California, once considered a leader in community solar, has struggled to implement Senate Bill 43 (SB-43), which mandated the creation of the Green Tariff Shared Renewables (GTSR) Program. As envisioned by SB-43, the GTSR Program includes a Green Tariff (GT) component and an Enhanced Community Renewables (ECR) component. It provides an opportunity for the three California investor-owned utilities (IOUs) combined to procure up to 600 MW of new renewable energy.

While the GT portion of this bill has attracted some customer interest despite a price premium ($0.015-$0.033/kWh), no new community solar projects have been built or approved under the ECR program. Developers say that the ECR program is unsuccessful due to its complex and uncertain bill credits, lack of sufficient financial return for solar developers, and burdensome program administrative requirements. A dramatically different financial model than net energy metering (NEM), the GTSR compensation structure is based on wholesale rates net of program fees/charges instead of retail rates. Thus, the GTSR currently does not provide a comparable economic return to NEM.

Shared renewables could play a large role in filling the gap as NEM policy changes in California, particularly due to economies of scale and potential locational benefits. As customers across California look for green electricity alternatives through the installation of NEM systems and enrollment in GT or Community Choice Aggregation (CCA) programs, it is in the best interest of the IOUs to have a competitive shared renewables program.

What are the key lessons learned from the development of the shared renewables market and ongoing discussions around reworking the GTSR Program in California? The California Public Utilities Commission (CPUC) and the California State Legislature, in partnership with IOUs and industry stakeholders, should work together revisit their interpretation of SB-43 to set the foundation for a successful shared renewables market in California.

California Legislation: SB-43

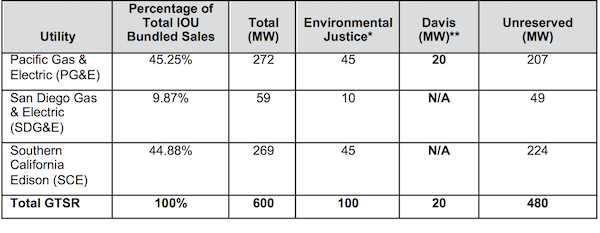

Almost a decade ago, the market expected California to emerge as a leader in community solar. Yet, it took nearly 4 years to organize SB-43. Table 1 outlines the program capacity allocation across the IOUs and the program-specific reservation carveouts.

Table 1: Allocation of Capacity, Green Tariff Shared Renewables

*Environmental Justice Reservation: SB-43 requires that 100 MW of the GTSR Program be reserved for facilities that are no larger than 1 MW and are located in “the most impacted and disadvantaged communities,” as identified by the California Environmental Protection Agency (CalEPA).

**City of Davis Reservation: Section 2833(d)(3) reserves 20 MW “for the City of Davis.” Decision 15-01-051 discusses the significance of this reservation.

Source: California Public Utilities Commission

The GT and ECR programs are described as follows:

- Green Tariff (GT): Customers purchase energy from a portfolio of sources with a greater share of renewables compared to the local IOU standard mix. The customer pays the difference between their current generation charge and a charge that reflects the cost of procuring 50-100 percent solar generation for their electric needs.

- Enhanced Community Renewables (ECR): A customer agrees to purchase a share of a local solar project directly from a solar developer in exchange for a credit from their utility for the customer’s avoided generation procurement and their share of the benefit of the solar development. ECR projects are limited in size to between 500 kW and 20 MW. No price premium specifics are available for the ECR program, as projects have not been completed.

CPUC Rulemaking

While other states (e.g., Colorado, Massachusetts, Minnesota, etc.) pressed forward in turning legislation into workable community solar programs, California’s process under SB-43 was burdened by regulatory delays. As illustrated in Figure 1, rather than adhering to the deadlines required by SB-43, the filings, hearings, and rulings stretched on for years.

Figure 1: Shared Renewables Implementation Timeline

Source: Navigant Consulting, Inc.

SB-43 mandates for community solar attributes required significant interpretation, specifying programs must preserve “nonparticipating ratepayer indifference” and “provide significant financial, health, environmental, and workforce benefits to the State of California.” However, CPUC does not take these externalities or social benefits into consideration, resulting in a renewables value credit lower than in many other states. From the utilities’ perspective, this interpretation is understandable, particularly considering the ongoing NEM payments to rooftop solar customers, upcoming NEM policy changes, and the need to maintain consistency with prices paid by CCAs. From the perspective of communities and developers, this interpretation leaves little incentive to create a “large, sustainable market” for shared renewable projects. Shared renewables can play a huge role in California as NEM policy changes. However, with the current rate structure and GTSR Program designs, it is highly unlikely that this will be the case.

Developer Experience with ECR Program

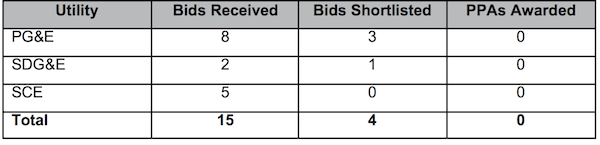

The first ECR program request for offer (RFO) launched in August 2016, and awards were planned for March 2017; however, no power purchase agreements (PPAs) were awarded. Of the 15 bids submitted, all bids failed to meet the program eligibility criteria. The second RFO is currently underway, with the market anticipating similar results in the fall of 2017.

