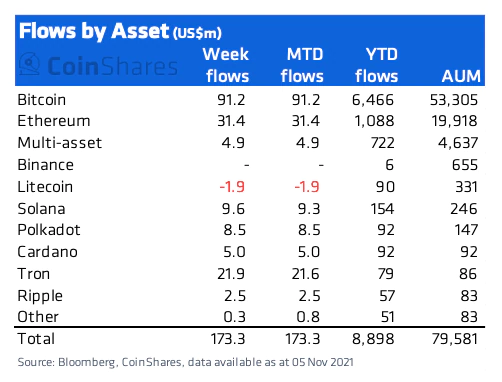

Digital asset products saw inflows totaling $174 million last week, bringing year-to-date (YTD) inflows to $8.9 billion. This is a significant increase from the $6.7 billion pumped into digital assets in 2020.

Total assets under management (AUM) have also reached an all-time high of $80 billion, with Bitcoin (BTC) and Ethereum (ETH) leading the chart with roughly $53 billion and $20 billion, respectively.

Inflows in Bitcoin totaled $95 million last week with a year-to-date record of $6.4 billion invested in the largest cryptocurrency.

With the recent events in the digital asset industry, these new highs shouldn’t be surprising, as cryptocurrency investments are becoming more mainstream. On Monday, former Citigroup CEO Vikram Pandit said that in the coming years, every major bank and/or securities firm will think about trading crypto.

For Ethereum, sentiment has remained positive. Funds focused on the blockchain’s native cryptocurrency, ether (ETH), saw inflows of $31 million last week. “Ethereum’s market share has suffered in recent months due to bitcoin’s dominance, but the recent combination of positive price performance and inflow has seen their AUM rise,” the report said.

Meanwhile, other altcoins remained popular as well. Polkadot generated$9.6 million, the largest weekly inflow on record, while Solana and Cardano attracted $8.5 million and $5 million, respectively.

Another coin that stood out last week was Tron, a digital platform focussed primarily on hosting entertainment applications, with inflows worth $22 million. Tron is now the 8th largest coin by AUM.