A drop in crypto markets from Monday evening (UTC) prompted almost $300 million in liquidations across several crypto futures, data from analytics tool Coinglass showed. More than109,000 traders’ positions were liquidated in the past 24 hours.

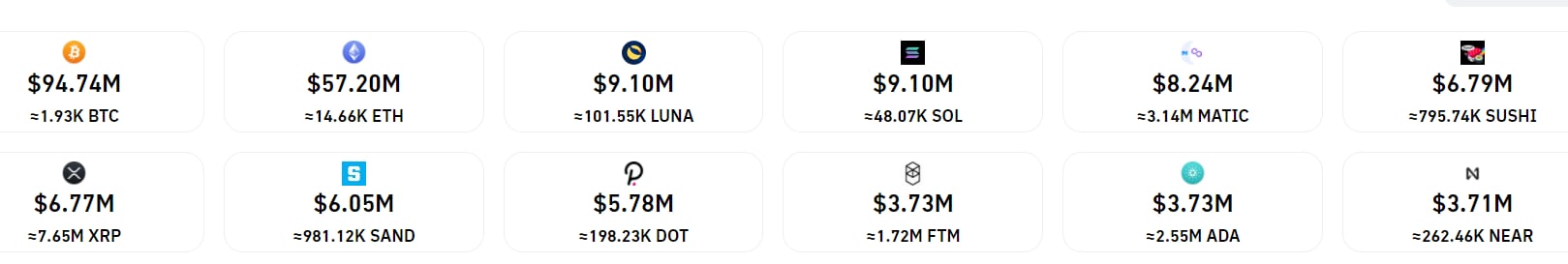

Bitcoin prices rose above $52,000 on Monday before tumbling as much as $3,000 early Tuesday, causing over $94 million in liquidations. Such figures were last seen earlier this month after bitcoin fell as low as $41,000 from highs around $69,000 in November. Losses due to liquidations exceeded $435 million at the time.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position as a safety mechanism due to a partial or total loss of the trader’s initial margin. They happen primarily in futures trading, which only tracks asset prices, as opposed to spot trading, where traders own the actual assets.

Nearly 80% of the $300 million in liquidations occurred on long positions, that is those belonging to traders betting on a price rise. Crypto exchange Binance saw $119 million in liquidations, the most among major exchanges, while traders on FTX took on $78 million in losses.

Futures on ether, the native currency of Ethereum, saw over $57 million in liquidations. Losses on altcoin futures were lower, with Solana (SOL) and Terra (LUNA) traders taking on slightly over $9 million in losses. The relatively smaller liquidation figures for altcoins, as compared with bitcoin, imply recent price surges for SOL and LUNA were mainly spot-driven.

Open interest – the total number of unsettled futures or derivatives – for bitcoin dropped 0.2% despite the losses, implying little money flowed out of the market despite the drop.

Data from Coinglass show $19 billion worth of futures positions on bitcoin remain open in the last week of 2021, and $11 billion worth on ether futures. The figures are several times higher than those for altcoins, with only solana futures carrying an open interest of over $1 billion into 2022 among large-cap cryptos.