It’s a very common sentiment for people outside of the crypto community to look at Bitcoin (BTC) prices and make a conclusion that it’s too late to get into crypto. However, a report shows that the industry is still at the beginning phase of the adoption curve.

In a joint report published by BCG, Bitget and Foresight Ventures, data shows that compared to traditional investment assets, crypto adoption is still very low. According to BCG, only 0.3% of individual wealth is invested in crypto.

The report shows that it’s incomparable to the 25% that is put into equities. Because of the data, the report concluded that the shallow penetration in terms of investment means that there is still a lot of room for more substantial growth and adoption within the crypto industry.

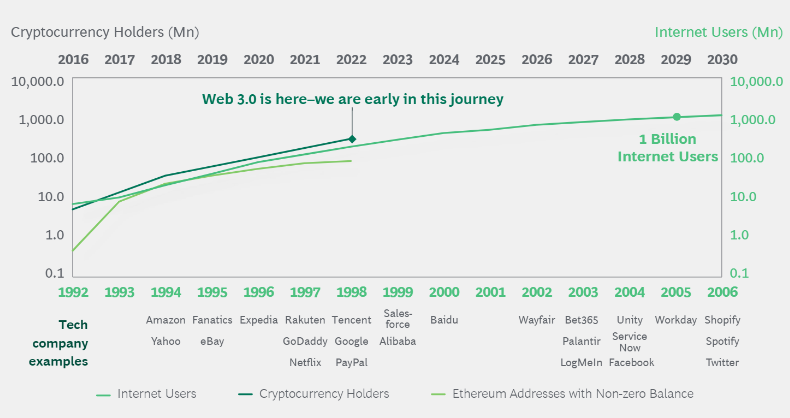

Apart from this, the report also compared the internet’s adoption curve to 1 billion users to current cryptocurrency holders, and Ethereum (ETH) addresses with non-zero balances. With this, the report mentioned that “there is plenty of growth to come.”

By comparing the data that they have, the researchers were able to predict that by 2030, crypto users may reach 1 billion if the trendline continues in its course.

Related: Bitcoin payments make a lot of sense for SMEs, but the risks still remain

A recent market report by consulting firm Verified Market Research predicted that in ten years, the nonfungible token (NFT) industry’s value may shoot up to $231 billion. According to the report, the sector may continue an annual compound growth rate of 33.7% in the coming years, with drivers identified as music, film and sports.

On the other hand, a report from Mckinsey reported that the metaverse alone could be valued at $5 trillion in 2030. The international consulting company surveyed consumers and companies across various countries and industries to identify a pattern in consumer behavior. According to its findings, e-commerce will be driving the cash flow within the Metaverse, making up to $2.6 trillion in revenue by 2030.