A new type of credit card aims to pay users cryptocurrency rewards rather than the typical ‘cash back’ incentives offered by traditional cards. The San Francisco based startup Blockrize aims to provide its customers with a 1% ‘crypto back’ rewards paid out in BTC or ETH.

Also read: Cryptocurrency Interest Wanes — Online Searches for “Bitcoin” Drop 80%

A Credit Line That Offers Crypto-Back Rewards for Every Purchase

A twenty-five-year-old named Thomas Harrison has decided to build a credit card called Blockrize, that offers a line of credit and pays users back 1% in cryptocurrency rewards for every purchase. Harrison was once the head of operations for the now-defunct Whatsgoodly app that offered different types of online polling. According to Harrison in an interview with the financial news outlet Market Watch, the card already has more than 2,000 individuals on the waiting list.

A twenty-five-year-old named Thomas Harrison has decided to build a credit card called Blockrize, that offers a line of credit and pays users back 1% in cryptocurrency rewards for every purchase. Harrison was once the head of operations for the now-defunct Whatsgoodly app that offered different types of online polling. According to Harrison in an interview with the financial news outlet Market Watch, the card already has more than 2,000 individuals on the waiting list.

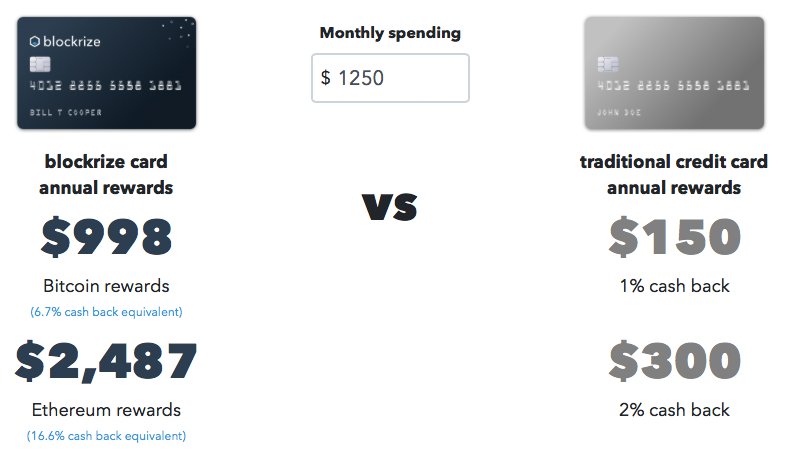

The Blockrize website details that traditional rewards cards with an average expenditure of $1,250 USD per month can earn $150-300 ‘cash back.’ If someone spends the same amount on the crypto rewards card they will earn $998 in BTC or $2,487 in ETH depending on each currency’s spot market value.

“1% crypto back on every purchase — Choose which cryptocurrency you want and earn it every time you use your Blockrize card — All you do is swipe, and we’ll handle the rest,” explains the company website.

With the Blockrize card you never pay fees on cryptocurrency so you keep 100% of the rewards.

1% Back in Crypto Can Be Equivalent to 6-16% ‘Cash Back’

At the moment Harrison is the only full-time employee running the Blockrize day to day operations. However, he is working with Shogun Enterprise’s lead fintech engineer Zak Allen, the peer-to-peer marketplace cofounder of Opensea.io Alex Atallah, and Jonathan Gelfand, managing partner at Card Linq.

Cryptocurrencies will offer a different type of incentive, but the asset’s value can fluctuate. Harrison says he suspects some people might not like the volatility involved with their accumulated rewards. “If prices go down? I do anticipate some people will be upset,” Harrison emphasizes.

Earning 1 percent crypto back in Bitcoin and Ethereum during 2017 would have been the equivalent of receiving 6.7 percent and 16.6 percent ‘cash back’ on every purchase — Receiving cryptocurrency rewards gives you the opportunity to earn much more than traditional credit cards.

What do you think about the Blockrize concept of earning cryptocurrencies as rewards instead of ‘cash back’ incentives? Let us know what you think about this idea in the comments below.

Images via Shutterstock, Blockrize, and Pixabay.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Credit Card Aims to Pay Users 1% Crypto Back Rewards appeared first on Bitcoin News.