Cornell University researchers, using the Falcon Relay Network, have concluded that neither of the two most popular cryptocurrency blockchains, Bitcoin and Ethereum, are as decentralized as once thought. A two-year longitudinal study claims Bitcoin underutilizes its network, Ethereum is better distributed than Bitcoin, and Bitcoin’s rewards for smaller miners is often unpredictable due to block size limits.

Also read: Ditch University and High Transaction Fees!

Cornell University Researchers Release Blockchain Study

Decentralization in Bitcoin and Ethereum Networks, a peer reviewed study from the Initiative for Cryptocurrencies and Contracts (IC3) at Cornell University, lead by Emin Gün Sirer (associate professor and co-founder of IC3), is bound to make some waves. Originally scheduled to be presented February at the Financial Cryptography and Data Security conference in Curaçao, the paper was released online and made available to the public 15 January 2018.

The paper measures the actual practice of decentralization, rather than hype to that effect, surrounding two the largest market cap cryptocurrency networks, Bitcoin and Ethereum. Researchers examine nodes and their interconnection, protocol requirements, and how they stand up to attacks, using the Falcon Relay Network (FRN) to gather data.

FRN disseminates blocks, connecting miners, full nodes, and ferries blocks by reducing orphans. In turn, the network overall is more efficient and can concentrate on security with the ultimate goal of helping Bitcoin scale by effectively decoupling disseminating block speed from network size. The hope is doing so will level the playing field among miners and increase decentralization.

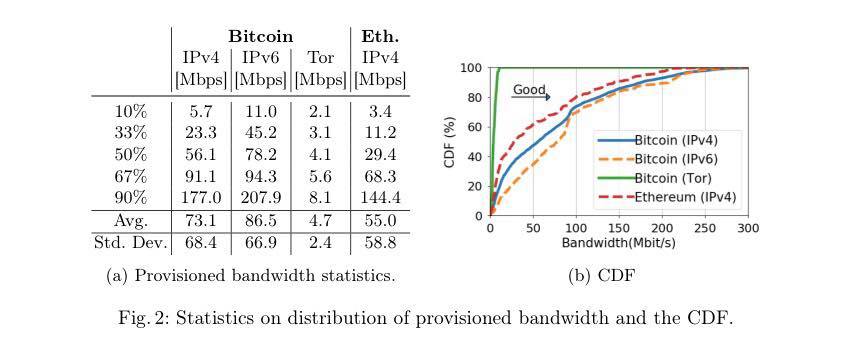

Along with colleagues Adem Efe Gencer, Soumya Basu, Ittay Eyal, Robbert van Renesse, the paper studies years 2015 through 2017, building on their earlier 2016 position paper. It appears bandwidth for Bitcoin nodes has increased by 1.7 times since 2016. With more allocation of bandwidth, researchers claim, block size can increase without impacting decentralization. And with an increase per second cleared, transactions for bitcoin should be able to nearly double – a major bone of contention for users.

Mining Concentration

If the worry then shifts to disk requirements, the authors point out how the costs of CPUs and disk space generally have bettered inversely: lower prices and more space. They argue, “To date, we have seen no sound, quantitative arguments for any specific value of the maximum block size in Bitcoin,” insisting there is “dissonance between the technical-soundness of the arguments and the actual technical facts on the ground.”

“Compared to Ethereum, Bitcoin nodes tend to be more clustered together, both in terms of network latency as well as geographically,” the study insists. “Put another way, there are more Ethereum nodes, and they are better spread out around the world. That indicates that the full node distribution for Ethereum is much more decentralized.” Researchers attribute this to data centers holding a larger percentage of Bitcoin nodes, over half in fact. Ethereum data center nodes, by contrast, account for little over a quarter.

Data centers can become troublesome in the quest for decentralization because they’re often held by corporations. Node counts can also help skew public opinion through what are known as Sybil attacks. Sybil attacks can overinflate influence in a peer-to-peer system, making it appear there to be more consensus than the actual reality. These are real concerns for consensus networks like Bitcoin.

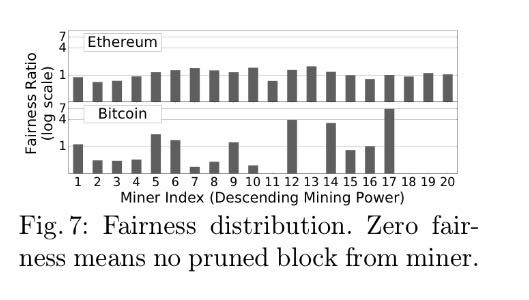

The study indeed found in both Ethereum and Bitcoin “mining [is] very centralized, with the top four miners in Bitcoin and the top three miners in Ethereum controlling more than 50% of the hash rate.” Indeed, the “entire blockchain for both systems is determined by fewer than 20 mining entities.” Finally, “mining rewards are more unpredictable for smaller miners in Bitcoin” compared to Ethereum. “This is partly because the high block rate in Ethereum helps provide many more opportunities for the laws of large numbers to apply in Ethereum, while Bitcoin, with its infrequent blocks, can exhibit much more uncertainty from month to month.”

Do you think decentralization is important in cryptocurrencies? Let us know in the comments section below.

Images courtesy of Pixabay, Cornell University.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post Cornell Researchers: Bitcoin Not as Decentralized as Assumed appeared first on Bitcoin News.