Crypto nerds are on the precipice of pulling off the caper of the century.

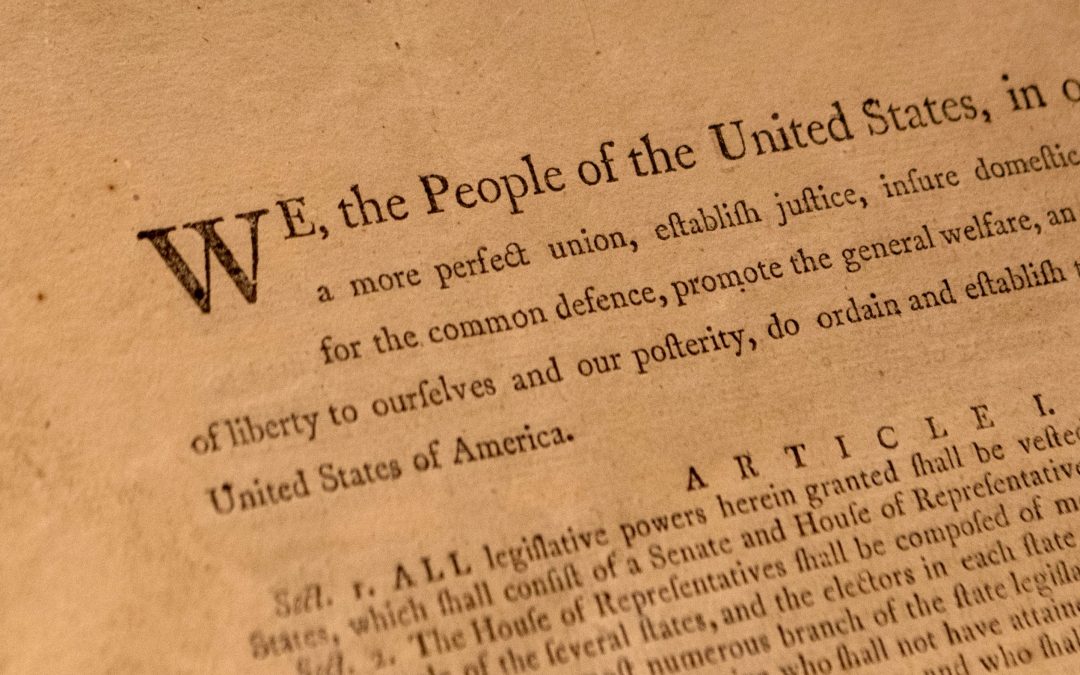

What started as a longshot bid for a decentralized autonomous organization (DAO) to buy one of 13 original copies of the United States Constitution is looking more and more like a possible lock as the group has now raised $27 million and counting – well above auction house Sotheby’s upper estimate of a $20 million price.

ConstitutionDAO, which formed just last Thursday, has raised the sum from over 7,600 addresses after a surge in large donations on Wednesday signaled confidence from whales that the plot might succeed – and that the venture could end up being profitable.

Read more: ‘I Think We’re Doing This’: Inside One DAO’s $20M Plot to Purchase the US Constitution

The achievement earns the DAO a number of superlatives, including status as possibly the largest DAO ever – and at the very least, certainly the largest DAO ever assembled for the purpose of purchasing an 18th-century legal document.

Attention now turns to the auction on Thursday, where the group will attempt to outbid a field of at least half a dozen private collectors also looking to own a piece of history.

Late push

The DAO’s outlook was not always so rosy. Midday Wednesday, the effort had only managed to attract 3,000 ETH over roughly 48 hours, with whales accounting for a disproportionately high percentage of donations – 17 Ethereum addresses accounted for roughly half the sum collected.

However, whales appear to have attracted the chum.

In just a few hours the total number of donating addresses jumped from 5,000 to 7,600, and the amount raised from $13 million to $27 million.

In an interview with CoinDesk, Yossi Hasson, the founder of non-fungible token (NFT) investment firm Metaversal and holder of the current top spot on the donation leaderboard, said that the DAO has additional funding on deck in case a counterbidder tries to bid beyond the DAO’s publicly-known means.

“We’re pretty confident we’re going to win,” Hasson said. “There are multiple strategies being discussed of how much of the capital that is being committed should be completely on-chain and visible before the auction, how much will be brought in after the auction – we don’t necessarily want others to know exactly the cards we’re holding.”

Legal questions ironed out

When donations opened, the frenetic nature of the DAO meant that it was somewhat up in the air what people were donating to, exactly.

Early ideas included fractionalizing the document, or burning it and reissuing it as an NFT (a la a stunt with a Banksy piece in March).

However, the real-world identities of multiple members of the DAO’s brain trust – roughly three-dozen individuals – are known, and now an actual LLC will be placing the bid on behalf of the DAO to comply with Sotheby’s know-your-customer (KYC) requirements. Additionally, fractionalization could lead to an unusually easy-to-pursue securities enforcement action from the Securities and Exchange Commission (SEC), per early discussions in the DAO’s Discord.

We the $PEOPLE

The current plan is to issue a governance token – likely called $PEOPLE – that enables holders to vote on decisions concerning the preservation and display of the document.

“This isn’t an investment, and that needs to be clear to people participating,” said Hasson. “You’re not owning a fraction of the Constitution, rather a token that gives a say in governance – it’s an important distinction.”

Despite not being an investment, that doesn’t mean the tokens can’t or won’t have monetary value.

Indeed, fractionalized NFTs can often reach market capitalizations orders of magnitude larger than the value they held as single tokens.

The trend is even becoming a kind of business model: SZNs, a project enabling DAOs to form around the ownership of NFT collections called albums, raised $4 million in a seed round in September.

Read more: Fractionalized NFTs Get Funding Boost as SZNS Raises $4M From Framework, Dragonfly

Many of those contributing ETH to the project may be making a bet that $PEOPLE could see a price rise after its issuance.

Hasson, meanwhile, told CoinDesk that Metaversal’s “primary goal” was to help preserve a piece of history and “give it to the people,” but that price appreciation could be on the table.

“At Metaversal we do believe you can go great by doing good,” Hasson said. “We’re able to contribute in the preservation of such an iconic, historical document – bring it into the Metaverse and let its story be told in new and novel ways – and if the $PEOPLE token appreciates as part of that, we’ve accomplished both of our goals.”