversed, pushing the index back into a bearish triangle pattern that started forming in October 2022.

Related: Ethereum gas fees cool down after May memecoin frenzy

Currently, the total market capitalization of altcoins is bound by a bearish descending triangle pattern with lower highs and a parallel support level of $433.39 billion. The selling would likely accelerate below this level.

If buyers push higher by building support above the parallel resistance at $616.35 billion by weekly closing, altcoins could continue to head higher over the next few weeks.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.