Table 2: ECR RFO Round 1 Results

Source: Renewable + Law, with numbers revised based on IOU conversations.

ECR Program Design Components: Barriers to Participation

Based on conversations with leading solar developers in the market, the following barriers have emerged as the largest roadblocks to the early success of the ECR program:

- Low and uncertain bill credit: Unlike many successful community solar programs, the California rules only credit customers for the wholesale generation value of the power, which is about one-third of the customer’s electric bill, and utilities add in layers of program fees. When compared to community solar bill credits in other states and NEM rates in California, the current bill credit cannot compete—which developers described largest program barrier.

- Demonstration of community interest: The developer must provide documentation within 60 days of being notified of a contract award that: (1) customers have either submitted “expressions of interest” covering 51 percent of project capacity or “committed to enroll” in 30 percent of project capacity; and (2) a minimum number of customers depending on project size have subscribed to the project (e.g., minimum of 3 subscribers for 3 MW projects and 20 subscribers for 20 MW projects). Additionally, at least 50 percent and one-sixth of project load should come from residential customers. This requires developers to frontload huge customer acquisition costs prior to being notified of contract award.

- AmLaw 100 securities opinion: The developer must include a costly securities opinion from an AmLaw 100 law firm stating the arrangement complies with securities law. After much debate, CPUC revised the requirement in June 2017; while a securities opinion is still required, it can now be from a qualified California lawyer. Although a victory for the program, some developers view this as a subtle change indicating the difficulty of modifying other more significant requirements.

From recent conversations with IOUs and market participants, major changes to the underlying program economics will not likely take place until 2018—if they occur at all. Additionally, SB-793 removed the January 2019 GTSR Program sunset date, making the program even more complicated to improve in the short term.

Call to Action – What’s Next?

The intent of SB-43 was to establish a viable GTSR Program in the IOU territories and to procure 600 MW of new renewable energy under the GT and ECR program components. Due to project economies of scale and potential locational benefits, shared renewables can play a large role in filling the gap as NEM policy changes in California. The key challenge in California is to develop a viable regulatory framework for promoting clean energy through a shared renewables business model while balancing the objective of maintaining nonparticipating ratepayer indifference.

CPUC and the California State Legislature, in partnership with IOUs and industry stakeholders, should work together to realize the original intention of SB-43:

(1) Balance key policy objectives.

a. Achieve 600 MW of new clean energy through the GTSR Program.

b. Test new shared renewables business models to promote clean energy.

c. Maintain nonparticipating ratepayer indifference.

(2) Revisit the GT and ECR rate structure, streamlining the complexities of the credit structure to reduce the variability and provide adequate stimuli to move the market to achieve the 600 MW policy goal.

(3) Streamline other requirements and approval mechanisms (e.g., demonstration of community interest, marketing requirements, etc.).

(4) Design programs to address the low income and environmental justice market segments.

The gap in pricing between NEM and the current California shared renewables programs is so wide that small changes acceptable to all parties could, without abandoning the principle of nonparticipating ratepayer indifference, result in a lower price premium or a higher credit that would stimulate the market. Similar analyses such as the best practice work of the Community Solar Value Project (CSVP) and others indicate that there is reason for optimism. By addressing these challenges, California’s vision for shared renewables as articulated in SB-43 could be achieved.

Karin Corfee (left) is the global leader of Navigant’s Markets, Customers, Products, And Services team. With more than 30 years of experience, she specializes in strategic planning, energy efficiency, renewable energy, sustainability, and climate planning initiatives. Recently, she has conducted numerous studies examining net metering policies and the impacts of DER on the grid. Karin has assisted in numerous strategic planning engagements, including the CAISO Five-Year Strategic Plan, the California Energy Efficiency Strategic Plan, and the New Jersey Renewable Energy Plan.

John T. Powers (center) is Founder and CEO of Extensible Energy. An energy economist with more than 30 years of experience in consulting and technology development for the electric utility industry, John has worked in energy efficiency, demand response, and renewables for most of his career. John currently serves as Project Officer for the Community Solar Value Project, a DOE SunShot project helping utilities to develop better Community Solar programs. That project includes developing a framework for analyzing financing, siting, storage options, demand-response options, and other program design decisions.

Andrea Romano (right) is a Managing Consultant in Navigant’s Energy Practice, where her work focuses on helping private and public entities make decisions regarding distributed energy resources (DERs) including market and policy assessments, due diligences, strategic analyses and distributed generation technical potential and adoption modeling. Recently, Andrea has been focused on community solar, working closely with utilities across the country who have developed or are developing community solar programs to evaluate the impact of these programs. Andrea began her career in commercial and utility solar project development working at a solar EPC firm.

Lead image credit: depositphotos.com